Originally published on Forbes.com Dec 1st, 2013

Judge Barbara Crabb ruled recently that the exclusion of cash housing allowances from taxable income by members of the clergy (“ministers of the gospel”)is unconstitutional. Among the reactions are cries from the clergy that their lives are not really the tax picnic that you might perceive given the tax free housing allowance that they can use to pay deductible mortgage interest and real estate taxes to help shelter the rest of their income. They are right. The tax treatment of clergy is a confusing result of piecemeal changes made in 1921, 1954, 1967 and 2002 (I probably missed a year). Maybe it is constitutional. Maybe it is not. Regardless, it is something of a mess. We need a Clergy Tax Simplification Act Of 2014 which will pass constitutional muster. To start I will review the current situation. Judge Crabb’s decision addresses just part of it.

The Employee Issue

Ministers, are by statute, considered self-employed for FICA purposes. That means that they pay 15.3%, while secular employees will have 7.65% withheld from their pay, which is matched by the employer. It gets worse. Most ministers will not get the income tax benefit of being self-employed – better deal on out-of-pocket deductions – because they will be considered employees for income tax purposes. Perhaps more significantly, it is such a confusing system, that people probably get it wrong more often than they get it right. The Evangelical Council on Financial Accountability in reacting to Judge Crabb’s ruling quoted from a report that said:

Given the dual tax status of many members of the clergy (e.g., the common circumstance in which a minister is an employee for income tax purposes but subject to the self-employment tax for Social Security purposes), and the fact that the clergy housing exclusion applies to income tax but not to Social Security tax, much confusion exists among members of the clergy regarding the applicability of the exclusion under current tax law. Accordingly, the IRS should improve the tax forms, worksheets, and educational guidance for members of the clergy in connection with the clergy housing exclusion.

When you get people asking the IRS to give them more educational guidance, you know that the system is needlessly complex. If you want to study on it some, here is the IRS audit manual for ministers.

The other peculiar thing that comes out of the dual status situation is that ministers who are required to live in parsonages are taxed on the value of the housing for self-employment tax purposes. That makes them worse off than other employees, such as apartment managers, who are required to live in employer-provided housing.

Is It Really That Good A Tax Deal To Be A Minister?

We could construct a lot of examples, but I’m going to stick with back-of-the-envelope type of computations. A moderately compensated senior pastor might be making on the order of $80,000 per year. The FICA penalty is on the whole pay. The income tax savings on the housing allowance is on the part of the pay designated as housing allowance which is actually spent on providing a home. If the pastor is married with a spouse making some income the saving might be mostly at 25%, otherwise it might be mostly at 15%. All in, their special status is not generally putting them very far ahead of similarly compensated professionals.

So if we reformed the system and treated pastors the same way that we treat the executive directors of not-for-profit organizations, the rank and file would probably not be much worse off. Those that are required to live in church housing would come out ahead. It is a different story for those at the top of the ministerial food chain.

It Is A Great Deal For The Favored Few

The housing allowance is a real bonanza for the mega pastors of the mega-churches, the folks my blogging buddy Reverend William Thornton refers to as “religious racketeers”. His denomination, the Southern Baptist Conference, has scads of modestly paid pastors (SBC is the second-largest denomination in the US in terms of members, but the largest in terms of clergy serving congregations).

I would wager that if you put it to a vote, most of them would be happy to give up the income tax exclusion for housing in exchange for simplicity and a FICA match. That might not sit well with the 200+ or so mega pastors of the SBC’s megachurches, who may have disproportionate influence on the denomination’s well-paid leadership, which also likely has handsome housing allowances.

When I spoke to Reverend Russell Moore of SBC’s Ethics and Religious Liberty Council, he insisted that the mega pastors are such a tiny minority that they are not worth discussing in this context. He also indicated that it would be wrong for the denomination to even attempt using moral suasion to influence the mega pastors to stop being such chazzers and accept a reasonable dollar cap on the tax-free housing allowance.

Never Mind Constitutional – What Is Right?

Of course, even though most ministers might come out even, the congregations would come out behind. They would be required to match FICA on their minister’s pay, just like every other struggling not for profit has to match FICA on its executive director’s pay.

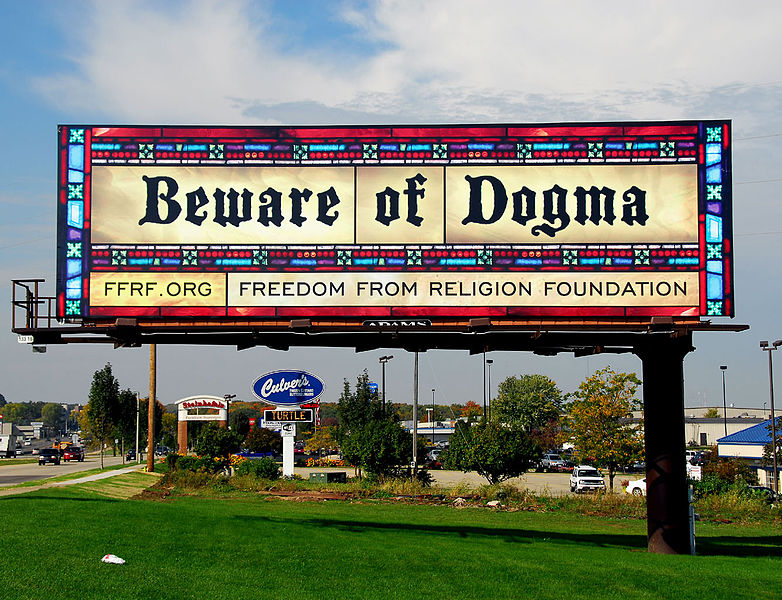

I am not a great fan of the Freedom From Religion Foundation since I think they are a bit overzealous in their effort to keep religion out of the public square. The housing allowance controversy is a real gift to them. It will be really hard for denominations to look like they are claiming the moral high ground while they are defending a special tax break that most benefits the richest clergy. Steve Furtick of Elevation Church has as his primary job, as I understand it, encouraging his followers to emulate someone who is reputed to have said:

If thou wilt be perfect, go and sell that thou hast, and give to the poor, and thou shalt have treasure in heaven: and come and follow me.

In order to do this, he needs a 16,000 square foot home? And his denomination supports the notion that he should not have to pay income tax on the money his congregation pays him to support that mansion?

When secular people create organizations that, inter alia, feed the hungry, give drink to the thirsty, clothe the naked, shelter the homeless, visit the sick, and visit the imprisoned they can share the advantage that churches have in receiving tax-deductible contribution. Of course, the secular organizations have to apply for exempt status and operate in a fiscally transparent mode by filing Form 990, something that churches don’t have to do.

The secular organizations hire people who are taxed pretty much the same way that everybody else is and follow pretty much the same requirements that for-profit employers have to follow including matching FICA. It is hard to see the public policy rationale for giving better tax treatment to people who help the poor because God tells them to than people who help the poor because they believe it is the right thing to do. I’m sure somebody can explain it.

In defending the special tax status of ministers against constitutional challenge, the primary line of defense has been “standing”. The argument is not so much that it is constitutional, but that nobody has the right to challenge it in court. That might be a good legal tactic, but it is hardly an inspiring strategy for people claiming the moral high ground.

What I would like to see is a proposal to Congress that would phase in a transition of clergy to being taxed like everyone else. Give it a couple of years so small congregations can plan to adapt and grandfather people who are at or near retirement. The way it got the way it is was not from some comprehensive plan, but from piecemeal changes over nearly a century. Let’s have the Clergy Tax Simplification Act of 2014 to clean it up. If a couple of the major denominations got behind it, there would probably be bipartisan support. It would be nice to get those congressmen talking to one another again.

You can follow me on twitter @peterreillycpa.

Afternotes

I have not discussed the one-time election that clergy can make to avoid self-employment tax based on conscientious objection. I’ll leave that for my commenters.

Once again I have turned my tax blog into “all parsonage, all the time” for a brief period. Always makes me worry when I do that. What has the Tax Court has been up to without me watching? I’ll let you know soon.

On the bright side, since blogging about your own blog represents the height of self-absorption, I vowed to only doing it at century marks. If I am in the middle of something when the bell tolls, I have to wait another 100 posts. Thus I let 400, 500, and 600 go by without remark. And here passes 700 without a review. Unless I pick up the pace, it will be late in tax season, before 800 and I am expecting the toughest tax season in a very long time as I am starting with a very small firm. Much as I look forward to doing some actual work, I still find the prospect daunting and fear the impact it will have on my blog.