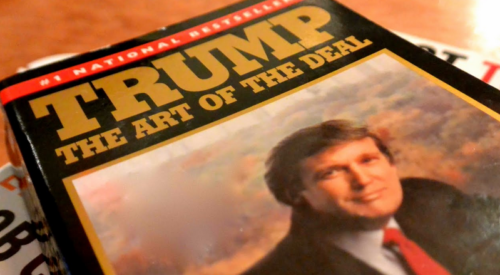

There was definitely something disturbing about the energy of Trump supporters in Worcester last month as they heartily approved of his demonizing of Syrian refugees. I’m not going to go full Godwin on him like Diane Williamson of the Worcester Telegram, but I just want you to know I was paying attention to the big picture as I was cramped into my seat at the DCU, which for me is forever the Centrum, primarily in my capacity as a tax blogger hoping for some crumbs. I did have a big takeaway from the event. As I walked the few blocks to the library parking lot having deftly avoided the $20 event parking fee across the street, I decided I just had to read The Art of The Deal. We were told that if our fellow Bay Stater, John Kerry, had read Art of the Deal, he might have come back with a much better agreement with Iran.

Worth Reading

It was tough for me as I was in the middle of City on Fire, which is a brilliantly plotted work, but rather a long haul. Interestingly both City on Fire and Art of the Deal have quite a bit on the New York City fiscal crisis of the nineteen seventies. You have to give Trump credit. He always believed that his native city would rise. Bottom line, I’m really glad I took the time out to read Art of the Deal. Published in 1987, it evokes some powerful memories. Unlike the Centrum frenzy last month, there is much for a tax blogger in Art of the Deal, especially one who spent much of his time with closely held companies and real estate deals. There is also some insight into Trump’s character

That’s Why They Call It The Internal Revenue Code of 1986

The opening of the book is something of a week in the life of Donald Trump as we follow along as he talks to and meets with various people. The one incident that grabbed me is this.

Jack Mitnik, my accountant, calls to discuss the tax implications of a deal we are doing. I ask him how bad he thinks the new federal tax law is going for real estate, since it eliminates a lot of current real estate write-offs.

To my surprise, Mitnik tells me he thinks the law is an overall plus for me, since much of my cash flow comes from casinos and condominiums and the top tax rate on earned income is being dropped from 50 to 32 percent. However, I still believe the law will be a disaster for the country, since it eliminates the incentives to invest and build – particularly in secondary locations, where no building will occur unless there are incentives.

For whatever it is worth, I think it is actually Mitnick, someone whom I’d like to learn more about sometime, but dammit Jim, I’m a tax blogger not an investigative reporter. Regardless, Trump here is describing what was something of an inflection point in my career.

Although real estate had always been a natural tax shelter, the Economic Recovery Tax Act of 1981 by introducing 15 year depreciation had turbo-charged it. Trump mentions depreciation in passing.

I don’t have to please Wall Street, and so I appreciate depreciation. For me the relevant issue isn’t what I report on the bottom line, it’s what I get to keep.

Real Estate Pre-1986 Deferral And Conversion

Prior to the Tax Reform Act of 1986 any building that could generate enough net operating income to cover debt service had an additional value as a potential shelter. At break-even if the depreciation deductions exceeded the principal amortization, there was a loss, even though there was no negative cash flow. The loss really only created a deferral since the basis of the property was being dragged down. At some point the principal amortization would exceed the depreciation and you would have income without positive cash flow. That is where the other element came in – conversion. If you walked away from the building with a mortgage in excess of basis, it turned around on you as capital gain.

Particularly in the affordable housing area developers who put a project together could get investors to pay them mainly for the shelter with upside on the real estate being something like icing on the cake. There were a lot of bells and whistles and I’m really simplifying this, but a cleverly structured deal would have investors paying over say five years while getting losses twice as much as their contributions, in effect meaning that they were getting an interest in real estate instead of paying taxes . Losses would continue for some period after pay in and when the dreaded crossover came, a new group of investors would be there to take you out, kind of wash, rinse, repeat.

I was growing up professionally during this period. My observation on the times is summed up in Reilly’s Third Law of Tax Practice – “Any reasonably complex tax matter involving significant dollars, regardless of whatever else it might be, is a white collar jobs program”. One of the key elements in an affordable housing project besides site acquisition, zoning, HUD financing and subsidy, was a group of reasonably high-income individuals, dentists for example, who had income that needed sheltering. And of course, the accounting firm that found them was the logical choice to do the related tax work and regulatory audits.

What Art Of The Deal Says About Trump’s Character

There were two anecdotes in Art of The Deal that really struck me. They tie in with Trump’s statement about the method in what sometimes can appear to be madness:

The final key to the way I promote is bravado. I play to people’s fantasies. …… I call it truthful hyperbole. It’s an innocent form of exaggeration – and a very effective form of promotion.

He tells the story of how he got the Holiday Inn board of directors to believe that his Atlantic City Casino project was well advanced, by having the site manager bring in as much heavy equipment as he could find and make a great show of activity.

What the bulldozers and dump trucks did wasn’t important, I said so long as they did a lot of it.

It was in his first really big deal though the transformation of the rundown Commodore hotel into the Hyatt Grand Regency, that he brags about doing something that I find rather troubling. In his negotiations with Jay Pritzker to team up on the project, Tump had wanted to get a covenant from Hyatt that they would not open another hotel in the five boroughs. Pritzker refused. Trump went ahead anyway, but he still wanted that covenant and then, by his own account, saw an opportunity.

….just before we closed I was alone with an executive from the bank. I pointed out that this was a rather big and risky investment the bank was making, and that one way to further protect the loan might be to insist on a restrictive covenant

I was taking a chance because right then and there, the whole financing could have fallen through. But what I had going for me was that Jay Pritzker was not at the closing.

When I told my covivant those stories she was appalled by both of them, but CV is a veteran of the Peace Corps and a spiritual community before going into public accounting and her standards for openness, honesty and authenticity are rather high. So I turned to someone I know who is extremely successful in business and something of my North Star when it comes both to questions of practical business wisdom and business ethics. When he was honored by a group of people in his industry one of the speakers said of him “He knows the meaning of a handshake”.

I related the two anecdotes and he chuckled about the bulldozer story allowing that he might have done something like that and told me a story about somebody he knew who had pulled a similar ploy. The Pritzker story was another matter. The distinction being that at that point Trump and Pritzker were partners. “I wouldn’t have done that” does not sound like a ringing condemnation but from NS who tends to be rather understated it kind of is.

Of course, a lot has happened with Trump since 1987, but I find that the fact that he took particular pride in that maneuver with Pritzker extremely troubling.

The Trump Tax Plan

We can hear just a bit of an echo of Trump’s conversation with Jack Mitnik (or more likely Mitnick) nearly thirty years ago. Jack pointed out to Trump that the lower rate on ordinary income was more of a benefit to him than the lost tax breaks that other developers had been selling to dentists and the like. In Trump’s current plan a 15% rate for business income is called for, a rate lower than the capital gains rate.

Trump indicates that the plan is fiscally responsible, although the Tax Foundation scores it as costing about a trillion per year in revenue. Of course maybe he was just engaging in a bit of “truthful hyperbole” when he rolled out the plan.