Most Recent Posts

Kent Hovind Is Back Seeking Exoneration Or Pardon From President Trump

Hovind praises President Trump’s executive order Ending The Weaponization Of The Federal Government. His praise for our President is effusive, but there a further ask. He wants the President to undo he damage done to Hovind starting in 2001 when IRS began investigating him culminating in his imprisonment in 2006.

Is Rothing A Must? How Historically Low Are Current Rates? Are Tax Rates Sure To Rise?

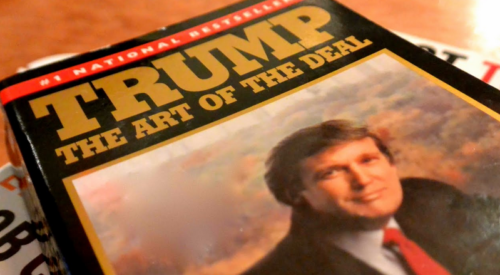

Our President waxes poetic about how great things were from 1870 to 1913. It reminds me of a satiric song by the Chad Mitchell Trio called Barry’s Boys (referring to Barry Goldwater). It opens with the line “We’re the bright young men who want to go back to 1910”. So much for higher future rates, if this type of thinking prevails.

Rudy Davis Reflects And Is Pessimistic About Trump Presidency

I believe Donald Trump is a negotiator at heart and is a tool of the devil. His tactics are to give us a little bit to make us think he really cares about us. All the while, he is working with shadowy figures to bring about the New World Order that is spoken about in the bible. – Rudy Davis

To Roth Or Not To Roth ? Is There A Question?

Idea of paying taxes now in exchange for the prospect of lower taxes decades in the future struck me as preposterous – like hitting your head against the wall because it feels so good when you stop.

Zaxby’s Founder Wins Substantial IRS Refund In Conservation Easement Case

The market for undeveloped land is imperfect, but the people engaged with it are not a bunch of idiots. So if you buy multiple parcels of land you will not be able to buy them at an average value substantially below fair market value.

Trump Challenger Sentenced To 188 Months In Prison On Tax Charges

On October 30, 2024 Judge Means sentenced Castro to 188 months in prison followed by one year of supervised release. A condition of the supervised release is the payment of restitution in the amount of $277,243.

Harness the Power of Your Tax Refund: A Savvy Spender’s Guide

Using your tax refund to pay down or eliminate high-interest debts, such as credit card balances, payday loans, or personal loans, is a financially astute decision.

Charitable Easement Deduction $16,745,000 Claimed $93,690 Allowed

A claimed charitable easement deduction that is almost 179 times the amount allowed by the Tax Court probably makes you think that we are talking about a syndicated...

No Tax On Tips – Now Social Security – What Is Next?

This is very similar to the “no tax on tips”. They are both proposals that purports to be directed toward a disadvantaged class, but will really only help the more advantaged members of the class like the servers in high-end steak house or in the case of senior citizens people like me or even more the older CPAs who are determined to die with their boots on.

No Tax On Tips – Be Careful What You Wish For

I frequently do an “Other Coverage” section on my posts, but I wouldn’t know where to start on this topic. I will note though that I have not found another article where somebody ran numbers on the effect of the various legislative proposals. Reilly’s Sixth Law of Tax Planning – Don’t Do The Math In Your Head.