Originally published on Forbes.com.

If somebody calls you up to talk about your unpaid federal taxes, just hang up.

Period. Full Stop. That’s it. I hold that view so firmly that I have decided to make it Reilly’s Fifteenth Law of Tax Planning.

But, But, The Call Might Be Legitimate

That’s right. After years of warnings that anybody calling you out of the blue claiming to be from the IRS is running a scam of some sort, we now have a notice from the IRS – IR-2017-74 with the pithy title “Private Collection of Some Overdue Federal Taxes Starts in April; Those Affected Will Hear First From IRS; IRS Will Still Handle Most Tax Debts”.

The notice then explains to you how to separate the wheat from the chaff. Don’t you need to know whether the person calling is a scammer or someone from CBE Group, Conserve, Peformant or Pioneer, the companies engaged by the IRS? Not really. Either way you should just hang up.

Before you start getting legitimate calls, the IRS will contact you by mail and it will include Publication 4518, which explains the private collection program and even tells you what you can do to get out of it. Do you need to do that? Actually, you do not. As a matter of fact, there is good reason to think that being on the private collection naughty list is better for you, if you can put up with the occasional annoying phone call that you hang up on. To understand why you need to know just a bit about IRS collections.

How It Works

For practical purposes, the IRS has four possible faces. At one extreme is a kind of black box. You send in timely returns with timely payments or maybe you receive a refund. At the other extreme is IRS Criminal Investigation. You have to get very extreme, to get them interested in you. And you shouldn’t be reading tax blogs, you should be finding a lawyer. The other two faces, which it is very important not to confuse are examination and collection.

You deal with examination if the IRS thinks that your return might be wrong. This can be extremely stressful and annoying. If there are significant dollars involved, you are best advised to hire somebody to deal with it. A CPA or an Enrolled Agent to deal with a Revenue Agent doing an audit. A tax attorney if it goes beyond that. To maintain perspective though it is important to know that at the end of a process that might take years – audit, IRS appeals, Tax Court petition, back to IRS appeals, Tax Court decision, Appellate Court – all that happens is that you get a bill. It might be a big bill, but that is it. Once the final, final bill is issued after however much appealing you choose, examinations is done with you.

And maybe you just write a check and you are done and you will never deal with the part of the IRS that now has private companies making phone calls for it. That would be collections.

Collections

The job of the collections arm of the IRS is to, you know, collect. Once the matter is in their hands there should no longer be any question as to what the correct amount of the tax is. “Doubt as to liability” is an issue that can be raised with them, but generally if they have the account, there is no doubt. At the end of the day when you are actually dealing with collections, whose determinations can be appealed to Tax Court, you are arguing about “reasonable collection potential”. Thanks to the RCP concept, if you are not interested in accumulating net worth and you are not a total chazer about it, paying your income tax is somewhat optional.

Here is the funny thing about the people doing collections for the IRS. Congress forbids the IRS from evaluating them based on how much they collect. The private companies, on the other hand, will be paid on a percentage basis. Go figure.

What You Need To Worry About

At any rate, if you end up with an unpaid tax- (Say you filed without paying or there was an adjustment to your return or you didn’t file so the IRS filed for your)- what IRS collections will do, if they do anything, is send you annoying mail telling you you should pay with the letters getting progressively more ominous. Now if that mail really bothers you, you can get proactive. If the amounts are significant you should probably hire somebody. That person will not be somebody who mostly does returns nor should it be somebody who advertises on TV that your debt can be settled for penalties on the dollar. Collections is a specialty. I don’t have a shortcut to tell you how to find somebody. Just make sure it is someone with one of the valid credentials CPA, Enrolled Agent or attorney and that they focus on collection work to some extent. Check their references thoroughly and look up whether they actually have valid credentials. Like you can tell I am really a Massachusetts CPA by checking here.

The other thing you might do is nothing. I would suggest however that you read all those notices and save them. Also tell the IRS when you move. There is a form for that. Because at some point you might get a notice that really matters. That is when you better do something:

If the IRS pursues enforcement action, the taxpayer still has options. After the IRS files a Notice of Federal Tax Lien, and prior to the Service initiating levy action, a taxpayer is given the opportunity to request a hearing with the Office of Appeals. The taxpayer also has a right to appeal certain other collection actions. For example, if the taxpayer’s request for an installment agreement is denied, the taxpayer has a right to appeal that determination. Each taxpayer subject to enforcement action receives Publication 1660, Collection Appeal Rights. This publication explains a taxpayer’s right to make an appeal and the procedures for requesting an appeal.

At any time before or during collection action, a taxpayer who believes a pending collection action will create a significant hardship may apply for relief by submitting Form 911, Application for Taxpayer Assistance Order (ATAO). The Office of the Taxpayer Advocate will review the application, and if appropriate, take steps to resolve the taxpayer’s problem with the IRS to relieve the hardship.

If you continue your passive-aggressive ways at that point, they can take your stuff or tell people who owe you money to pay them instead – or else.

Here is the funny thing, though. They might never get around to doing that, because they don’t have enough resources. And they are not being evaluated on how much they collect, but rather on how well they do at answering the phone. And when they start threatening to actually take money from bank accounts, they start getting phone calls and filings and the like. So they just sit on accounts. Lots of accounts. Including maybe yours.

Light At The End of the Tunnel

It might seem that your passive-aggressive ways are dooming you to a life sentence of waiting for the other shoe to drop. But that is not the case. There is a statute of limitations on collections. Ten years. Now that may seem like a really long time, but if your account is one of the ones turned over to the private collectors, you might already be halfway there. And here is the beautiful part, from your viewpoint rather than that of good tax administration, the private collectors cannot do any of the nasty stuff that real IRS collection people can do. They can’t do liens and levies which can make your life really miserable. All they can do is encourage you to pay in full either all at once or in installments.

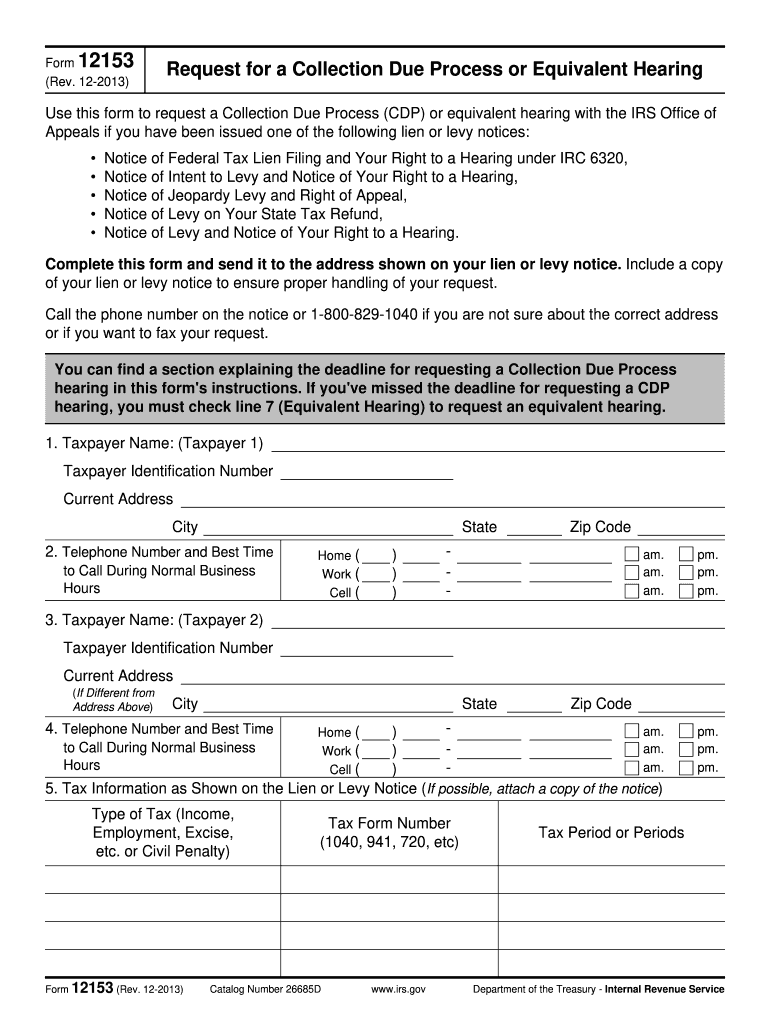

Now when you get the really serious notices from the IRS and you file Form 12153 to request a collection due process hearing the result of which can be appealed to Tax Court, the downside is that the ten-year clock stops ticking. And this is why having your account with the private collectors is such a beautiful thing. They can’t do any of the nasty stuff, but the ten-year clock is still ticking. When they give up on you, they have to hand you back to the IRS which has to start over. So maybe rather than hanging up on them you should have long discussions, but that is only for the really advanced passive-aggressive types.

Really You Should Pay

If you want to be a good citizen and a good person, you should pay the balance due if there is any way that you can. If your account is getting turned over to these collections folks though you either have a different view of tax than I do or you really can’t pay. In either case, the fact that your balance is growing because of interest likely does not matter, because people in your situation end up paying based on reasonable collection potential rather than the “correct tax”, which is of academic interest. So treat the callers from CBE Group or whichever of the gang of four happens to have your account the same way you treat the guys calling from Mumbai. But watch your mail and tell the IRS when you move.