Originally published on Forbes.com Mar 23rd, 2014

We are approaching that magical time when the signing of tax returns becomes a last second fire drill, particularly for the half of a couple, that is least involved in getting the return prepared. I’d like to suggest that you take a deep breath and actually look at your return before you take that final step. What follows is hardly a comprehensive checklist, but it covers some items that might have gotten by your preparers, even if they are pretty good.

Filing A Joint Return Is Not Mandatory

A joint return will usually result in a lower aggregate tax than two married filing separate returns. There is a trade-off to that lower aggregate tax called joint and several liability. That means the IRS can pursue either half of the couple for the whole tax, There is relief for “innocent spouses”, but it is challenging to qualify for that. Joint and several liability is one of the reasons that I recommend that separate returns be seriously considered for the final year of a marriage. Many tax preparers are not sensitive to the “joint and several liability” issue and will imply that joint filing is obligatory.

If you are presented with a joint return, in a hurry-up ask no questions mode, slow down and take a deep breath. If you have any reason to doubt, the accuracy of the return, don’t sign it until you have satisfied yourself about possible discrepancies. If you have any reason to think your spouse has unreported income, don’t sign. If the balance due is not going in with the return and it is mostly your spouse’s income creating it, don’t sign without a clear plan about how the balance will be dealt with.

Investment Interest Deduction

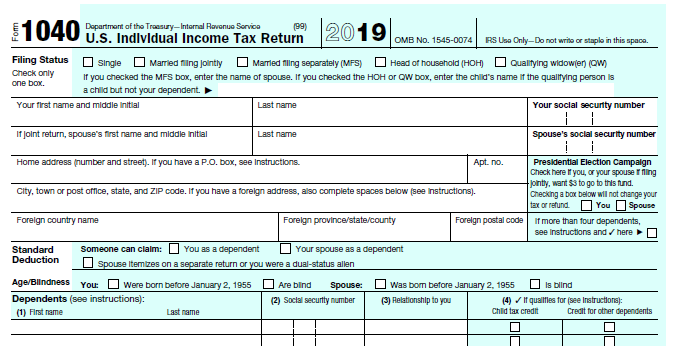

If you are one of those people who get a two hundred plus page book that purports to be your income tax return, I’m going to give you a couple of things that you should look for as you thumb through it. The first one is Form 4952. See if you have a number on Line 7 that is larger than the number on line 2.

If that is the case, you are accumulating investment interest deductions that you will be able to use in the future. You will get to use that deduction if you ever have investment income other than long term capital gains and qualified dividends. Given persistent low interest rates for investors, that future time may be “next never”. By giving up the preferential rate on some of your dividends and long term gains, you get to use the deduction in the current year. This opportunity is not often well communicated.

There is another odd thing that can happen on this form. Line 4(g) is where you put the amount of favorably taxed income you are electing to treat as ordinary. It is rather silly to elect more than your allowable interest deduction, but apparently, some software packages allow you to do this. That chuckling you hear is coming from Pennsylvania, where the Robert Flach, the Wandering Tax Pro, is doing returns by hand and would never make a mistake like that.

Don’t Waste Deductions Due To AMT

Go to line 45 on page 2 of your 1040. If there is a big number there, that means that you are deep into the alternative minimum tax. The details of the computation are on Form 6251. If you have unproductive property, you should probably make the election to capitalize real estate taxes and carrying charges. It won’t save you any money on the current year’s return, but it will allow you to get a benefit from those expenditures when you sell the property.

Investigate Large AMT

If you are tens of thousands of dollars deep into AMT, it would probably be a good idea to have an intense review of the computations done, particularly if you have not been deep into AMT in the past. Even though the AMT presents itself as an add-on to the regular tax, it is actually a complete parallel system. It’s like you are the citizen of two different countries and you pay tax where ever it is higher. In AMT land rates are lower, but there are fewer deductions and some deductions are stretched out over a longer period.

This means that the basis in your assets and carryover losses are different, usually higher, for AMT purposes than for regular tax purposes. Really good tax software will keep track of all that. If you have switched accountants or your accountant has switched software providers, there is a good chance that AMT carryovers got lost. I’m thinking of writing an insider’s guide to the sausage factory of high-end tax preparation, but for now, I’ll just say that there is a decent chance that your accountant is not keeping track of all the things that you would think should be tracked, if you knew more about AMT.

Be Careful About Non-resident State Returns

If you have a transaction that subjects you to state tax in another state, a property sale, for instance, it is a really bad idea to just blow off that return. The state that you blow off has forever to catch you. If they catch you after the statute has run on your home state return, it will be too late to claim a credit. Also if an out of state return has a significant balance, make sure that somebody who is familiar with that state takes a good look at that return. Many of the East Coast states have peculiar systems that sharply differ from federal computations. Among those are New Jersey, Pennsylvania, and Massachusetts, and don’t get me started on New Hampshire.

About Those Losses

If you are posting losses from side activities, be sure that you will be in a position to show that you have written plans as to how the activities will be profitable someday and are able to document the time that you spend on the activities. If you have a full-time day job as a computer engineer or something like that and are claiming that you spend even more time on your real estate activities than your day job…. Well, I might believe you, but nobody who matters, (e.g. revenue agents or Tax Court judges) will. If you really and truly believe that your horse ranching will be profitable in the future, you might want to consider capitalizing as much as you can to lower the audit profile and have the assurance that those expenses will be deductible when your Triple Crown winner finally comes in.

Charity

For contributions of $250 or more, it is crucial that you have a written acknowledgment, with the proper language, in hand when you file your return. The Tax Court cuts no slack on this issue.

And The Latest The Obamacare Tax

If there is a significant number on line 60 of your 1040, it may be due to the new Form 8960. Anytime, there is something new like that, one or more major tax software providers will get it wrong. Even if the software does not get it wrong, preparers will not get the input right. If you look at the form you will see several places where it says “see instructions”. It might just as well say – “Lots of people will get this wrong because hardly anybody reads instructions anymore”.

Of course, your CPA, with whom you play golf, will assure you, as you are sipping single malt scotch together, that his people are all over the latest developments. The sad truth is that that fellow’s primary job is play golf with you and make you feel good about his firm. There is a chance that he could explain what is supposed to be on Line 7 of your Form 8960, but not a great chance. If use a national firm, the partner may be able to tell you that they have somebody in their Washington office who actually wrote the legislation or something.

You know what. She is not going to be working on your return. Most of the work will be done by an intern in close collaboration with a service center somewhere in India. The software package they use will have been selected based on how well it does corporate consolidated returns. Bottom line, if there is a good-sized number on line 60, make sure somebody tears the computation apart if you can’t do it yourself. I’ve only looked at one Form 8960 so far this year. It was wrong.

Don’t Be Afraid To Extend

If all of a sudden this year you have a large AMT liability, I’d want to really look closely at your returns for the last several years, before I told you to go ahead and pay it. You will be hard-pressed to find somebody moderately competent to put time into giving it the scrutiny it deserves between now and April 15. It is a different story in May, so if there is a serious question about the accuracy of your return, get an extension.

You can follow me on twitter @peterreillycpa.