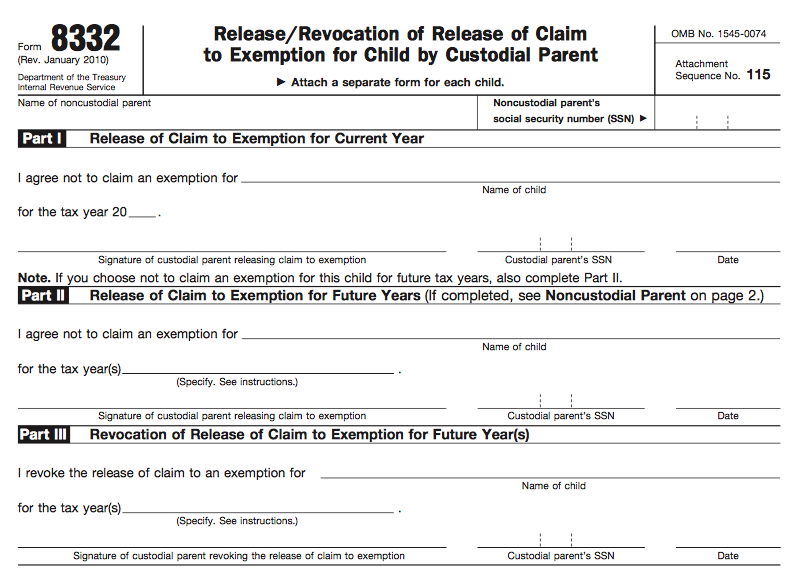

We can hope when the plague is over that IRS will not worry too much about who was actually entitled to a qualifying child so they can fight crime somewhere else. But it is too much to hope for. I foresee the Tax Court being clogged with stimulus related qualifying child cases starting a few years from now. For a lot of people the trump in their card game with the IRS will be Form 8332- Release/Revocation of Release of Claim to Exemption for Child by Custodial. It is possible that a Form 8332 for the year 2018 could make all the difference on a dispute about a 2020 rebate credit. It has to do with the peculiar way the credit works, which we can illustrate with a rather extreme example.

The $3,300 Baby

Blynn, the child of Robin and Terry is not actually a baby. It just sounds more colorful that way. Blynn was born in 2011. Robin and Terry divorced in 2014. Terry has custody of Blynn. As is very common the couple agreed to claim Blynn in alternate years. This is actually not great tax planning, but I can understand why it is used since the dependency claim tends to carry an emotional weight out of proportion to its economic significance in divorce settlements.

2018 was custodial Terry’s year. Robin was quick to send in a 2019 return so at the end of April Robin received $1,700. $1,200 for themselves and $500 for Blynn based on Robin’s 2019 return. Terry also received $1,700 which included $500 for Blynn based on Terry’s 2018 return. Robin in due course received another $600 for Blynn.

Had Terry filed a 2019 return they would not have received the extra $600 for Blynn, but 2019 was a disaster for Terry and they had no filing requirement. So there might have been $600 based still on the 2018 return. (To be honest I don’t know of that happening in real life. In principle it should have. In the only real life example I know of Terry filed a timely extended 2019 return and was disgruntled about not receiving $600 for Blynn in December.)

Is it OK with the IRS that Robin and Terry got the $1,100 each for Blynn? Actually it is, which I explained in some detail in this post. Here is the link to the IRS statement in August on the subject. But that is only $2,200 for Blynn. Where is the other $1,100? This is where it goes from good to great. Terry has been having a really hard time. Robin is not in a position to take care of Blynn. So in January of 2020 Blynn moved in with one of the grandparents – Morgan.

When Morgan files their 2020 return, they are claiming Blynn. And they will be getting an $1,100 credit even though both Robin and Terry each received $1,100 for little Blynn. Great country, America, as one of my JBC buddies used to often remark.

None of these people had adjusted gross income over $75,000 in any of the relevant years, by the way.

Maybe No $5,200 Baby For 2021

Congress must have caught on. The 2021 rebate of $1,400 is done pretty much the same way with an advanced payment based on either the 2019 return or the 2020 return with a true-up on the 2021 return that only goes in favor of the taxpayer. There is a caveat though. The American Rescue Plan Act of 2021 provides that to the “maximum extent administratively practicable”:

…an individual is not taken into account more than once, including by different taxpayers and including by reason of a change in joint return status or dependent status between the taxable year for which an advance refund amount is determined and the taxable year for which a credit under subsection (a) is determined

It remains to be seen how practicable that is going to be, but that is not the main point.

Make Sure You Have Form 8332 If It Is Required

In our example above It is critical that Robin have Form 8332 signed by Terry for 2019. The fact that they have a deal that requires Terry to pass on the deduction cuts no ice with the IRS or Tax Court. Noncustodial parents without Form 8332 are regulars in Tax Court and they almost inevitably lose. There are alternatives to the form for older divorce decrees, but I would encourage you to get the Form 8332 regardless. If you are entitled to Form 8332 and the noncustodial parent is not coughing it up, you might need to visit the divorce court.

Form 8332 is not just a divorce thing. It also applies to never married co-parents who are living apart.

Whose Child Is This?

Sometimes it is not clear who the custodial parent is. If each parent thinks they are the custodial, it is a nontrivial problem to sort it out . There is a discussion of the issue on Page 13 of Publication 501. It comes down to how many nights, but there is somewhat excruciating detail on how you count nights away at summer camp and what you do about parents who work nights. This issue does not come up in Tax Court as much as Form 8332 cases. I have only covered one case that addressed the issue, but it was a doozy going into a lot of detail about football practice.

Unmarried co-parents who are living together can decide from year to year which one of them takes the exemption with no need for Form 8332. Since presumably they have equal nights, there is a tie-breaker rule with the exemption going to whoever has the highest adjusted gross income in the event that they don’t agree. There must be a couple like that with identical adjusted gross. I don’t know what happens then, but they probably should get a prize or something.

Please don’t take this as a complete discussion of the question as to who is the custodial parent. In ambiguous situations you will need to look closely at the regulations, if you want to get it right.

Mostly Missed Opportunities

Careful timing of return filing and mixing and matching dependency exemptions will present many divorced or never married co-parents with opportunity to pick up thousands of dollars. Note that our example was about an only child. Imagine if Blinn has a passel of siblings – Jessie, Riley, Skyler and Jaime. It could really add up. Making it work, though, will require a level of trust and transparency that many uncoupled couples won’t be able to achieve.

How Tough Will The IRS Be?

We don’t know whether the IRS will be going after 2020 and 2021 advance payments, if they determine that 2018 or 2019 returns that they are based on were wrong. Being something of a worrier I am inclined to assume the worst. If you are a non-custodial parent make sure you have that Form 8332. The stakes may be higher than usual.

I have been unable to get an any IRS feedback on whether the adjustment of a 2018 return will cause a clawback of a 2020 payment. Here is the wisdom of the #TaxTwitter crowd.

#TaxTwitter If IRS adjusts a 2018 or 2019 return can they claw back an advance rebate payment that was based on that return?

— Peter Reilly (@peterreillycpa) March 22, 2021

Originally published on Forbes.com.

For great value continuing professional education. I recommend the Boston Tax Institute

You can register on-line or reach them by phone (561) 268 – 2269 or email vc@bostontaxinstitute.com. Mention Your Tax Matters Partner if you contact them.