One of the things about being a CPA is that you are rarely the smartest guy in the room. If you are working at anything above an elementary level there will be people who would be better accountants than you are. Fortunately they got good guidance in high school or something like that and took up something more demanding.

One of those smart guys in my career was Jim Luckett, who was the executive director of the Boston Housing Partnership when I was doing the audit and tax compliance work on a couple of its projects. Jim and I lost touch, but reconnected through Facebook. He asked me for some advice and a referral on some of the fine points of the Paycheck Protection Program and I had to tell him that it was unlikely than anybody else had come up with a better answer than he did after studying it.

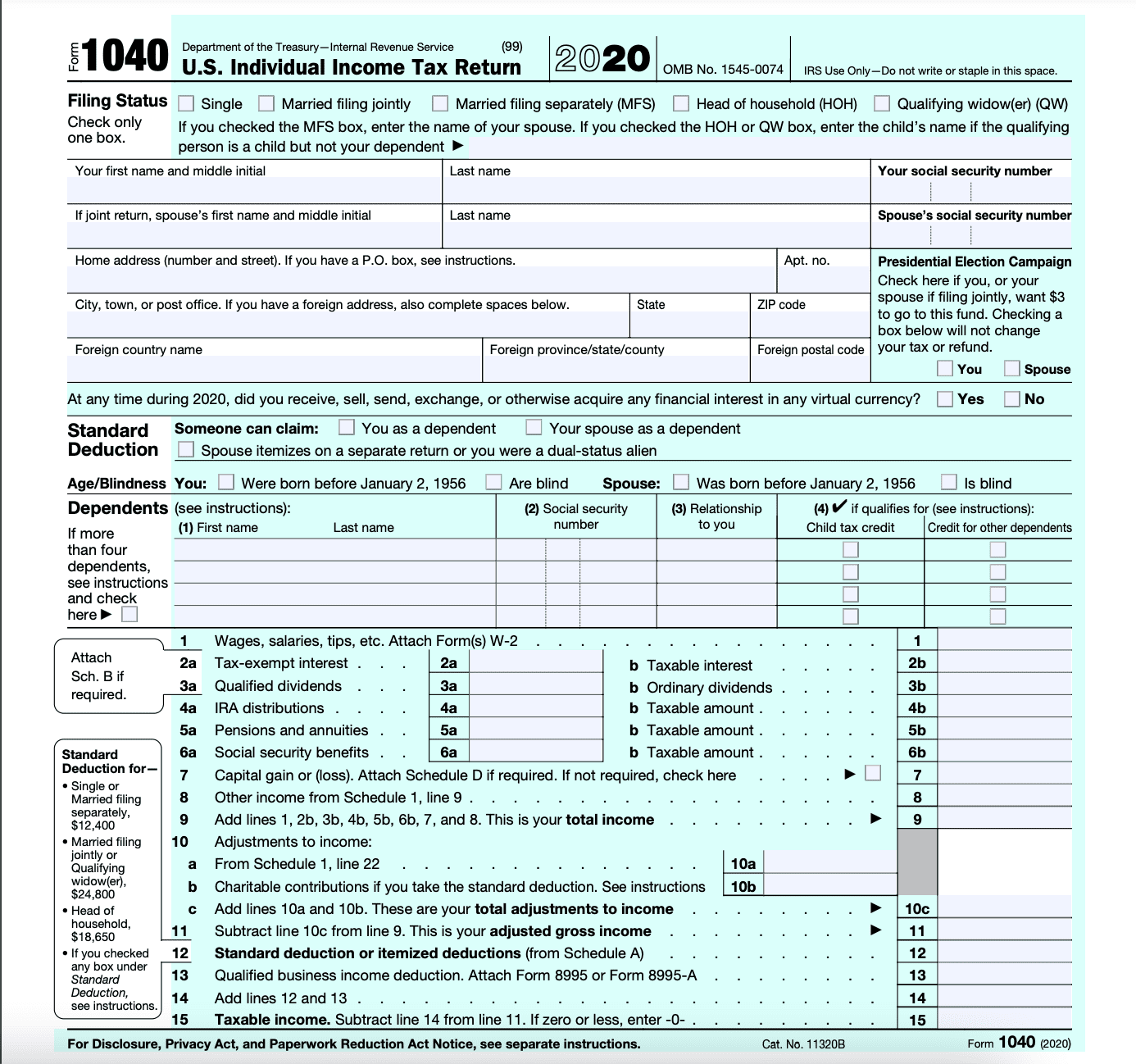

At any rate Jim does his own return and decided to do it twice with competing software packages. Here is the result in his own words.

Turbotax vs. H&R Block: Winner is Turbotax.

I bought both and did my taxes on each. Both had software bugs that caused the taxes owed to be too high. However, TurboTax phone support had very short hold times and intelligent people on the other end, who acknowledged the bugs were real and claimed they would report them so new versions of the software would be fixed. The phone response was truly stunningly good. Some of the people I talked to were CPAs — or at least said they were — and I believe they were.

H&R Block phone support was impossible to deal with. Never got to a person who was even willing to try to understand what the problem was. Very long hold times. I was shunted from person to person for 3 hours, including very long hold times with obnoxious recorded announcements while on hold, and then the connection went dead.

I would say the errors were worse in TurboTax for my particular set of tax situations this particular year, so in that sense, H&R Block is better because if you didn’t catch the errors in either, TT could cost you thousands of dollars more in needless tax payments than Block would. But for me, the lousy phone support at Block is a deal breaker. Plus, in past years I did find an error in Block that did cost me thousands until I got the money back by filing amended returns.

It’s a jungle out there, Jane.

———————————————————————————————————————————————————————–

My covivant who is a superior preparer has a family and friends mini-practice, which includes my return. She swears by Drake for whatever that is worth.

Jim Luckett got out of the affordable housing consulting business and now sells sailboats through SailboatsToGo.com.

For great value continuing professional education. I recommend the Boston Tax Institute

You can register on-line or reach them by phone (561) 268 – 2269 or email vc@bostontaxinstitute.com. Mention Your Tax Matters Partner if you contact them.