Most Recent Posts

The Xavier Stories – A Roundup

In anticipation of the finale of the series on my high school I have decided to organize the Xavier High School material up till this point. Not all of it is part of...

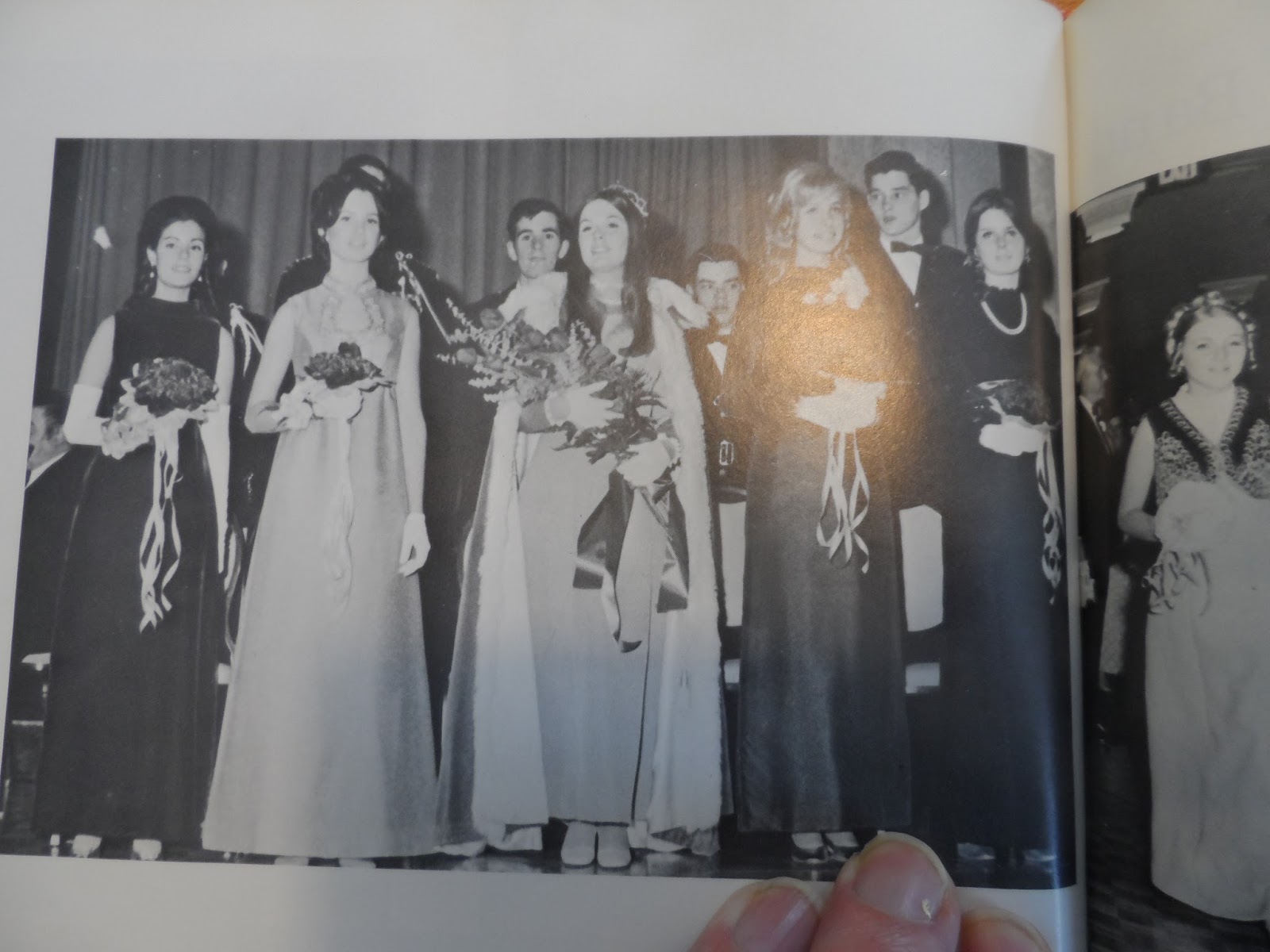

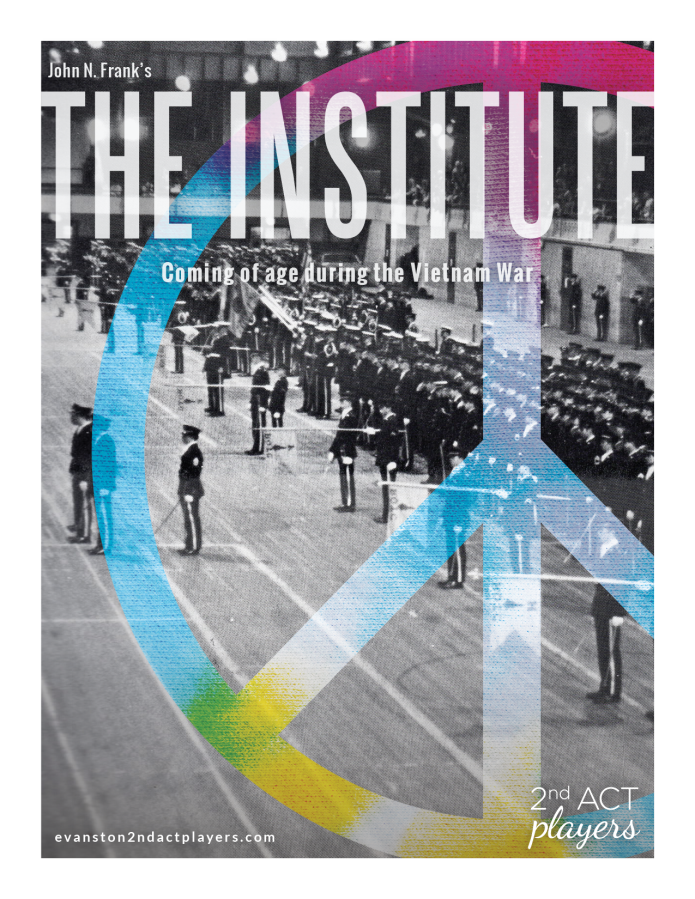

The Xavier Regiment – Back To The Future

In the last couple of years I have been sporadically haunted by memories of my somewhat peculiar high school days. Xavier High School at 30 West 16th Street in...

Does IRS Exelon Win Threaten Triple Net 1031 Deals?

Here is the problem they faced. In order for the economics of this deal, other than tax benefits, to work there did not have to be an actual power plant involved. After all, Unicom is getting 77% of the money back in six months and there is an insurance company guaranteeing that they will get more than 100% of the money in a little over thirty years and probably not by coincidence the timing is such that they could defer the back end money with another 1031 deal.

Jill Stein Puts Financial Transactions Tax Front And Center At Northampton Church

The only part of the tax program that she mentioned is a financial transactions tax, which she characterized as making Wall Street pay a sales tax. A “tiny tax” of 50 basis points would pay for free college education for everybody. Much of the rest of the program would be financed by cutting the defense budget in half. With the Green New Deal making us 100% renewable, there will not have to be any wars for oil.

So that’s the first tax story from the event. The financial transactions tax is front and center on the Green agenda.

A Unitarian Universalist Sends Rudy Davis Seven Principles And Six Sources

When Kent Hovind was facing a new trial in 2015, I dubbed the ragtag group that came out to support him the Hovindicators. The most visible was Rudy Davis, who turned...

Learn Kindergarten Math And Stop Calling Them All Third Parties

We really have to stop saying "third party". I understand the logic of the term, but it is still wrong. To say we have a two party system is probably a fair statement,...

The National Anthem – Stand Up – Sit Down – A Case For Both

I guess you can start this story with Colin Kaepernick of the San Francisco 49ers refusing to stand for the National Anthem. It is important to note that the concerns...

More On The National Anthem Controversy

I just did a piece inspired by reaction to Colin Kaepernick declining to stand for the National Anthem. Although Kaepernick's stand or (unstand) is based on current...

Minister’s Vow Of Poverty Does Not Beat Income Tax – And Kent Hovind Update

And yet he still could have succeeded. I’m personally not sure about the IRS’s reasoning in Rev. Rul. 77-290, but the ruling exists and provides a roadmap for pastors who want to take a vow of poverty to avoid paying taxes: basically, they have to mean it. Here, if Pastor White had given up signatory authority over the bank account, he probably wouldn’t have had to pay taxes.

And, in that way, right or not, the IRS’s standard is remarkably clever. It says, “If you’re actually willing to give up your rights to the money, we’ll believe your vow of poverty, and treat you like you didn’t earn the money.” But the thing is, that’s a really steep price, and White was apparently unwilling to pay it. So he lost, and rightly.

Mike Pence Voted For Bill That Cost Him Tens Of Thousands In Income Tax

That ruling would have made the $673,797 deductible to Mike Pence, which could have wiped out his taxes for three or four years. Unfortunately for him, Congress plugged that hole in 2002 with the Job Creation And Worker Assistance Act of 2002. Congressman Mike Pence voted “Yea” both times on that bill when it came to the House. So here, we have a Congressman who voted in favor of a bill that ended up costing him, by my back of the envelope computation, nearly $100,000. I really can’t tell whether he saw it coming, but we should probably give him just a little credit for that.