Most Recent Posts

Kent Hovind’s Big Splash In The Conecuh County Pond

Wedding Bells The big news in Hovind land this week, is Kent's upcoming nuptials with Mary Tocco and the resulting controversy since they are both divorced. I'm...

Can You Beat The IRS By Waiting Out The Ten Year Statute?

I’m not ready to recommend just not paying as a valid tax strategy. Remember for the ten-year statute to work for you, there has to be an assessment, which generally means you have to file. On the other hand, if you have an old liability kicking around and you are not getting any mail, there is probably not much point in trying to be proactive about it. If somebody calls you up and tells you you have to pay right away or you will be arrested, that is a scam. I think at this point, there may be more scam IRS collection people than real ones.

From a policy viewpoint, it seems clear that collections should be seriously beefed up. At this point, maybe Congress needs to make up a new agency and charge it with that duty so it can still punish the IRS without further eroding compliance. Remember Learned Hand’s words “taxes are enforced exactions”. With no enforcement, they become voluntary contribution

New York Strip Club Fights Tax Battle Using Scholars And Loses

By Yellowdune456 - Own work, CC BY-SA 4.0 Originally published on Forbes.com. Going to a strip club is not something that is edifying, but contemplating tax...

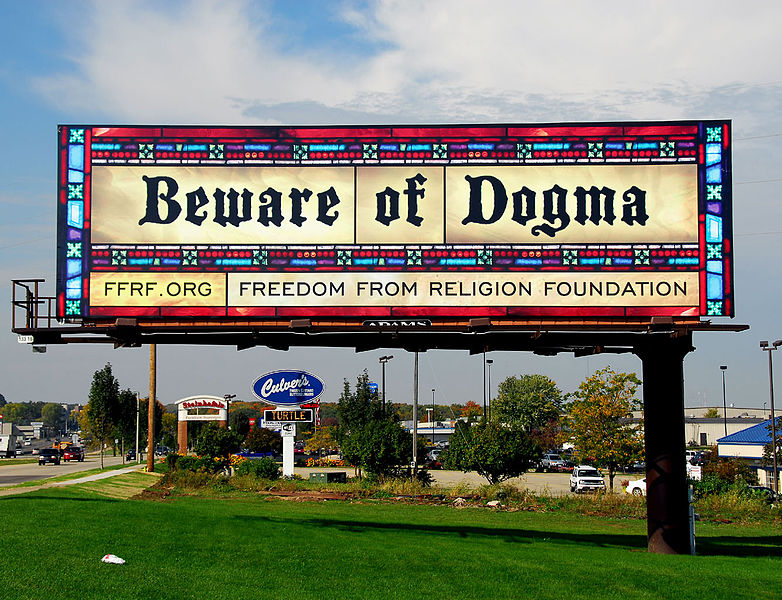

Freedom From Religion Foundation Has Clear Path To Challenge Clergy Housing Tax Break

For the most part though, defense of the clergy housing break is a great source of ecumenical spirit. In the last round of litigation there was an amicus brief in defense of the constitutionality of Section 107 that included among others The International Mission Board of the Southern Baptist Convention, The Greek Orthodox Metropolis of Chicago, The Islamic Center of Boca Raton, and The International Society of Krishna Consciousness.

Experts Comment On Tom Clancy Estate Litigation

Never, ever use a codicil. A Codicil requires just as much formality as does a will, and so the better practice is to sign an entirely new will rather than use a codicil. In this case, that fact that Tom Clancy revoked the prior will (with the language making the Family Trust taxable) and only had the language that makes it qualify for the marital deduction, there would be much less ambiguity. This is also true not only for technical corrections like this but also when you change your mind about bequests in a Will. For example, Aunt Mabel may make Nephew Phil very happy with a $10,000 gift under her new will, or very mad if she reduces a $50,000 gift under her prior will using a codicil.

Use models, and flow charts to illustrate what the plan should do when explaining the effects to the client. This case revolves around intent. If you could clearly illustrate the cash flow (and tax effect) of the revised language as explained to Clancy before he signed the new document, it is ancillary evidence of his intent in executing the document. Even though for you this is elementary math, for us medieval history majors, it is about as clear as mud. A picture is worth a thousand words (or a will contest).

Kent Hovind Has Conecuh County Editor Concerned

So now it is time to welcome a new member to the hearty band of Hovindologists, who to the puzzlement and sometimes chagrin of those near and dear to them follow the...

Tom Clancy’s Widow Prevails Over Kids From First Marriage In Estate Dispute

I often remark that you learn all the math you need for tax work by the fourth grade. The math issue in this case is one of the rare exceptions. If a share of an estate is exempt from estate taxes because it is going to benefit a surviving spouse, as in this case, or a charity and you use some of that share to pay the estate taxes, then that much does not qualify for the exemption.

So now you have a higher estate tax and if you pay some of that additional tax from the exempt share, you have an even higher tax and so on. A real accounting Einstein could solve the problem with algebra , but you can also grind it out by doing the computation over and over till it does not change. Thanks to Goal Seek in Excel, it is really not that hard, but still, I would want at least an eighth-grader handling it.

The Brokenness Of IRS Collections

A couple of observations here. There are numerous reasons why people are delinquent on tax payments. There are the people some of us call tax protesters who prefer to think of themselves as the ones who really understand the law, notwithstanding decades of losing in court. There are the war tax resisters, a fairly earnest, mostly harmless bunch. There are people who find themselves in severe hardship. But in my opinion, the largest group is people who would rather keep the money for themselves and think they can get away with it. Since the nineties, I think Congress has been overly solicitous of them which is really not fair to the majority who organize their lives to live on their after-tax income.

The Statutory Problem With IRS Firearms

In the end, the court elected to detour around the statutory construction question. Instead, the court assumed a statutory violation but held that suppression was not an appropriate remedy. This prudential approach makes eminently good sense: as we recently wrote, “iscretion is often the better part of valor, and courts should not rush to decide unsettled legal issues that can easily be avoided.” Thus, we too assume without deciding that the agents who executed the search of the defendant’s home violated 26 U.S.C. § 7608 because they were armed.

IRS Weapons And Ammunition Spending Is Unremarkable

Then I found a GAO report about ammo use by the Department of Homeland Security. In 2009, DHS had spent $19 million to acquire 84 million rounds of ammunition. That works out to $0.22 per round. The other little tidbit was some detail on border patrol agents. The ammunition requirement for a new officer is 3,300 rounds which drops to 600 rounds for experienced officers. That does not seem like very much practicing, but as I noted if you look at sites that advise on this stuff, you will see all sorts of answers including people claiming that it is a lot of dry firing that really makes you good. Hopefully, I’ll spark a vigorous debate in the comments section.

My source explained to me that IRS CI special agents, although they are required to have accounting training like regular revenue agents are law enforcement officers who are expected to meet standards similar to all other federal law enforcement officers. There are not that many newbies among them as the size of the force has been dropping through attrition due to budget constraints.