Originally Published on forbes.com on March 13th, 2012

______________________________________

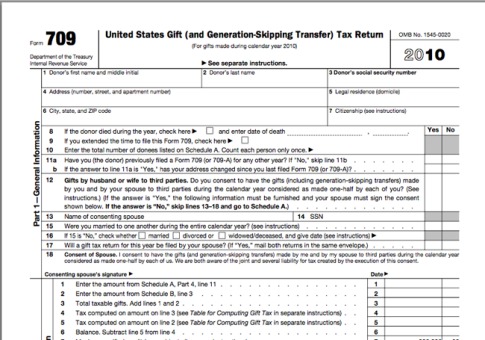

If you have not used up your unified credit yet there is a pretty compelling case for making a large gift in 2012. I’m talking to the 1% here, of course. As of today the combination of taxable estate and cumulative taxable gifts that can pass to the next generation free of estate and gift tax is $5,120,ooo. Based on current law, that number goes down to $1,000,000 effective January 1, 2013. There was a rumor going around that the Super Committee would scale it back to $1,000,000 with an effective date of November 23, 2011. The rumor turned out to be something of an urban legend, but it prompted a few pre-Thanksgiving mega gifts. The “Sensible Estate Tax Act of 2011” would have made it about 1.3 million effective January 1, 2012. That was pretty much dead on arrival, but it had provisions limiting valuation discounts that are likely to resurface.

Now would be a good time to start planning the mega gift. A family limited partnership might help leverage the amount of assets that can be transferred. Doing that properly takes time and care, so you really do not want to start trying to put the wheels in motion in December. Charles Rubinjust recently alerted us to a potential pitfall in making a 2012 mega gift – the threat of clawback. Claws can be pretty scary:

What you usually will see here are my own observations on original source material. I’m making an exception here because I think this piece –Clawback Myth or Monster or Clawback for Dummies by Charles Rubin is really important and there won’t be any original source material on it until it is too late. Here is the problem. We have a gift tax and an estate tax but they are part of a unified system. There is a unified credit that currently lets you make $5,120,000 of taxable gifts before you start having to pay gift taxes. If you never make any taxable gifts your estate can pass $5,120,000 to the next generation free of estate taxes. If your taxable gifts totalled something between 0 and $5,120,000, that will determine the level at which the estate tax kicks in. Mr. Rubin explains how this works in some detail, which I will mostly spare you.

As noted above the inertia of the law as it is now written and the unlikelihood of a Republican sweep make it likely that the unified credit will cover significantly less than $5,120,000 in 2013. Unless I missed a beat somewhere in the last thirty years, I don’t think that the unified credit equivalent has ever gone down. That would account for nobody being sure exactly how the estate tax computations will work for someone who makes a mega gift in 2012 when the credit covers $5,000,000 and then dies in 2013, when the credit covers $1,000,000. Here is an excerpt from Mr. Rubin’s explanation of the potential problem:

If correct, this means that when a donor later dies, and substantial 2011 or 2012 gifts are added into his or her estate tax computation, the constructive gift tax reduction applied to the tentative estate tax will be low – and there will not be a corresponding high unified credit amount available for estate tax purposes to offset this enhanced tax. Thus, in effect, this statutoryanalysis recaptures some of the gift tax that avoided tax at the time of the gift under the then-available unified credit, as estate tax due at death.

Got that. Right. Well, I hate to say it, but I can’t figure out how to make it any clearer. At the risk of gross oversimplification I’ll speculate that someone who is left with a $3,000,000 estate after having made a $5,000,000 mega gift might have estate taxes computed as if the estate were $7,000,000, which conceivably could wipe out the estate. Does that make the mega gift a bad idea ? It does not. I’ll steal from Mr. Rubin again:

Nonetheless, even with clawback, the benefits of a larger 2012 gifts remain. These include (1) enhanced GST exemption for generation-skipping gifts or gifts to trusts that may later have a skip, (2) shifting of appreciation in gifted assets to third parties after the gift that would not otherwise occur (which may provide future estate tax savings), and (3) in many circumstances overall tax savings may still result, even with clawback. Thus, while clawback at worst may reduce benefits of 2012 gifting, enough remain that it may still make sense in many situations

Add to that the fact there is a very strong argument that clawback will not apply at all, and the argument for a mega gift remains very strong. The thing to watch out for is if the residual estate is directed differently than the mega gift. This would be particularly likely in the case of a second marriage or a large portion of the estate residue going to charity. Who then bears the cost of the clawback ? That might not be real clear, which can mean litigation. As I noted in a piece about a case in the New Jersey probate court, not all blended families are like the Brady Bunch. Might the kids have to kick back some of the mega gift to fund step mom’s QTIP ? That would not be pretty. That might be another reason to use a family limited partnership, since adjustments could be made by reshuffling units rather than donees having to reach into their pockets. Addressing these type of issues is another reason why planning for 2012 mega gifts should start yesterday.

You can follow me on twitter @peterreillycpa.