Originally published on Forbes.com.

Freddie S. Raley is my new hero. He was featured recently in a decision by the United States District Court for the Northern District of Alabama Southern Division. Mr. Raley is an 83 year old disabled veteran. He is suing Bank of America. Bank of America has numerous ATMs scattered just about anywhere I go, which I really appreciate, since I hate paying a buck or two to get at my own money.

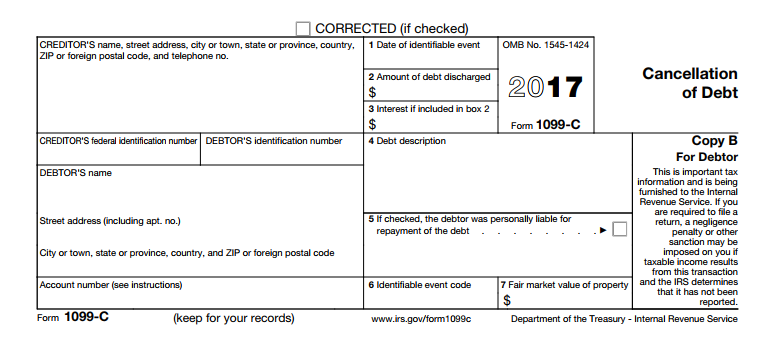

Bank of America also has a goodly percentage of my net worth in its coffers. Sorry Bank of America, I have a rule that I will always root for a disabled veteran, so Mr. Raley has me rooting for him in this case. I would probably root for him anyway, since it looks like BOA really dropped the ball when they sent Mr. Raley a 1099-C for $7,454.07,

What is Form 1099-C?

Generally if you owe money and it is determined that you don’t have to pay it back, you are considered to have taxable income, referred to variously as income from the discharge of indebtedness or cancellation of debt income (COD). If you think about it you can see that not taxing COD would be a hole in the Internal Revenue Code that you could drive a fleet of trucks through.

Nonetheless, the concept disturbs me a bit. It seems like kicking somebody when they are down. (There are ways to excluded COD income if you are in bankruptcy or insolvent) At any rate, it is the duty of certain types of creditors to send out Form 1099-C when they decide to stop chasing somebody. The amount of the discharge is indicated in Box 2 of the form. The instructions indicate that if you disagree with the amount in Box 2, you should contact the creditor. Good luck with that.

But Mr. Raley Never Owed Anythingi

Mr. Raley’s troubled relationship with BOA did not start with the 1099-C. It started with BOA hounding him to make payments on a credit card. Mr. Raley told them that he never had no stinking BOA credit card and he didn’t want to hear from them anymore. If BOA wanted to contact him, they could do so through his lawyer. That didn’t work. He still kept hearing from them. Then in January 2014, he received the 1099-C showing $7,454.07. When Raley’s attorney contacted the bank, he was told that if he believed there was fraud associated with the account, he should contact the fraud department. Nobody had mentioned the fraud department when collection efforts were being made, although to be fair to BOA, it’s not that hard to find.

The Lawsuit

Mr. Raley sued in the Circuit Court of Jefferson County, Alabama. There were four counts – violation of the federal Fair Debt Collection Practices Act, state-law negligence, state-law private nuisance and state-law wantonness. Because of the federal issue, BOA moved the case to the District Court. The recent decision was on BOA’s motion to dismiss, which was successful on some but not all counts.

Overall BOA is arguing that it did not breach any duty and Mr. Raley has not shown any specific ways in which he has been injured. In its motion to dismiss BOA argued, among other things, that:

…Raley has identified no generally applicable duty of care which the Bank breached by issuing a Form 1099-C that reported the cancellation of a debt which Raley claims not to owe.

….his wantonness claim is supported by nothing more than the conclusory allegation that the Bank’s action in issuing a 1099-C were “wanton and done with malice”

Raley’s defamation claim fails because Raley has failed to allege that he has suffered any reputational injury as a result of the Bank’s actions and because the Bank’s mandatory reporting to the IRS is privileged.

The Decision

It is somewhat complicated and lawyerly. Mr. Raley tried to amend his complaint, but there were procedural issues surrounding the amendment. Initially he wanted to include 26 USC 7434 which provides for civil damages for fraudulent filing of information returns. (I recently covered Shiner v Turnoy, which concerned Section 7434.) As it happens 1099-C is not one of the forms covered by the statute. So that was out.

Mr. Raley abandoned the 7434 claim and the court had ruled against him on the Federal Fair Debt Collections Practices Act claim, so he requested that the case, which no longer had any federal issues be sent back to state court. Apparently, once the case gets into federal court, the court has discretion to settle the whole case, even if the issues that allowed it to get into federal court are already settled. The federal court, however, also has the option to kick it back to the state court.

28 U.S.C. § 1367(c)(3), however, provides the court with discretion to decline to exercise its supplemental jurisdiction over the state-law claims once all federal claims have been eliminated. In exercising this discretion, district courts are instructed to consider “the circumstances of the particular case, the nature of the state law claims, the character of the governing state law, and the relationship between the state and federal claims,” as well as ““the values of judicial economy, convenience, fairness, and comity.”

The bank had arguments against the other four counts and was hoping to get them dismissed. The District Court indicated that if it had decided to keep the case, it still saw something to argue about.

On common law negligence:

If this court was not remanding the case to state court it would find that Raley plausibly states a claim for common law negligence. Raley alleges that his attorney repeatedly informed the Bank that Raley did not open the credit card accounts and does not owe the debt, yet the Bank still issued the 1099-C. The Bank apparently did not refer the matter to its fraud department, or even inform Raley or his attorney that such a department existed, until February 2014.

On wantonness:

While these are unproven allegations, they are sufficient at this stage to plausibly allege that the Bank acted with a reckless or conscious disregard of Raley’s rights, especially considering the repeated denials of liability and lack of a sufficient investigation into the validity of the debt.

On defamation:

…the court suggests that Raley has sufficiently pled actual malice; the facts, as alleged, can lead to the plausible inference that the Bank was at least reckless as to the falsity of the statement, since it was repeatedly put on notice that the debt may not be valid yet did not sufficiently investigate.

The Court did not, however, find any plausible claim of statutory negligence, making that due to be dismissed.

I was particularly impressed with the defamation claim. Mr. Raley was upset that BOA had told anybody that he was the type of person that would not pay his debts.

Bottom line, the case is going back to the state court.

After consideration of all relevant factors, the court finds that remand of the action is appropriate. Only state-law torts remain, and under principles of comity, “tate courts, not federal courts, should be the final arbiters of state law,”

What To Do If You Get A 1099-C?

The worst thing you can do if you receive a 1099-C is to ignore it. You can, of course, simply report the income and pay the tax. If you are in bankruptcy or insolvent, you can use Form 982 to exclude some or all of the income. I have not found authority about what to do if you receive one that is wrong and you can’t get the creditor to reissue. I think most practitioners would put the amount on your Form 1040 and then make another entry to back it out. There is a really good chance that that will work on a practical basis. Most of the case law about people with debt discharge income involves people who took the ignore route.

About Freddie S. Raley

As I often note, I am a tax blogger not an investigative reporter. I did not find any information that would allow me to easily contact Mr. Raley to congratulate him on his partial victory and applaud his principled stand. Having apparently been the victim of identity theft, he may be keeping a relatively low internet profile. Nonetheless, in my search I stumbled on an interesting story. In 1961 the Alabama Air National Guard covertly flew in support of the ill-fated Bay of Pigs operation. Historians Warren Trest and Donald Dodd wrote about that aspect of Bay of Pigs in a book titled Wings of Denial: The Alabama Air National Guard’s Covert Role at the Bay of Pigs. A list of participants at the end of the book includes a Freddie S. Raley. I don’t know if it is the same fellow, but it seems like a pretty good bet.

Afternote

It is important to note that the Court was ruling on a motion to dismiss Mr. Raley’s claims not on the ultimate outcome.

When reviewing a motion to dismiss under Fed. R. Civ. P. 12(b)(6), the court must ““accep the allegations in the complaint as true and constru them in the light most favorable to the plaintiff.”

A subsequent decision might show Bank of America in a more favorable light.