Most Recent Posts

IRS Conservation Easement Settlement Offer – Sweet Deal ?

Under the deal you are allowed your out of pocket meaning that the disallowance is $300,000. And that is taxed at 21% making the deficiency $63,000 for a total tab of $66,000 including the 5% penalty, Of course there will be interest on top of that. Nonetheless if back when you did the deal you made a wise investment with your $58,4000 in savings over and above the investment, you will actually have come out ahead for having invested in a really ridiculous deal.

Tax Court Rules On $187 Million In Charitable Deductions From $9.5 Million Purchase

It is rather intriguing that in the most recent batch of Tax Court decisions the notion that easement valuation is fundamentally different does not even come up as something that might be considered.

Jury Will Decide Merit Of $43 Million Tax Refund Claim By Zaxby’s Cofounder

All Townley has to do is to get it to the jury (which the judge seems to be allowing) and the jury will also have some tendency to help the hometown boy. Notwithstanding there, the mega dollars involved may put some of the good old boys on the jury off.

Tax Court Allows Only 2.5% Of Claimed Easement Charitable Deduction

Significantly, none of petitioner’s experts who testified at trial opined as to the fair market value of the unencumbered easement property. Rather, they determined the net present value of the subsurface aggregate and ignored the regulatory definition of fair market value. The regulations require us to determine fair market value on the basis of the price that a willing buyer and a willing seller would agree to

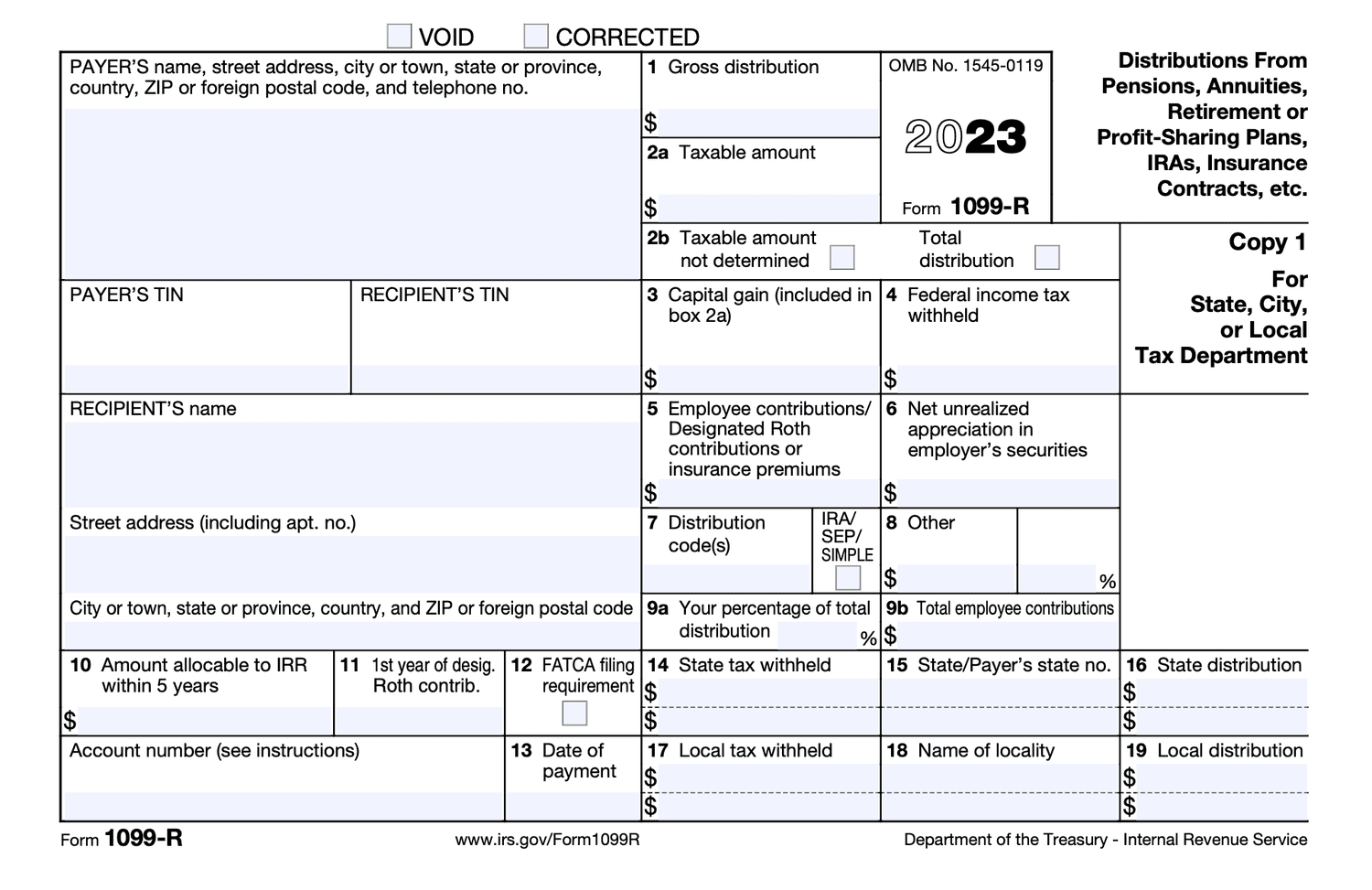

Charitable Distributions From IRAs – What Can Possibly Go Wrong?

Essentially the determination that a distribution is a QCD is on the taxpayer not on the trustee of the IRA.

O’Keefe v. OCU – Byers v. FC – Update!

O’Keefe was employed as a graphic design instructor. Byers was employed as a coach and physical education instructor. While both may be considered “ministers” under the theological concept of the “priesthood of believers”, neither can be shown to have been ministers as envisioned by the application of the “ecclesiastical abstention doctrine”.

A Tale Of Two Tenured Professors

This is a guest post by Robert Baty. You can read about him here. Abilene Christian University led the way for the Churches of Christ, despite the facts and the law. ...

Judge Lauber Provides Anatomy Of A Tax Dodge In Easement Decision

“Like many others with bold dreams, Reynolds was a casualty in the real estate collapse. While there may have been more spectacular financial stumbles, few have been more surprising, given the Reynolds family’s large holdings, solid reputation and deep political and business connections.”

Lafayette In Massachusetts In 1824 – September 3 Sturbridge

Sturbridge celebrated its bicentennial in 1938 with an elaborate pageant. Lafayette and the Coming of Industry was one of the scenes portrayed.

Lafayette In Massachusetts In 1824 – September 3 Charlton

This is part of a series on Lafayette’s visit to Massachusetts August 23, 1824 to September 3 1824. In preparation for Lafayette’s arrival, Lt. Edwards assembled...