Most Recent Posts

The Guardian Seeks Transparency In Amazon Tax Court Case

Guardian has not cited, and our own research has not discovered, any instance in which this Court, or any other court, has been asked to decide whether a media organization should be allowed to intervene in a pending Federal tax controversy. Guardian’s motion presents novel questions, both as to the proper standards for intervention in the absence of any Rule governing the subject, and as to whether the IRS, as an agency of the United States, adequately represents Guardian’s interest in public disclosure.

A Very Broad Transaction Tax Might Have Merit

Thanks to the reckless greed of Wall Street over the past few decades, the American economy is a grossly unbalanced playing field.The only way we can level it is if we rein in reckless speculative financial trading and curb near-instantaneous high-volume trades that create instability in the stock market and our national economy. These financial practices have no intrinsic value, and exist to make a quick buck for already-wealthy speculators. If we want to give middle-class families a fair shot at a strong economy that works for all Americans, we need to put Main Street FIRST.

Nevada Corporation Exists Under IRS Name For Decades

So that’s that, which brings us to the interesting part. How long was there a Nevada corporation called – Department of Treasury – Internal Revenue Service? Over 20 years. DT-IRS was formed in 1994. As far as I can tell, it has not been wreaking havoc during that time. Early on AR Salman sued the actual IRS for using its name, which thanks to the registration he owned. He was looking for $900,000. What he got instead was a ruling that he was a “vexatious litigant”. That particular case was not Salman’s first tax protester rodeo.

Facebook, Leprechauns And The Cayman Pot Of Gold

Until this month even a close follower of the news might be hard-pressed to name more than two people famous for having worked for the IRS. Of course, John Koskinen and Lois Lerner have been made famous by Congressional investigation rather than from doing their jobs. Now there is a third. Nina Wu Stone is a Revenue Agent for the Large Business and International Division of the IRS. And it is her declaration that is attached to the summonses to Facebook filed by the United States in the District Court for the Northern District of California.

How To Not Get A Deduction For Paying Your Girlfriend’s Mortgage

Sadly, Mr. Jackson did not really have much of that going on. He claimed that he gave Ms. Furney $1,000 in cash each month. Nonetheless, he deducted $15,720 in mortgage interest in both 2011 and 2012. That’s a pretty hefty deduction given that he had wage income of $39,292 and $33,022 in those two years. The Form 1098, which was as you would expect addressed to Ms. Furney showed $13,794 in each year. So the $15,720 appears to be what my first managing partner, Herb Cohan, would refer to as “You know. A figure.”

Restoring Fifties Plymouths Ruled Business Not Hobby By Tax Court

The critical element, in my view, is adjusting your behavior as you see that things are not working. You will see people who win horse cases on the same grounds. Amway Independent Business Owners on the other hand always seem to keep on keeping on in the face of persistent losses.

Mr. Main did not avoid the common problem of attorneys in Tax Court. He lost some of his deduction for lack of substantiation. That was the story of the great F. Lee Bailey, who is now filing for bankruptcy. He won against the IRS on a highly technical issue and split with them on hobby loss, but got absolutely killed when it came to substantiation. Mr. Main, on the other hand, seems to have only given a bit on that issue.

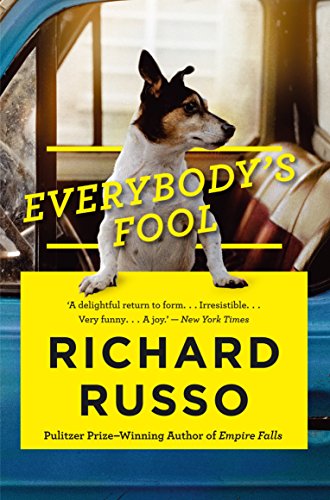

Anachronism In Richard Russo’s Everybody’s Fool?

It is hard to believe that I could catch an otherwise unremarked anachronism in a novel by a major novelist that was published by Alfred Knopf. Well maybe it's just...

Transgender Comic Julia Scotti Blows The Doors Off Fairview Famous

It takes a Jersey girl, or in this case, a transgender woman, to not only have the bravery to come out on national television, but to drop the F-bomb as well!...

Remembrance Of Things Past – St. Johns Fairview Class Of 1966

I have to admit that I am a bit pleased with myself for having pulled off a fiftieth reunion for my grammar school class - St. John the Baptist of Fairview NJ Class of...

Has Kent Hovind Really Handed The Keys To Creation Science Evangelism Ministries?

If you wanted to give credit to one person for Kent Hovind being a free man today, that person would probably be Don Camacho, foreman of the jury in Kent's trial last...