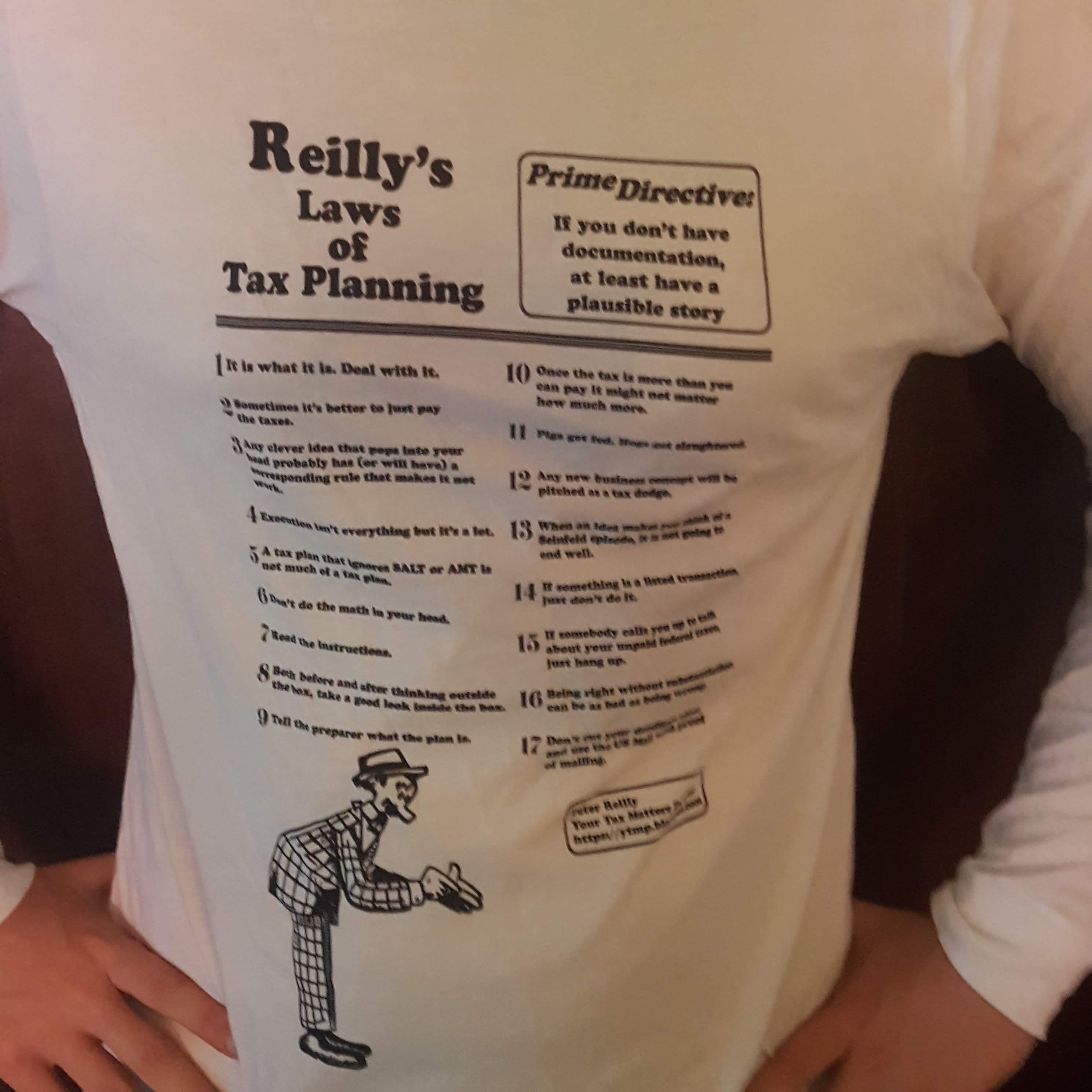

Get some Reilly’s Laws of Tax Planning Gear

Originally published on Forbes.com.

There has been a bit of hobby loss action, since the Tax Court decision in the case of James and Elaine Donoghue on June 11 which I covered here. None of the decisions struck me as quite interesting enough to merit a post, but I have resolved to be your go-to-guy when it comes to hobby loss, so I thought I would combine them. And, hold your excitement, my hobby loss work has inspired an addition to Reilly’s Laws of Tax Planning, but we’ll save that for the end and give you the latest.

Know When To Fold Them

We’ll start with the gamblers. Here are the latest.

The Fourth Circuit affirmed, without comment, the Tax Court 2017 decision in the case of James Boneparte. Boneparte worked full-time for the Port of New York Authority at the Lincoln Tunnel but spent a lot of time in Atlantic City at racetracks and casinos. He did not keep detailed records and did not get a lot of credit for reading books and watching videos about winning at slots and baccarat. It is interesting to note that the Tax Court found that his $82,000 from the Port Authority was substantial income in 2013.

Next up is Jun Wu, a Tax Court Summary Opinion. Summary opinions are not precedent, but I still find them instructive and if I like the result, I would not hesitate to use it with a Revenue Agent. This is not such a decision. Jun Wu lived and worked in San Francisco, so his gambling was in Vegas. Among the multitude of things that have stayed in Vegas are Jun Wu’s gambling losses.

Wu’s pro se status comes through loud and clear:

Petitioner intended to win when he gambled, and he developed his winning strategies by reading a book he could not remember the name of, talking to people and casino employees at the various casinos, taking a class that lasted “a couple hours”, and “just by playing”.

It strikes me that his trial prep left a bit to be desired. At any rate, only the first of the regulatory factors (business-like manner) is discussed at length. Along with the recreational aspect, that was enough to sink his claim.

Other than the win/loss statements provided by the casinos, petitioner did not maintain any records for the activity, and he did not develop or follow any form of business plan

Finally, for the gamblers, there is Theodore Zalesiak, another summary opinion Zalesiak’s game was poker and he was actually positive in some years. Still, the Tax Court dealt him aces over eights without much in the way of illuminating discussion.

And A Horse Of Course

The horse is RS Noble Heir starring in the Tax Court memorandum decision in the case of Sheldon Sapoznik and Melissa McCrossen. RS Noble Heir had that great job that certain horses get as their final career. Unfortunately, he died before performing. He was succeeded by a gelding who was held for sale. Major Sugarfixxx was sold at a breakeven.

The Tax Court found that there was not a business going on there.

Petitioners did not create written business plans for their horse-related activities, nor did they maintain complete books or records.

You will search hard to find a taxpayer who wins when the analysis starts out that way.

And The New Law

It was not an upbeat month or two for 183 victims, but my fundamental view on 183 has not changed. If your client really is trying to make money, the losses should be claimed, even if the chance of profits is remote. Hence we now have Reilly’s 18th Law of Tax Planning – Honest Objective Trumps Realistic Possibility.

It is rooted in one of the earliest and most significant 183 decisions, the first time 183 was discussed by an appellate court. It concerned Maurice Dreicer, a trustafarian who spent years (and hundreds of thousands of dollars) searching for the perfect steak. The Second Circuit ruled that the Tax Court had used the wrong standard in denying Dreicer’s losses.

We hold that a taxpayer engages in an activity for profit, within the meaning of Section 183 and the implementing regulations, when profit is actually and honestly his objective though the prospect of achieving it may seem dim. Because the Tax Court applied a different standard, we reverse and remand for redetermination of Dreicer’s deduction claims.

Even on that standard, Dreicer still lost, but that is neither here nor there.

Other Coverage

Lew Taishoff had “EV’RY GAMBLER KNOWS” and focused on Wu’s lack of evidence.

Ev’ry gambler knows that the secret to survivin’ when at the table at 400 Second Street, NW, or any of its satellite locations, is paper…lots and lots of paper. Diaries, bank statements, the plastic cards the casinos give out for you to prepay your bets, canceled checks, spreadsheets, and anything else you can write down, print out, or electronically retrieve.

Jun Wu didn’t.

Mr. Taishoff added a nice note at the end.

While my colleague Peter Reilly, CPA, seems to be sanguine about prospects of winning a hobby loss Section 183 goof, I still would look first to the paper. It’s the secret to survivin’, and not only for gamblers.

Mr. Taishoff had WINNING ISN’T EVERYTHING on Zalesiak.

Law360 had something behind its paywall on all the cases.

Other Note

There actually is a gambler song that is better than The Gambler.

Correction

In an earlier version of this piece, I indicated that gambling losses will not be deductible as itemized deductions under TCJA. That was an error