What Happens When You Are A Full Year Resident Of More Than One State

And if someone can afford to take on the trappings of two different domicile identities – sophisticated New Yorker and Connecticut Yankee or whatever – maybe it is fair that they pay full tax to each state. Manhattan has a lot of infrastructure to support, you want to make out you are a New Yorker, pay up.

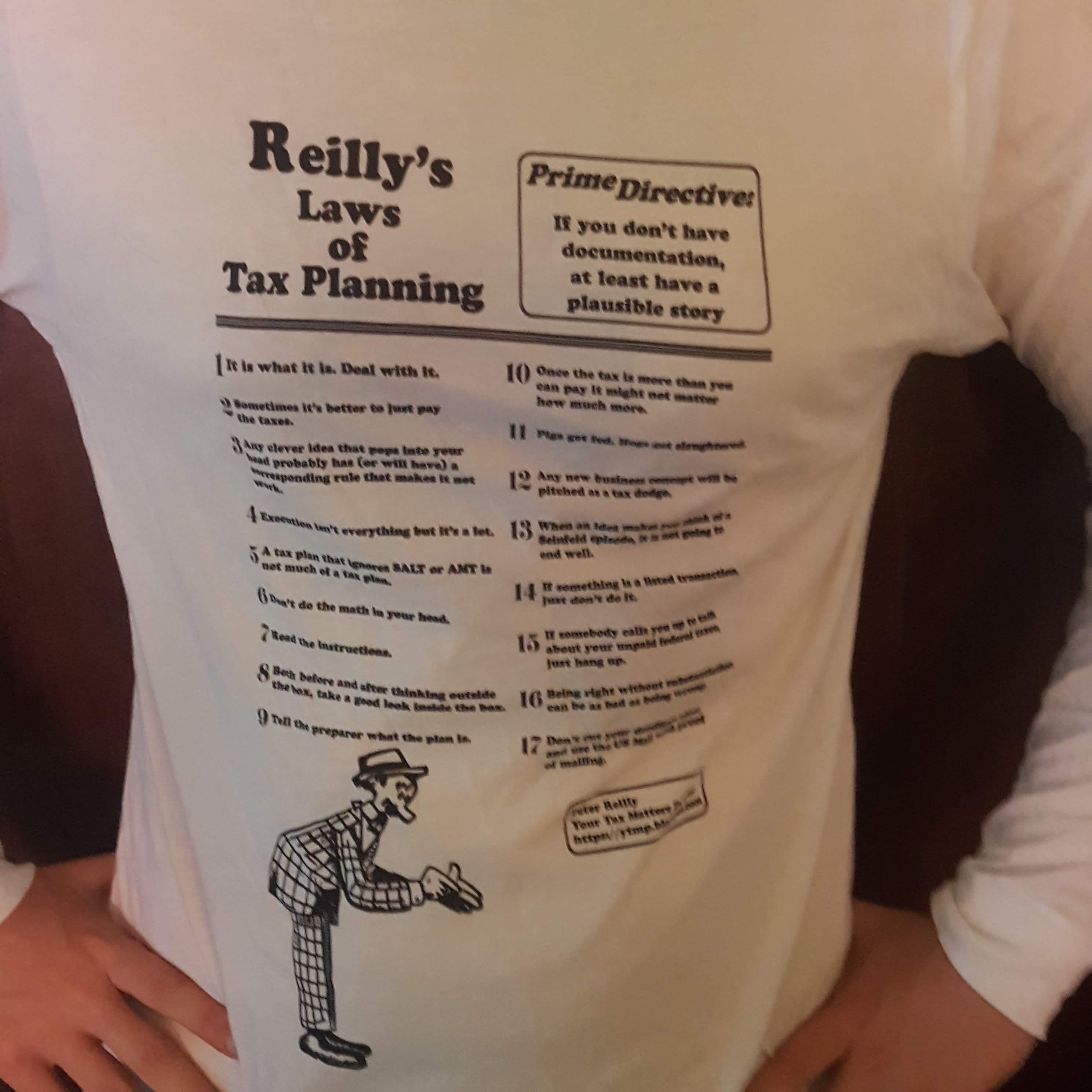

Hobby Loss Roundup And A New Law Of Tax Planning Announced

It is rooted in one of the earliest and most significant 183 decisions, the first time 183 was discussed by an appellate court. It concerned Maurice Dreicer, a trustafarian who spent years (and hundreds of thousands of dollars) searching for the perfect steak. The Second Circuit ruled that the Tax Court had used the wrong standard in denying Dreicer’s losses.

We hold that a taxpayer engages in an activity for profit, within the meaning of Section 183 and the implementing regulations, when profit is actually and honestly his objective though the prospect of achieving it may seem dim. Because the Tax Court applied a different standard, we reverse and remand for redetermination of Dreicer’s deduction claims.

Even on that standard, Dreicer still lost, but that is neither here nor there.

Follow Me

Over and over again courts have said that there is nothing sinister in so arranging one’s affairs as to keep taxes as low as possible. Everybody does so, rich or poor; and all do right, for nobody owes any public duty to pay more than the law demands: taxes are enforced exactions, not voluntary contributions. To demand more in the name of morals is mere cant.