Most Recent Posts

Future Generations Endorses Hillary Clinton

One of the reliefs of post-election will be the end of campaign appeals in my inbox. It is my own fault, as I sign up for everything in the hope of getting material...

Live Blogging Election Night

We went to the Unitarian Universalist Church of Worcester to watch the results. First discussion was what station to watch. I was for Fox since I thought we might...

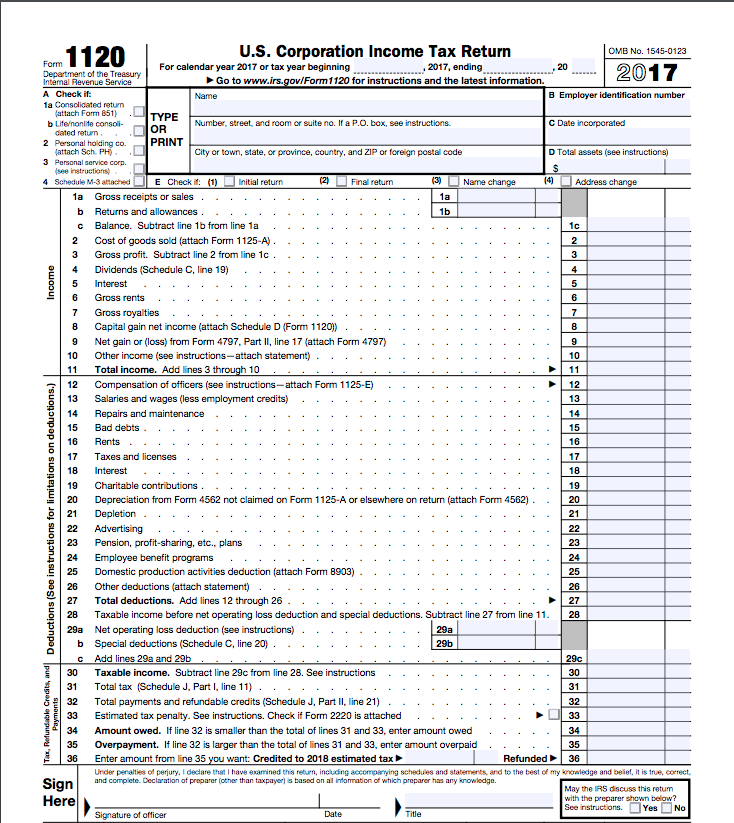

Top 100 S&P Companies Averaged 25% In Income Taxes Actually Paid

Originally published on Forbes.com. WalletHub's statement, last week, that the S&P 100 pay 28% in total income taxes was not as wildly wrong as I thought it would...

Not Every Women’s Rights Narrative Starts At Seneca Falls

.....memory is made, not found and what we remember matters. - Lisa Tetrault This post is something of a personal reaction to The Myth of Seneca Falls: Memory...

How Much Do Large Corporations Pay In Income Tax ? Probably Less Than You Think

In the case of BH, much of the difference comes from faster depreciation for tax purposes In one of the debates Donald Trump mentioned how much he loves depreciation. Warren Buffett has a more nuanced view of it). Berkshire’s net deferred tax liability grew by $1.263 billion. And as long as the company continues to put more property in service, at least on a dollar basis, than it retires that deferred tax liability, currently $63.199 billion will likely continue to grow.

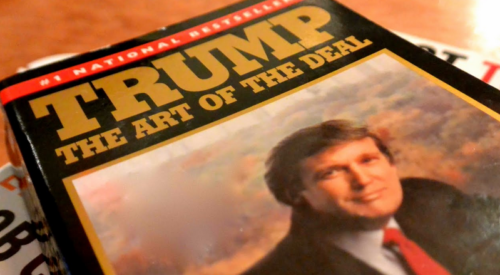

New York Times Analysis Of Trump’s Tax Position Misses A Lot

What is most disconcerting to me about this particular Times piece is that it does not really appear that Trump was getting away with that much. He did not get a principal reduction from the bondholders, so requiring him to pick up ordinary income at that point would have really been kicking him when he was down. And he did give up equity in return for the more favorable debt terms. Unlike the Son of Boss shelters that would be coming later, everything about this was real. There were real casinos that lost a ton of money. After the restructuring there was as much principal as there had been beforehand and some equity had been surrendered.

Jill Stein Finds It Is Not Easy Being Green

My speculation for the cause of her reticence was that details in her returns that were fairly mundane would, seen through glasses with Green lenses, appear quite shocking. Dr. Stein’s mother, Gladys Stein, died in 2010. Assuming conventional estate planning, assets accumulated not only during her parent’s lives, but also. possibly, something from her grandfather who invested in Chicago real estate might leave some traces on her 2012 or 2013 returns.

It probably does not hurt Mike Pence that he had an ownership interest in a chain of gas station convenience stores, but if Jill Stein owned something like that even on a transitory basis, there would be somebody at the Green Party convention calling for her to make reparation. That was my thinking, anyway. We’ll probably never know.

Law Professor Calls Trump’s Tax Losses Fake

There is something else to consider. Apparently, that 1995 Trump return was one of the last ones prepared by Mitnick. Given Trump’s involvement in public companies, there is a pretty good chance that his return has like Romney’s been done by one of the major national firms since then.

And here is the thing about net operating losses. Trump did not deduct the loss in 1995, he got to carry it forward and commentators assume that he must have used it in subsequent years. The net operating loss is a deduction in the year that it is used. Even if the statute is closed on the year of the loss, the IRS gets a bite at it in the year that it is used. More importantly, for this discussion, the preparer of the return can’t just rely on the prior accountant having it right.

Trump Had A Point About His Own Taxes In The Debate

The only two roles I could see for Trump in public accounting are client from hell or managing partner. Public accounting firms at the regional and large local level tend to be run by somewhat sociopathic dictators of greater or lesser benevolence. Hillary Clinton on the other hand could be the leader of a peer review team or one of the people in a national firm that has a job not involving direct client service coming up with nonproductive things for working people to do. Clinton is definitely the Big Four type. Trump not so much.

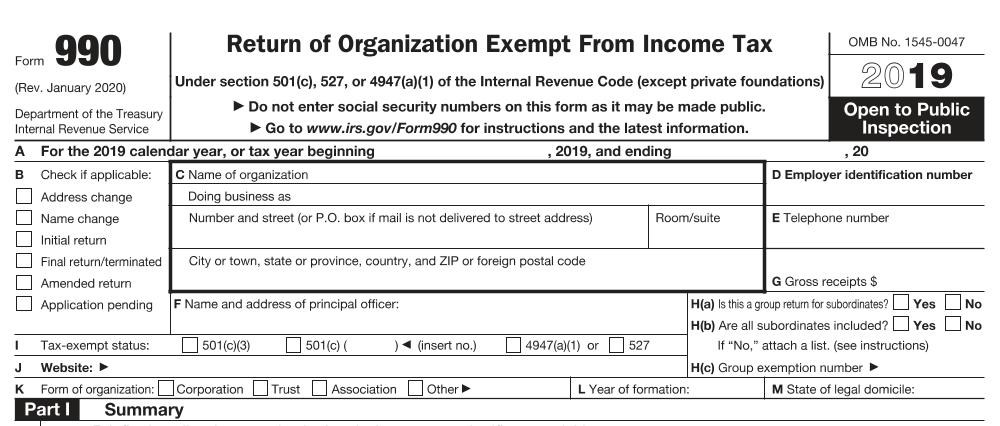

How Much Do Public Companies Pay In Income Taxes?

In computing its reported earnings under Generally Accepted Accounting Principles BH provided for a deduction from reported earning (pretax $34.9 billion) of $10.5 billion in income taxes – 30%. This is explained in some detail in Note 15 (Income Taxes), where you will find that the largest element in the difference in the provision from the hypothetical 35% is the special treatment of dividends received by corporations.

In Note 13 (Supplemental cash flow information) you will find that the amount actually paid for income taxes was $4.5 billion- 12.9%. The relationship between the provision and the amount paid is similar in the previous two years.