Most Recent Posts

IRS Coinbase Summons What Are You Going To Do When They Come For You ?

You will often see the blockchain referred to as a ledger. As I read the descriptions, though, I think that it is actually more of a journal. Back in the day we would have various journals that item by item recorded things like purchases, sales, receipts and disbursements. The totals from the journals would be “posted” to the ledger. At year end, the income accounts would be closed. To analyze an account was to show the exact transactions that went into that account. A critical component of the process was to cut things off. Beginning in the eighties, we entered a kind of brave new world thanks to databases. Some of the systems designed to use them were focused on issues like inventory management with the accounting functions thrown in. It sometimes seemed that it was like never being able to step into the same river twice.

Ed Brown Thinks I Have A Staff – Go Figure

The only critique that I am going to present is that Mr. Brown makes it clear that he was being just a bit disingenuous when he managed to get his supporters to say that he just wanted someone to show him the law that required him to pay income tax. The law is in Title 26 of the United States Code (The Internal Revenue Code) and for all the talk about how complicated and confusing the law is, the basic requirement illustrated by Sections 1, 61 and 6102 are not complicated.

What Mr. Brown apparently wants is to be shown a law that is in his view, as a United States Constitution Ranger, is valid.

Thomas More Law Center Victory Over California AG – Big Win For Free Speech Or Dark Money?

It does seem to me that this litigation is much ado about not much. The contributors are still disclosed to the IRS. And if people are attached to their anonymity, they now have the much better option of donor advised funds. The biggest player in that field now is probably Fidelity Charitable. When they accept your recommendations to give to particular not for profits, it us up to you whether your identity is disclosed to the recipient organization. If you run all your controversial contributions through Fidelity Charitable or some other donor advised fund, the only report going to the IRS (and by extension the California AG) will show that you made a contribution to Fidelity Charitable or some other donor advised fund. The recipient organization will report that it received money from the donor advised fund.

Tax Court Upholds IRS Penalties On Decades Old Cattle Shelter Losses

I think if I had been the judge, I would have told the IRS that it just wasn’t right to penalize this guy after all those years. The purpose of penalties is to encourage compliance not rasie revenue and laying them on over twenty years late just does not do the trick. Of course, there are many reasons why I am not a Tax Court judge and now we have just added another. There are two morals here. One is that having the people who sell you the tax shelter be the ones to prepare your return is probably not a good idea. The other is that not only should you get it in writing. You should also make sure it is signed.

IRS Denies Exempt Status To Christian Coffee Shop

You pay for the car behind you at the fast food window and get the attendant to hand them a card that mentions the name of the church. It’s non-confrontational, non-direct even, and may be effective in branding the church leading to visits to worship and further inquiries. We are evangelicals, you know, and a subtle way to offer good news is OK with me.

Father Kent Hovind SJ Not So Much

Kent Hovind developments keep verging on Forbes worthy, but have not quite gotten there. For those new to this blog, Kent Hovind is an Independent Baptist minister...

Foreclosure Cash For Keys Not Taxable As Service Income

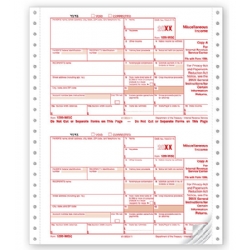

One tax preparation point is worth mentioning here. I would have done the computations much as the CPA did and I would have also reported the $7,500 as income and then backed it out, which might have avoided a document mismatch. Frankly, I’m not sure that would have worked. And it is possible that that is what the Bobo’s CPA did and it got picked up anyway, but given the low stakes and the weakness of the IRS position, this really feels like everything was on autopilot from the point at which Greentree decided they needed to issue a separate 1099 for the “cash for keys”.

What To Do Right Away In Anticipation Of Coming Trump Tax Cuts

Generally, it is better to give appreciated property, but if you really want to put the pedal to the metal you will need to give some cash to get to the 50% of AGI limit. You might want to consider using a donor-advised fund which will allow you to spend more time deciding which specific charities to benefit. Also, some smaller charities don’t have the infrastructure to deal with large donations. The best-known donor-advised fund is probably the one run by Fidelity which has over $15 billion in assets. They explain the whole process pretty well. They are not the only alternative of course, but if you want to be picky about who you use, you should start looking into it now.

There has been some controversy about the effect that donor-advised funds are having on philanthropy. Apparently some people really like to see their charitable account growing and never get around to advising the fund to actually give anything to operating charities. All I can say is don’t be one of those people. In the situation, we are facing where your charitable deduction is likely worth much more on your 2016 return than it will be in the future the donor-advised fund is a very valuable tool.

IRS Can Sometimes Collect Corporate Tax From Former Shareholders

The shareholders of Little Salt were not alone in being caught by double taxation from a corporate asset sale. It seems that people not paying attention or thinking ahead in 1986 were legion. I shake my head and feel sad, but the people who founded MidCoast Investments, Inc. saw opportunity. They offered shareholders of companies a great deal. After the asset sale when all that was left in the company was money in the bank and an obligation to pay corporate income tax, they would buy the company from you.

A Cheer And A Half For Meritocracy

The system is rigged in favor of anyone who excels at getting her or himself educated to the graduate degree level and then working hard for decades. See, e.g., Barack...