Originally published on Forbes.com Sept 17th, 2013

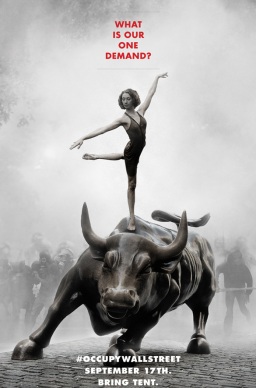

So today we get to celebrate the second anniversary of Occupy Wall Street. According to this story, the problem with OWS was a lack of focus:

But without leaders or specific demands, the movement has turned into an amorphous protest against everything wrong with the world.

For the second anniversary, there seems to be an attempt to focus on something. That would be a financial transactions tax (Robin Hood tax).

To commemorate the 2nd Anniversary of Occupy Wall Street, the Robin Hood tax coalition that consists of two hundred million supporters around the world including Occupy Wall Street, Bill Gates, Warren Buffet, UN Secretary General Ban Ki-Moon, The Vatican, The AFL-CIO, Lawrence Summers, Nancy Pelosi, Nobel Prize Laureates Desmond Tutu, Al Gore, Joseph Stigliz and Paul Krugman will rally to support H.R. 1579, the Inclusive Prosperity Act, a financial transaction tax of 0.5% that will raise hundreds of billions of dollars a year that puts people before profit and helps stabilize the financial markets. Dozens of major economies have already implemented this tax. 11 countries including Germany and France will begin to implement the tax on January 1.

More than a thousand people are expected to march from the United Nations to Bryant Park beginning at 5:00 PM today.

Financial Transactions Tax

The financial transactions “Robin Hood” tax was mentioned along with innumerable other things in the during the early days of OWS. Supporters put it as being very modest a mere 0.5% or $0.50 per $100. With interest rates as low as they are now, 50 basis points does not sound that low to me. The financial transactions tax was part of the Green Party platform in the last election. Here is what Jill Stein had to say when I asked her about it.

When I wrote about the idea, I received dire warnings that something like the Robin Hood tax would turn lower Manhattan into a ghost town as trading would move to Hong Kong. Opponents of the tax maintain that it would not raise as much as predicted and its incidence would not be where advocates hope:

Financial transaction taxes would generate significantly less revenue than advocates project. So-called “Robin Hood Taxes” collected would be disproportionally paid by pensions, retirement savings, annuities, charitable trusts, low-risk money market funds, non-financial businesses and working men and women–not the banks that are, ostensibly, the target of an FTT.

Banks and bankers can be held financially accountable by direct taxation and regulation. A financial transaction “Robin Hood” tax falling heavily on innocent bystanders would not accomplish this goal.

Why This Is Interesting

It seems highly improbable that there would be any chance of a financial transactions tax passing until after the 2016 election. Who knows what the world will be like then ? Why I find this interesting is because of the way it represents the battle for the populist high ground. The Tea Party has made a comeback with its IRS scandal narrative and its last gasp against Obamacare. There does not seem to be an equivalent on the Left. The financial transactions tax might be promising in that regard, although I have to admit that my evidence for that is highly anecdotal.

The Elderly Curmudgeons

During the heyday of Occupy Wall Street, I would give constant reports to a few guys in the office of the large regional accounting firm where I worked. I referred to us as the elderly curmudgeon division. Included in the group were two of the founding partners of the firm, I being one of them. Of course, we had managed to maintain our relative insignificance through a series of mergers. I represented the extreme left of the group. At least one of the crowd was a Tea Party fellow traveler, if not a card-carrying member. As you might expect, they had a pretty low opinion of OWS, with one notable exception. They all thought the financial transactions tax might have some merit. They thought that Wall Street had become an overheated gambling casino and that a transaction tax might have a beneficial effect on volatility.

In turned out that the OWS days were also the last days of the large regional accounting firm. We sold to a national. The elderly curmudgeons including me were a poor fit for the national firm as it turns out. I think it was more because we are curmudgeons than elderly. I could call the guys up to ask them what they think about the current demonstration, but it just would be the same as dropping by their offices. I suspect that their opinions have not changed much in the last two years.

Turn Out Might Not Be That Big

On of the benefits of working for the national firm was that they had a security chief. He had some sort of really high-powered special ops background. I always wondered how it made him feel to now have a job telling CPAs to come in to get out of the rain (lots of storm warnings were issued). I remember getting quite a few updates about Occupy Wall Street. My covivant still works there and she told me that no warnings were issued for today’s demonstrations. We’ll see.

You can follow me on twitter @peterreillycpa