Originally published on Forbes.com.

One of the most important provisions of the House version of Tax Cuts And Jobs Act is the repeal of the Generation Skipping Tax. GST repeal is not getting much attention. The scoring of GST is lumped in with the repeal of the estate tax at $172 billion. The GST has probably not produced much revenue since it was enacted in its current form in 1986. But from a revenue production viewpoint you might view the GST as producing seeds that have been planted every year since 1986 and that some of those seeds have finally started reaching the stage where they will be bearing fruit. That would be the IRS view. On the taxpayer side, theGST is a bomb that might be going off soon or detonated without being noticed putting trustees at grave risk.

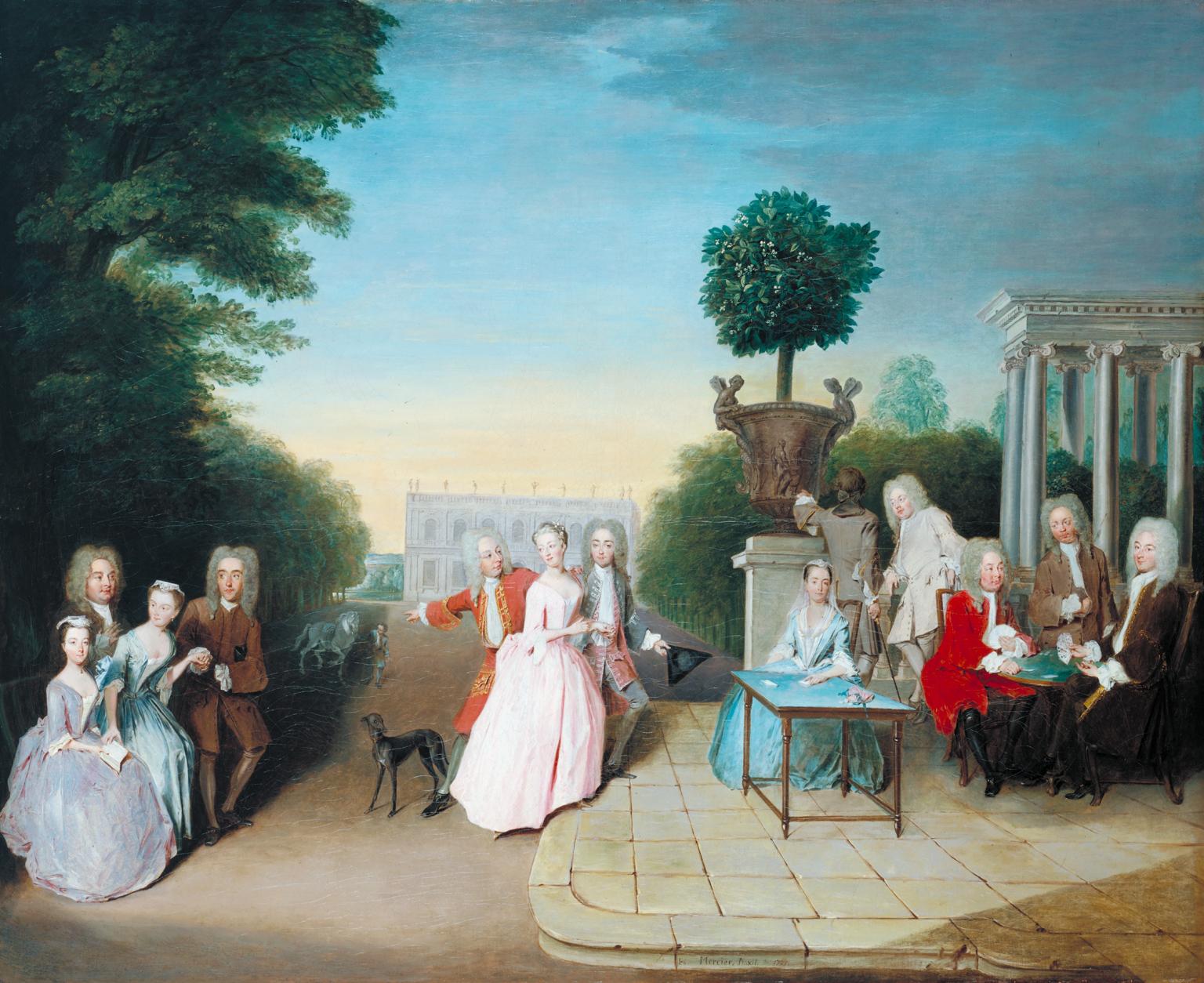

More to the point, the GST was set up in conjunction with the estate tax to help moderate the tendency to fuel wealth inequality through the establishment of dynastic trusts. The content of the Tax Cuts And Jobs Act makes me think that the Republicans feel just fine about rising wealth inequality and dynasties. Their bill seems directed to what I call the New Gentry and the GST was a looming threat to the New Gentry, perhaps even more significant than the estate tax. If the venerable Harvey comic book Richard Rich died in 1990 leaving one hundred million to a non-exempt trust that under the laws of Colorado can last one thousand years, there is a 40% haircut scheduled when Richie Rich Jr. dies, which can’t be that long from now. And it will happen again when Richie Rich III dies. God forbid, but if the investment advisers don’t keep up Richie Rich X might have to get a job.

Some History

To understand the GST you need to know something about trusts. Wealthy people were creating trusts long before there was an estate tax to worry about. The remark “Don’t put your trust in money, but put your money in trust” is attributed to Oliver Wendell Holmes Sr., who died in 1894. Trusts protect assets for future generations from the improvidence of heirs, lawsuits, and greedy spouses.

Trusts have three types of players – grantors, fiduciaries, and beneficiaries. The grantor is the person who puts the property into the trust and sets its terms, sometimes creating the trust with a will so that the trust commences on the death of the grantor. That is the scenario we will assume for this discussion. Also to simplify we will assume the grantor no longer has a spouse as a potential beneficiary. The fiduciary, also called the trustee, is responsible for the trust assets. As far as the rest of the world is concerned it is as if the trustee owns the assets. The trustee is bound to follow the terms of the trust. The beneficiaries are the people who get distributions from the trust.

Enter The Estate Tax

The estate tax encouraged trusts, because it was figured out early on, that if once every generation the fortune has to take a haircut from estate taxes, it would be hard to stay even, much less get ahead. So when somebody created a fortune that went into trust on their death, there would be an estate tax levied at that point, but there would not be an additional estate tax when the founder’s children died or his grandchildren. Back in the day, there was a limit on how long you could stretch it out. There is a common law concept called the rule against perpetuities. Trusts could last no longer than 21 years beyond the life of people alive at the time of its creation. There are a lot of complications and twists and turns to the rule. It can be really confusing and create unpleasant surprises.

Still, even with the rule, a trust can last a long time. John D. Rockefeller Jr. established an intervivos trust in 1934. His granddaughter Abby O’Neil was alive then as was his son David Rockefeller. They both died this year. I’m not a Rockefeller genealogist, so just for talking purposes let’s assume they were the last of the descendants who were alive in 1934. That would mean that the 21-year clock started this year. Probably some of the great-grandchildren and great-great-grandchildren will pass before the trust has to terminate. That is a lot of estate tax that old John Junior avoided there as he kept the appreciation from 1932 to 1960 out of his estate and then any estate tax that would have been due on those assets if they had gone directly to children and then grandchildren and then great-grandchildren. That’s at least three bites at the Rockefeller apple, that the estate tax did not get.

The Generation Skipping Tax was supposed to put a stop to that, but it is a slow process. Glossing over the complexities of definitions, GST applies the estate tax rate to three types of transfers. There is a direct skip where you outright give something to a skip person. Then there is a taxable distribution. That is when a trust makes a non-exempt distribution to a skip person. Finally, there is a termination, which is where the action is going to be. In order to keep things simple, we will assume that wealth is only going to lineal descendants (The rules address how third cousins once removed and total strangers fit in, but life is complicated enough without that). The children are the non-skip people. The skippers are the grandchildren and their children and their children and so on.

About That Rule Against Perpetuities

As the story about John Junior’s trust indicates it is reasonable to expect that a trust subject to the rule might last about a century. If set up before 1986 the trust would probably skip estate tax of all the children and grandchildren and maybe some of the great-grandchildren and beyond. As Ray Madoff points out in a 2010 New York Times piece – America Builds an Aristocracy – many states are repealing the venerable rule (according to Wikipedia it goes back to 1682)

In the mid-1990s, however, many states repealed the perpetuities rule, and now any wealthy American can set property aside for his heirs forever, simply by hiring a trustee from one of these states.

The new limits are all over the map, but anybody can hire a trustee in one of the states with long limits – Colorado is 1,000 years.

You can’t beat the GST by having your trust have a 1,000-year term in Colorado. The law indicates that when the last of the children pass, there is a termination for GST purposes. At that point the grandchildren get promoted to non-skip persons and the trustees can start distributing to them without incurring GST. When the last of the grandchildren die, there is another termination and the great-grandchildren are promoted. When the last of them dies, there is another termination, and so on.

Suppose you have a family where the tradition is to have four kids – the first at age 20 and the last at age 40 – and everybody lives to be eighty. When the patriarch dies as a widower, he has four children and sixteen grandchildren. The youngest child is 40 and the youngest grandchild is a newborn. If the trustees don’t distribute to skip persons the first bite of GST comes forty years after the patriarch’s death when the youngest grandchild is 40 setting the stage for another termination in 40 years. So a Colorado thousand-year trust will get hammered 25 times (The current rate is 40%). I don’t want to do the math on how many descendants there will be at that point. I’m sure it’s a number.

The Deluge Is Coming

That family of fours is, of course, a silly example, but it is good for illustrative purposes. More significantly, it indicates that the GST is getting ready to kick in in a big way in the next decade. Again keeping it simple, the GST should be hitting the first decedent’s trust it applies to around – well now. Eighty year-olds who died in 1990 would have as their youngest child someone around forty then, give or take. That child would now be seventy-seven perhaps looking forward to many more golden years but still not thinking life-time memberships are such a bargain if not hesitating to buy green bananas.

Lot’s of Planning

The estate planning community has been all over the generation-skipping tax for decades. I suspect that more money has been spent planning for the generation-skipping tax than has been paid in GST. There are all sorts of considerations on how to apply the exemptions, which are a big deal to multi-millionaires, but likely round-off errors to billionaires. A CPA I know once lost a major account because some backroom nerd at the attorney’s office told the client that the proper election had not been made, which would have dire consequences. Of course, those consequences would be suffered by children not yet born. I had this image of people begging in the street with signs that said that their ancestors had misused the GST exemption.

That lesson made me pretty fanatical about insisting that the planning attorney review any gift tax returns I am involved with. Elections involving GST are a great illustration of Reilly’s Ninth Law of Tax Planning – Tell the preparer what the plan is. With all that planning, you would think that the planners would be hearing from trustees about the passing of the last of the non-skip beneficiaries.

This Should Be A Thing

I could not find any statistics on the GST, but the IRS does have spotty statistics on the estate tax. So we know that for 1992, there were 923 taxable estate returns filed with assets over $5 million. The aggregate net worth of those estates was over $18 billion. That was carved back by $4 billion in estate taxes. If the trustees kept the principal up with inflation that might mean a pool of over $6 billion that will be hit with GST in the next few years. In 1995, there were 1,973 taxable estates in the five million-plus category with over $30 billion in assets. After carving back for seven billion in estate tax, that would mean a $23 billion pool which with principal keeping up with inflation would be nearly $37 billion now.

In 2010, trustees had an opportunity to blow out to the skip generations without incurring GST, but I can’t find much report of people doing that and there was a concern about retroactivity. So I am going to stand by my opinion that there is a good bit of exposure out there.

The Dog Is Not Barking

When I reached out to contacts in the estate planning community, I found that there is not much concern about this looming problem. A far-seeing trustee would have bought a last to die insurance policy on the first generation beneficiaries, but I have never heard of insurance guys hustling a product like that.

I spoke with Richard Baum of Anchin Block & Anchin Accountants and Advisors, who practices in this area and has written on it. He agreed with the analysis that that trusts that have run out of non-skip beneficiaries are facing a problem, but he has not heard much rumbling in the estate planning community about the issue. Lauren Detzel of Dean Mead thinks the scoring on the value of the repeal of GST is low

I totally agree that there are lots of nonexempt trusts with substantial assets that will benefit from the repeal of GST that probably haven’t been factored in. By adding in a non skip person as a beneficiary of an otherwise GST trust planners could kick the tax bite down the road to the death of the non skip person. Lots of baby boomers are non skip beneficiaries of nonexempt trusts. If they die after 2023 big tax savings.

Howard Medwed of Burns and Levinson who is the person I would think would know if there is concern in the estate planning community about the passing of non-skippers. He has not heard anything either. He was pretty dismissive of my notion that there is a conspiracy going on – a bevy of billionaire grandchildren out begging in the street after having exhausted their exempt trust.

I did hear from one attorney who mentioned some trustees who are totally invested in illiquid assets who are left with one elderly non-skip beneficiaries but are unconcerned.

What Will Happen?

The repeal of the estate and generation-skipping tax is something that is not likely to be irrevocable. If the Democrats come roaring back in 2024, it is likely to be re-instituted. You can bet though that many sleeping trustees will awaken then and there will be massive distributions in the waning days of GST repeal. Thus, even if the estate tax repeal does not stick, it will take a one generation bite off the table.

How Is Compliance?

Given how crippled the IRS is and how obscure the generation skipping tax is, I suspect that there might be a lot of noncompliance. In other words, there may be quite a few trusts that have had taxable terminations and not done anything. My background was starting in a large local CPA firm, so for much of my career I always figured that the clients of the Big Eight, then Six, then Four would be getting meticulous compliance, while we sometimes had things get by us. For example, we were a little weak on how probate accounting interacted with the tax law, which caused us to be embarrassed when underemployed IRS estate tax examiners were put onto making adjustments on fiduciary returns that had passed capital gains to beneficiaries.

After that, I was moderately fanatical on that issue and others related to probate accounting, but I figured a national firm would never trip up like that. More exposure has made me think that might not be the case.

We have a variety of ways to remind us that tax returns need to be filed. Many of them are annual or monthly or quarterly. We mostly know that when somebody dies Form 706 might need to be filed. But when the last non-skip beneficiary of a trust dies, who is going to remind the trustee that Form 706-GS(T) might be or probably is required. Would the typical 1041 preparer know to ask the trustee if 706-GS(T) had been filed?[ Would the trustee know? And if Richie Rich Junior had gotten a new set of advisers after the original Richie Rich died, would they have reached out to the trustee with free advice giving her a heads up that it is time to send 40% of the trust to the IRS. I mean really maybe somebody should tell the trustee, but does it really have to be me?

If an invigorated IRS ever makes a project out of this it might be ugly

So the House bill is doing the New Gentry a real solid with GST repeal. Speaker Ryan – This Dom Perignon is for you.