Expats Need Expert Tax Advice

Given their jobs as intelligence analysts Elena and Federick are probably smarter than most CPAs and EAs, myself certainly included. Nonetheless, hiring someone with some specialized tax knowledge would have been money well spent. The Tax Court sustained deficiencies of nearly $90k and penalties close to $40k. And those are from the years 2004-2006, meaning the interest will be, as we say, “a number

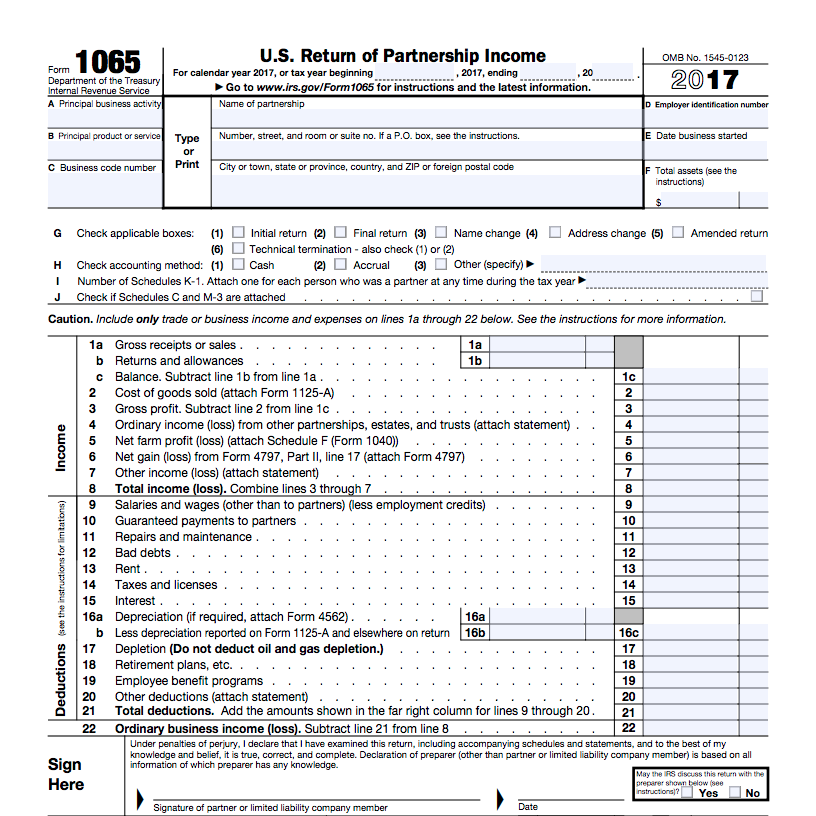

Partnership Tax Returns – Why Do We Even Bother?

Sorting out the types of discrepancies that TIGTA is highlighting requires people. And the IRS has fewer and fewer people every year. According to the IRS data book, the head count in 1999 was 98,730. In 2018, it was 73,519. Now if you believe as some do, that “taxation is theft”, that is 73,519 too many, but those of us who believe that taxation is the price we pay for civilization, it is crazy to keep gutting enforcement.

Gutting tax enforcement, however, is perfectly consistent with the libertarian drive to starve the beast outlined in Christopher Leonard’s – Kochland: The Secret History of Koch Industries and Corporate Power in America, which is a really good read by the way.

Follow Me

Over and over again courts have said that there is nothing sinister in so arranging one’s affairs as to keep taxes as low as possible. Everybody does so, rich or poor; and all do right, for nobody owes any public duty to pay more than the law demands: taxes are enforced exactions, not voluntary contributions. To demand more in the name of morals is mere cant.