Most Recent Posts

IRS Nixes Student Loan Payoff Charity

So here is the deal with NATFY. There is some beleaguered millennial feeling crushed by student debt. You want to help him out. But how do you know he really has student debt? And if you gave him some money to help pay down the student debt what is to prevent him from squandering the money on avocado toast and massaged kale? That where NATFY (No Avocado Toast For You) comes in. Here is the process they put into place.

Housing Industry Panicking About Tax Reform

We’ll start with the low-income housing tax credit which is the one I’m giving you. Protect the Lease connects the low-income housing credit to “ensuring housing affordability”. I wanted to do a little more than just looking at Forms 990 to assess how credible NAA and NMHC were. What I did was ask Mike Novogradac. Mike built a substantial national CPA firm (over twenty offices- ranked about 30 nationally) around the Low Income Housing Tax Credit. Mike assured me that the sponsors of Protect the Lease are substantial and credible.

And concern about the LIHTC is well grounded. Even the threat of tax reform has had an impact on the LIHTC. The credit is rationed by state population and assigned to developments by state housing agencies. Developers, in effect, sell the credit, which is spread over ten years, mostly to corporations. Concerns about tax reform, such as lower rates, have already affected the appetite of corporations for the credit pushing down the development dollars that credit allocations yield.

Motion To Stop IRS From Examining Marijuana Dispensary Up In Smoke

Last week I wrote about The Green Solution, at least by its own account Colorado’s #1 Marijuana dispensary. It was resisting an IRS summons based on the notion the Code Section 280E, which denies marijuana sellers ordinary and necessary business deductions, inappropriately puts the IRS in the drug busting business. Things did not go well for The Green Solution as the Tenth Circuit ruled that the anti-injunction act applied allowing the IRS to proceed. Now another shoe has dropped.

IRS Leans On LA Tax Assessors For Land Building Allocation

The practical problem that practitioners face when doing returns for people who own a couple of rental properties is that it is difficult to justify spending anything on an appraisal for rental properties in the sub million dollar category. Moving $100,000 from land to residential real estate will give you a bit over $3,600 in additional depreciation, which might save you a thousand bucks, unless, as often happens, your losses are suspended by the passive activity loss rules. Somebody selling cost segregation studies will make a presentation showing the future value of deprecation deductions, but it can be an uphill battle with skinflint real estate operators.

Mississippi Taxing – Nuclear Power And Accusations Of Racism

Claiborne County has significance in the history of the civil rights movement. In 1966, African American citizens of Port Gibson, the county seat, started a boycott of white merchants which was suspended after the City hired its first black police officer. Police shooting in the wake of the Martin Luther King assassination rebooted the boycott with leadership from the NAACP and Charles Evers, brother of Medgar Evers, who had been murdered in 1963. NAACP liability for collateral violence associated with the boycott ended up at the United States Supreme Court, which overturned a Mississippi judgment of $1.2 million against NAACP in 1982.

And property taxes were a big part of the racial struggle in Claiborne County. Evan Doss Jr. became the first black county tax assessor in 1972.

Chicago Loses $29 Million Appeal By Expedia And Other Online Travel Companies

The OTCs generally operate on a “merchant model”.They buy the room nights from the hotels and mark them up. That is where the taxes get funky. The OTC does not charge you tax on what you pay for the room. The OTC charges you a “tax recovery” amount. They then pay the operator occupancy tax based on the net rate the OTC is paying for the room.

What aggravates me about the system is that if the “tax recovery” amount is greater than the tax remitted to the operator, the OTC keeps the difference rather than refunding it. To be fair, I should be open to the possibility that the tax recovery amount is sometimes insufficient, but I’m a cynical bastard, and I’m thinking tax recovery is an additional profit center.

Marijuana Retailer Not Protected From IRS Summons

It would seem to me that it is probably not in the best interest of sound tax administration for the IRS to make 280E enforcement a high priority. It may turn into another debacle such as the one that Lois Lerner created when she decided that the IRS was the last line of defense against dark money. Reilly’s First Law of Tax Policy is “Make tax policy the Switzerland of the culture war”. The IRS is probably stuck with 280E for the moment, but it does not have to make it a major priority. Maybe conservatives could embrace state rights even when it comes to things that they associate with long-haired hippies, but that might be to much to hope for,

Lafayette Was Here – Probably

... there never was nor will be such a meeting in this or any country ,,, Salem Towne Junior July 25, 1824 Burying The Lede With A Geographic Diversion Stafford Street...

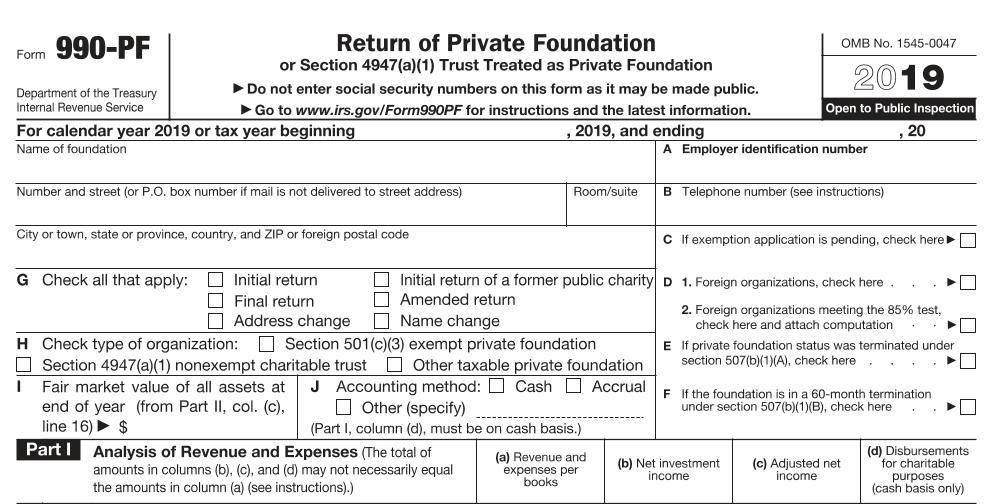

Spotlight On Charitable Foundation Abuse

As charitable abuse goes, I don’t think this particular deal, assuming the worst, is all that abusive. It is not a matter of real charitable dollars being diverted to personal purposes. All the money is coming from Mr. Martin, not the gullible general public and he is just seeking a favorable tax characterization on the money that he is giving his daughters.

President’s Religious Liberty Order Might Not Change IRS At All

It is hard to see what the IRS can change in response to this order. The most recent detailed guidance I know of is Revenue Ruling 2007-41 which teaches about the rules by way of 21 examples. The examples center on the organization or its officers in effect explicitly saying “Vote for Joe”. The officers can say “Vote for Joe” as long as they make it clear they are not speaking in their official capacity and are not using organizational resources. It is not clear that the Executive Order requires any revision to that ruling, but it would not surprise me if there is somebody in the Chief Counsel’s office checking on that now.