Originally published on Forbes.com.

The recent report titled The Use of Schedule K-1 Data to Address Taxpayer Noncompliance Can Be Improved from the Treasury Inspector General For Tax Administration (TIGTA) has me demoralized. A good part of my career was making sure that partnership returns were done correctly (or as correctly as possible) and that the items flowing from the partnership return were correctly (or as correctly as possible) reflected on individual returns.

Some of the care involved being right for the sake of being right, which is not such a bad thing, but there was also the issue of keeping clients out of issues with the IRS. You want to be ready for an audit and you want to avoid notices from information returns not matching individual returns.

I never reflected on this but looking back over the last forty years, none of the partnership returns I have prepared, signed or reviewed were ever audited. And I can recall no instance of there being a notice of a mismatch between an individual return and K-1 information.

It turns out that the uncontested excellence of the work of myself and my colleagues might not have been the source of the IRS radio silence about the returns we labored on long into the winter and late summer nights. If TIGTA is to believed, it may be that they were just not paying attention.

What’s A K-1?

A little background that some of you might want to skip. When it comes to timely filing of tax returns, there are two extremes. One is people who want to file ASAP to get their refunds. They are usually waiting for Form W-2 and maybe 1099s, which are due early and they will file in early February. The other extreme group files in early to mid-October, the extended due date. They are usually waiting for K-1s which are now generally due on September 15, when the entity returns are due if extended.

K-1s come from flow-through entities – partnerships, S corporations, trusts, estates -. If you get a K-1 you are required to include the reported income on your return or explain why you are not using Form 8082. To not do that is per se negligence.

Who Is Minding The Store?

What the TIGTA report tells us is that in some sense, nobody is watching the store or that what watching there is is pretty sporadic. There is some significant redaction in the report since it could provide a road map for some serious shenanigans.

Here are some of the more disturbing things for good citizens that scoundrels and those of the “taxation is theft” school will find heartening.

We reviewed AUR correlation data for TYs 2014, 2015, and 2016 and determined that approximately 3 percent of individuals identified as potential underreporters have a discrepancy with amounts reported from Schedules K-1. This percentage was also consistent for individuals whether or not selected for case review. However, the number of cases selected for review, including those with a Schedule K-1 discrepancy, decreased each year, with a significant decrease occurring in TY 2016.

In other words, they know that K-1s are not matching individual returns, but they don’t do anything about it. The reason is declining resources.

Also of interest is the fact that not all the income and deduction lines on the K-1s are electronically stored. I know it would be real handy to you scoundrels as to which lines those are, but that is redacted.

There are a host of other issues that are obscured by the redaction. Using my superpowers to read between the lines, it appears that a lot of returns go in where the K-1s don’t add up to the total income on the return. It says in the report

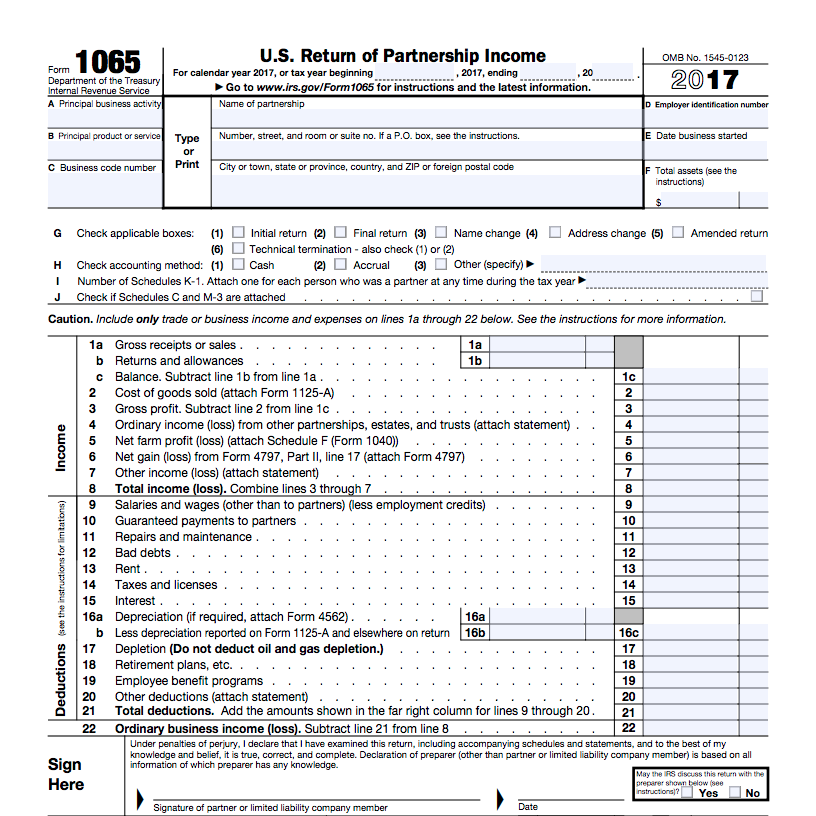

“Flow-through entities compute income and other tax-related amounts for a tax year on their return and then allocate the amounts to recipients using the appropriate Schedule K-1. The sum of the allocated amounts on Schedule K-1 should equal the amounts shown on the flow-through returns. For example, a partnership with three equal-share partners that earned a total of $600,000 of ordinary business income would report $600,000 on Form 1065 Schedule K, Line 1, and allocate $200,000 on each of the partners’ Schedule K-1, Line 1.”

The subsequent paragraph is heavily redacted, but my inference is that returns are being accepted without meeting that very basic criterion.

I remember when we did returns manually we would agonize over which partner to throw an extra dollar at so that the numbers would add up. Well that was silly.

My inner villain can come up with many evil plans to exploit these gaping holes in the system, but I will not share them. Most of them are probably already being executed and there are probably many that I haven’t thought of.

Some Things Need People

Sorting out the types of discrepancies that TIGTA is highlighting requires people. And the IRS has fewer and fewer people every year. According to the IRS data book, the head count in 1999 was 98,730. In 2018, it was 73,519. Now if you believe as some do, that “taxation is theft”, that is 73,519 too many, but those of us who believe that taxation is the price we pay for civilization, it is crazy to keep gutting enforcement.

Gutting tax enforcement, however, is perfectly consistent with the libertarian drive to starve the beast outlined in Christopher Leonard’s – Kochland: The Secret History of Koch Industries and Corporate Power in America, which is a really good read by the way.

Of course the Democrats are complicit in the process. I guess it would be hard to run on a platform of “Make The IRS Great Again”.

Other Coverage

Theresa Schliep has IRS Fails To Identify Nonfilers With K-1 Income, TIGTA Says behind the Law360 paywall.

Bloomberg Tax also has something.