Originally published on Forbes.com.

If your tax plan attracts the attention of a reporter famous for covering clergy sexual abuse of minors, that cannot be a good thing. I was thinking of adding that to Reilly Laws Of Tax Planning, but I think it is probably covered well enough by the Thirteenth Law – When an idea makes you think of a Seinfeld episode, it is not going to end well. Regardless, this brings us to consider the plight of the principals of the James G. Martin Memorial Trust, who, thanks to a tipster, came to the attention of Sacha Pfeiffer in a Boston Globe piece title ‘It’s a tax rip-off’.

Sacha Pfeiffer has the really cool distinction of being a reporter that ended up being portrayed in an Academy Award winning film. Spotlight portrayed the team of Boston Globe reporters who broke the story about the Archdiocese of Boston moving abusive priests from one parish to the other.

Not A Lot Going On With This Charitable Trust

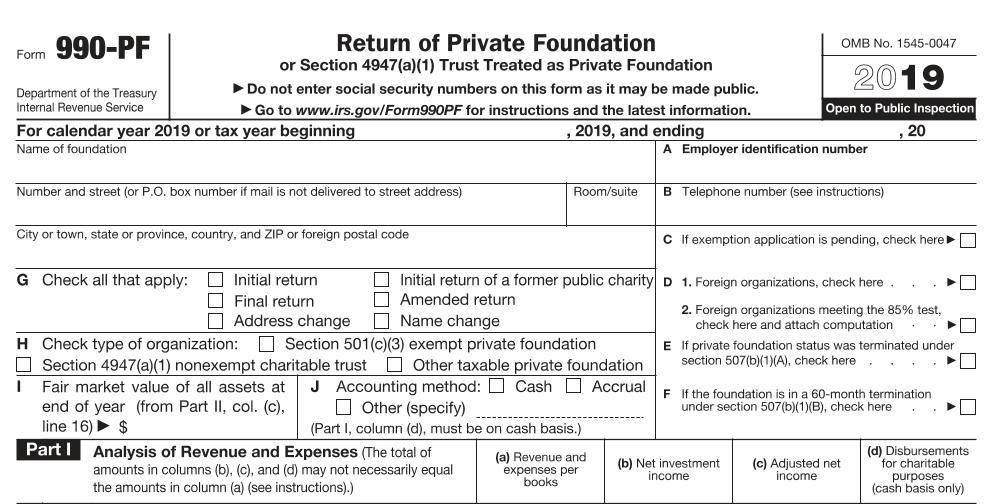

Ms.Pfeiffer, being an investigative reporter, had the time to go through twenty years of Form 990-PF for the trust, but you can pretty well get the flavor from the most recent one for the year ended March 31, 2016. The trust has just over $4 million in assets. In December of 2015, Gerard Martin gave the trust $1 million. That and just short of $60,000 in dividends is its entire income. The trust gave $505,000 to charities. Over half went to the Newton Country Day School with Camp Harbor View and the Immigrant Learning Center getting most of the rest.

In order to manage this enterprise, the Trust paid Thomas Marabella CPA $1,975 which is about what I would want for that return. Mr. Marabella has been in the game longer than I have. His license number is 3485 compared to my 7715. Given the three-year experience requirement back in the day, Mr. Marabella must have started in public accounting around the same time as Woodstock. You can see the traditional touch as one of the schedules is handwritten on old fashioned analysis paper. Then there was $252,000 in salaries $81,295 in pension expense and $18,931 in payroll taxes allocated 1/3 to investment income and 2/3 to disbursements for charitable purposes.

The salaries are split evenly among Marianne Burke, Michelle Martin, and Marilyn Parker. Ms. Burke is the executive director and the other two “review grants”. According to the 990-PF, all three put in more than forty hours per week. According to the Globe story, the ladies are Mr. Martin’s daughters. The returns for the previous two years which is as far back as I went are remarkably similar. Mr. Marabella has pushed his fee up by $200. You have to wonder whether he will break the $2,000 barrier. The three sisters, however, are apparently content with salaries of $84,000 per year. Ms. Pfeiffer indicates that over the last 18 years the trust has donated $6 million and paid the sister $5.3 million.

Ms. Pfeiffer’s tipster is of the opinion that:

Clearly, the primary purpose of the foundation is to provide a comfortable income to the three daughters

Well, I’m a little hesitant to be that critical since the trust gave $10,000 to the Sisters of St. Joseph. On the other hand, managing investments that are spread among six mutual funds and writing eleven checks to established charities really does not seem to require six thousand woman hours – reasonably well-educated woman hours at that -. At $84,000 per year, you could get someone with a few years experience in public accounting who would struggle to fill more than a couple of days on that mission.

How Good A Deal Is this?

The comments in Ms. Pfeiffer’s piece focus on the likelihood that Mr. Martin is getting an income tax deduction for the money that he is donating to the charitable trust, even though roughly half the money is going to his daughters. The savings is a little less exciting when you consider that the daughters are subject to income tax on what they receive either now or in the future from their well-funded pensions. Even if their income tax rate is lower than dad’s, payroll taxes eat up a significant portion of those savings. In one of the three years, I looked at the gift was of securities rather than cash, so there were some savings there.

Still, as income tax planning goes I don’t think the game is worth the candle.

The plan is, however, more sensible when you consider transfer taxes. Even if the income taxes are a wash, Mr. Martin is transferring something like half a million per year to his daughters without making taxable gifts. On the other hand, if the transactions were blown up, which any sort of audit would likely do, the results would be ugly. Mr. Martin would lose his income tax deduction, but the daughters would still have to pay theirs. And there would probably be some very nasty penalties.

All in, my advice would be that you not try this at home.

How Abusive Is This?

As charitable abuse goes, I don’t think this particular deal, assuming the worst, is all that abusive. It is not a matter of real charitable dollars being diverted to personal purposes. All the money is coming from Mr. Martin, not the gullible general public and he is just seeking a favorable tax characterization on the money that he is giving his daughters.

Some Comments

I reached out to my brain trust but did not hear back from too many. Paul Streckfus, editor of the EO Tax Journal, has had his patience worn out with these sorts of shenanigans.

Peter, nothing new here. The Globe article and Bruce Hopkins make a damning case. What is maddening is that the IRS should have an Exam agent begin an audit tomorrow, but the likelihood of that happening is probably nil.

Matt Erskine, who runs a boutique estate planning and wealth management practice with an emphasis on unique assets, answered at some length and went so far as to do his own post.

When a client asks me what a reasonable amount for an insider who is on the board of a private foundation, I usually say not more than 1/10th of 1 percent of the fair market value of the foundation each year. If the person has more responsibility, the salary might go as high as 3/10th of 1 percent. So the children, on a $4 million endowment Private Foundation, could be paid (or received benefits equal to) $4,000 per year (for being a board member) or $12,000 per year (for being an executive director or Board Chair) fairly safely. A salary of $84,000, or 2.1% of the endowment, for each of the daughters might be considered unreasonable compensation, unless there was some facts that argue otherwise.

Any amount may be grounds for loss of tax-exempt status and, in addition, may result in the imposition of self-dealing excise taxes (equal to 100% of amount of benefit received) on individuals benefiting from certain transactions with a private foundation.

Matt’s analysis is reflective of Reilly’s Eleventh Law of Tax Planning – “Pigs Get Fed – Hogs Get Slaughtered”.

Matt thinks, as do I, that there is not really great tax planning going on here, despite it apparently working for many years.

If his intent is to get income to his children, there are better, less risky ways of doing in including using a long-term reversionary trust, an low or no interest loan, or even hiring the child to work for a family business full or part time.

Other Coverage

Not being, until now, a regular Globe reader, I picked up this story while I was out and about listening to Jim Braude and Margery Eagan on WGBH. The Philanthropy News Digest had a summary of the article. That the Globe is behind a paywall might be a factor in the story not spreading. Thanks to Sacha Pfeiffer, I’m springing for the Globe now, but I’m hoping that will be the end of that. These charges are killing me.

About Spotlight

To go a bit off-topic, I have to say that I really liked Spotlight the movie. I particularly appreciated the street scenes in Boston and the part about Boston College High School. In my class at Holy Cross, BC High was the only high school contingent larger than my bunch from Xavier High School in New York. My covivant and I were visiting the Grand Canyon and I ended up striking up a conversation with a long-time member of the BC High faculty.

He had noted my Red Sox hat, which I wear as a regional marker when I am not in New England (When I am in New England I wear a Mets hat to show my heritage). At any rate, he indicated that he thought BC High was treated fairly in the film noting that overall they ended up looking a lot better than the Archdiocese. It is also worth noting that the scandal of clergy sexual abuse is not just a Catholic thing, as is sometimes implied. Catholicism is the largest Christian denomination in the country. Number 2 is the Southern Baptists and as my blogging buddy, William Thornton indicates they too have their issues.

Yes, I agree. Pigs get fed, Hogs get slaughtered.