An article I recently read cautioned estate planners about word choice in speaking to clients. One example they gave was of a planner who was courting the family of a sports star. The planner peppered his presentation with references to Code sections, which at least to this family, were reminiscent of encounters with the criminal justice system. The funniest story was about the prospect who stormed out in outrage when told that he was going to be provided with a trust that was defective.

Defective grantor trust is a really stupid name for something that, in the right circumstances, can be a very good idea. Somewhere along the line somebody realized that people might be disturbed by hearing that their trust was defective so the term became Intentionally Defective Grantor Trust. Kind of like – “Hey that defect in your trust. We put it there on purpose. So you should feel good.” Why is the name stupid ? The name is stupid because if the trust is done correctly it will have no defects, intentional or otherwise. The “defect” in the trust is a power held by the grantor or the fiduciary that produces an income tax effect that can be desirable. In software terms the “defect” is a feature, not a bug.

If you are heading to an estate planner for the first time you now know everything that you need to know about defective grantor trusts. If you have an inquiring mind, you may want to learn the origin of the silly name. I will do my best. First of all you need to consider the term “trust”. Entities that are called trusts or considered to be trusts under state law are not necessarily trusts for income tax purposes. A Massachusetts trust with transferable shares, for example, will likely be considered a partnership or an an association taxed as a corporation under federal tax law. I really can’t go into that topic much further, just keep it in mind, in case you are thinking about your realty trust, which is probably a title holding device, as you are reading this and understand that there are things called trusts that are not trusts for income tax purposes.

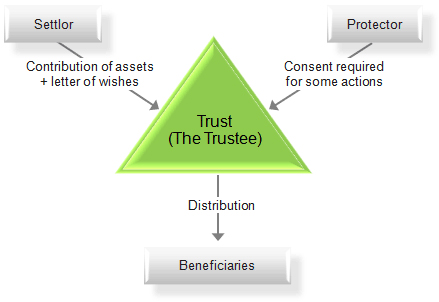

Typically a trust will have three major players. There is somebody who has a bunch of stuff that he wants to put in a trust. We call him the grantor. There is somebody, perhaps a corporate entity, who is going to take care of the stuff in accordance with the terms of the document. That is your fiduciary. The fiduciary will probably at some point make distributions in accordance with the terms of the instrument. Those distribution will go to beneficiaries. Grantor – fiduciary – beneficiary. Those are the three roles.

A trust like that is a separate taxable entity and is taxed on the same scheme as a decedent’s estate. Trusts and estate have their own Supchapter in the Internal Revenue Code. It is Supchapter J. People may differ about this, but I think Subchapter J is about the most complicated part of the Code. I’ll bet that an expert on fiduciary income tax would consider Willam McKee’s Federal Taxation of Partnerships and Partners light reading. She is the first person I would ask if I was having trouble finishing a crossword puzzle or Sudoku. Put simply, a trust is taxed like an individual, with smaller brackets so it gets to the top rate faster. A trust is allowed a deduction for distributions to beneficiaries. If the trust gets the deduction then the beneficiary is taxed on some of the trust’s income.

Back when rates were much higher, trusts were great income tax avoidance devices. There was for example the Clifford trust. A dentist would have a trust for his kids buy equipment, which he would then rent for use in his practice. After ten years the corpus of the trust would revert to the dentist. When the brackets were wider and the top rate was much higher, there were all sorts of neat things you would do to shift income. Trusts played a big role in that.

A major problem with that kind of income shifting planning was that even though you wanted taxes paid at your kids rates, it’s not like you wanted your kids to actually have access to the money. That was kind of the Achilles heel that Congress used to attack income shifting with trusts. The rules say that if the trust instrument gives the grantor or the fiduciary certain powers then the trust is a “grantor trust”. The trust is not treated as a separate entity that either pays tax itself or shifts income to beneficiaries. Returns are prepared as if the grantor did everything that the trust did. Transactions between the grantor and the trust are ignored for income tax purposes.

Back in the heyday of using trusts for shifting income, if a trust contained one of those powers, like the power of the grantor to withdraw property from the trust and replace if with property of equal value, someone who thought the trust was being used to shift income, would consider that power to be a defect. They would be right. The trust would not accomplish its intended purposes.

A lot of things happened to change the landscape most notably the Tax Reform Act of 1986. Bracket compression and other changes made income shifting less interesting. Somebody somewhere had a bright idea. There were powers you could put in a trust that would not pull it back into the grantor’s estate, but would require the trusts transactions to go on the grantor’s income tax return. Put an income producing asset into a trust like that and you have the pre-tax income going to the next generation with the grantor paying the income tax. It supercharges the gift. There are other advantages such as being able to transfer leveraged assets into the trust without worrying about recognizing gain. There is nothing defective about it except its name.

They really should have come up with a better name, but for some reason defective stuck. One more thing. Don’t be offended if they tell you that your trust is crumby. That is not even how it is spelled.

You can follow me on twitter @peterreillycpa.

Originally published on Forbes.com Oct 15th, 2012