Most Recent Posts

Seventh Circuit Will Not Let Tax Protester Blame His Lawyer For Conviction

From there, Mr. Stuart’s attorney pretty much let the prosecution run the show, perhaps thinking, not without reason, that the prosecutor was giving plenty of evidence for the defense’s theory. It is called the Cheek defense. In a probably futile attempt to dissuade people from drinking the tax protester Kool-Aid, quatloos has posted something titled Here Is The Law That Makes The Average American Liable for the Income Tax (I highly recommend it as a restorative after engaging with whackadoodle tax theories.). They give a great explanation of the Cheek defense, which has helped a few protesters keep their liberty.

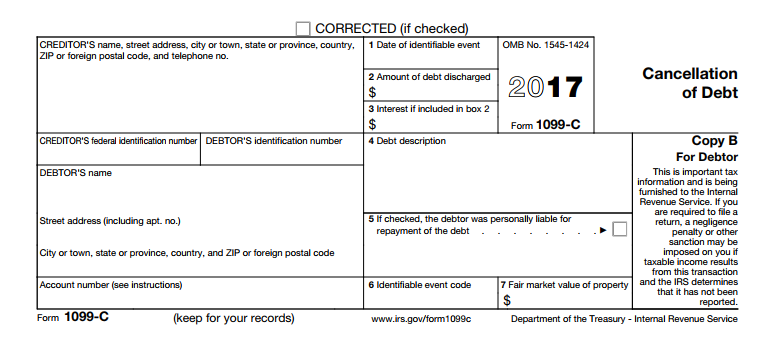

Chief Counsel Advice Provides Timely Warning About 1099 Filing Requirements

So it is coming out of an audit, where the examining agent took to heart the direction to go after backup withholding. Here we have to speculate a bit, but presumably the taxpayer is responding. “Hey. Joes Plumbing Inc. Joes Plumbing LLC. Six of one, half a dozen of the other. That’s not who you send 1099s to .” Sadly it turns out to be 0% of one and 28% of the other. Unless you can show that Joe decided to elect to treat his LLC as a corporation, which is not a high percentage bet.

The thing that I find interesting about this is that it does not seem to be happening as often as it could. If you are a tax preparer and not incorporated does it worry you that your clients are not sending you 1099s? Maybe it should. Or maybe you need to charge more. I mean the threshold is only $600.

Disabled Veteran Sues Bank Of America Over Erroneous Form 1099-C

The worst thing you can do if you receive a 1099-C is to ignore it. You can, of course, simply report the income and pay the tax. If you are in bankruptcy or insolvent, you can use Form 982 to exclude some or all of the income. I have not found authority about what to do if you receive one that is wrong and you can’t get the creditor to reissue. I think most practitioners would put the amount on your Form 1040 and then make another entry to back it out. There is a really good chance that that will work on a practical basis. Most of the case law about people with debt discharge income involves people who took the ignore route.

Was Kent Hovind 2006 Structuring Indictment Flawed?

I have written elsewhere that I believe that Kent Hovind is not under scrutiny for his religious beliefs. It is more likely for his association with tax protest like activity even though he claims to not be a tax protester himself. There is little doubt that if he had run his ministry in compliance with tax laws as they are commonly understood by what I would call the reality based community, IRS CID would not have come within miles of him. Nonetheless, in his fairly constant protest that he got a raw deal on the structuring, he may be on to something, perhaps once more illustrating the principle that even a stopped clock is right twice a day.

Repair Regs – A Hellish Tax Season And Refunds Of Biblical Magnitude

The new regulations force accountants to lift up their eyes from the invoices and look at the actual building. Much of the teaching in the regulations is done by example. Besides the basic structure there are eight separate units to consider as part of a building. One of them is heating, ventilation and cooling. Consider two buildings. One has 10 roof-mounted HVAC units. The other has a single chiller unit. If you replaced four of the 10 roof units or the single chiller unit, you will get a whopping big bill, which you would either expense or capitalize depending on how aggressive you are. What the regs say is that you can probably expense the four roof mounted units, but definitely have to capitalize the single chiller.

Here is where accounting method changes come in for some big money. Suppose that four years ago you spent, to make the math easy, $390,000 on items which you capitalize (and of course to make the math easy placed in service on January 1). It is too late to amend that return, but with an accounting method change you get to write off the $350,000 that remains undepreciated in 2014. That’s what people are excited about. Of course, it is more likely to be a help to the owners of large buildings who might have capitalized the replacement of 10 out of 100 elevators six years ago. Small time landlords who own buildings with just one of everything are not going to have even proportional adjustments.

Restoring Trust In IRS Is A National Imperative

Prior to the reorganization the IRS was organized into 33 geographic districts, each headed by a district director who typically had extensive field experience. This structure was replaced with a “stove pipe” structure. The effect of the structure is to have people reporting to management in far away offices, often in Washington. The stove pipe means that information only goes up and down with no local coordination. Also it has also been considered not so necessary for senior executives to have any field experience or knowledge of tax administration. Case in point is one Lois Lerner, who came from the Federal Election Commission and based on her priorities thought that she was still working at FEC while head of the IRS Exempt Division

God’s Property Radio And Kent Hovind – Not A Great Source For The Whole Truth

This is another follow-up to Monday's post about the challenge I received to interact with Kent Hovind. For some background on Doctor Dino and his tax woes, you can...

How I Accidentally Impersonated A Veteran

Samuel Johnson once remarked that "Every man thinks meanly of himself for not having been a soldier, or not having been at sea." I'm sure that, in reality, it is not a...

Ernie Land Challenges Common Law Theorists And Others To Make Kent Hovind A Test Case

I only just met Ernie Land, but I found that we had quite a bit in common. We are roughly the same age and when we discussed the best way to run a religious based...

Thespians And Pagans Fight Assessors In New York Court

Most of my pretty limited exposure to neo-paganism has been of traditions that were in part resisting the spread of the Roman Empire. The Phryganium, though is a revival of a tradition that was practiced in the Empire. In some of the coverage, you get the sense that there was a belief that the Town was upset by the paganism. I still would not rule out that it was generalized resistance to having another property go off the rolls. In my original article, I pointed out a Massachusetts case in which West Springfield was trying to tax a house that was lived in by women who were actual Catholic nuns.