Most Recent Posts

GAO Reports On Charity Tax Abuse

If the IRS only has enough staff to do a hundred audits of abusive transactions involving tax-exempts, it’s hard to see how better analysis will help all that much.

“As we discussed earlier in this report, IRS’s Research, Analysis and Statistics office also has developed the capability to analyze narrative information, which it has tested on the Form 8886. However, this analytical tool is not being used operationally to review the Form 8886 or any other disclosure report. Our analysis shows that the tool has the potential to help IRS better search disclosure reports for additional information about transactions that could help IRS identify potentially abusive schemes involving tax-exempt entities.”

Expats Need Expert Tax Advice

Given their jobs as intelligence analysts Elena and Federick are probably smarter than most CPAs and EAs, myself certainly included. Nonetheless, hiring someone with some specialized tax knowledge would have been money well spent. The Tax Court sustained deficiencies of nearly $90k and penalties close to $40k. And those are from the years 2004-2006, meaning the interest will be, as we say, “a number

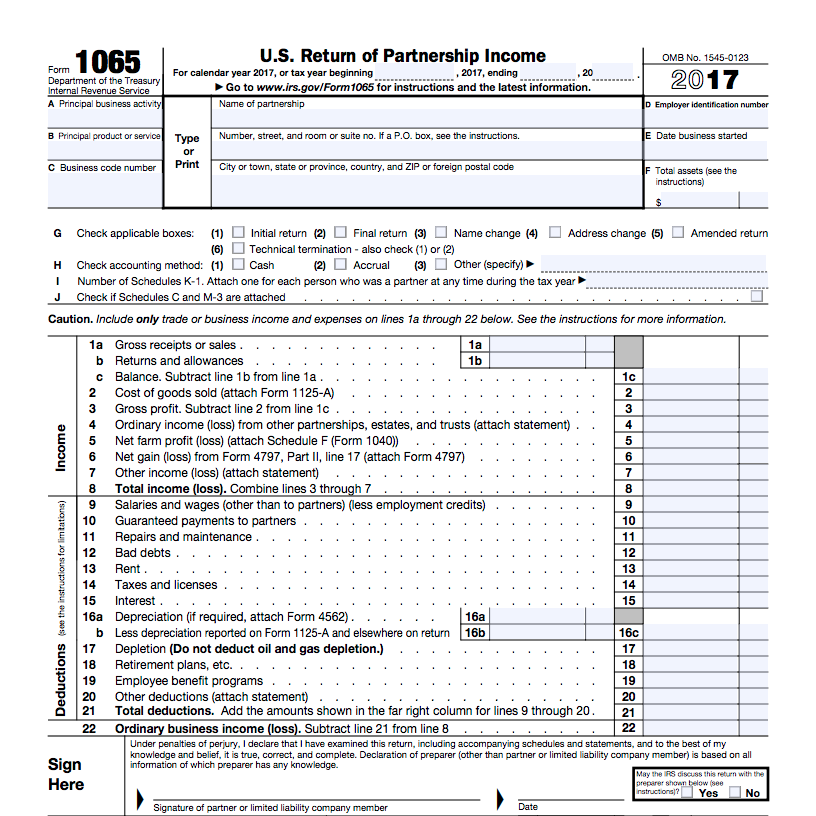

Partnership Tax Returns – Why Do We Even Bother?

Sorting out the types of discrepancies that TIGTA is highlighting requires people. And the IRS has fewer and fewer people every year. According to the IRS data book, the head count in 1999 was 98,730. In 2018, it was 73,519. Now if you believe as some do, that “taxation is theft”, that is 73,519 too many, but those of us who believe that taxation is the price we pay for civilization, it is crazy to keep gutting enforcement.

Gutting tax enforcement, however, is perfectly consistent with the libertarian drive to starve the beast outlined in Christopher Leonard’s – Kochland: The Secret History of Koch Industries and Corporate Power in America, which is a really good read by the way.

Tax Court Can’t Order IRS To Not Jerk People Around

Whatever the merits of such a rule might be, it will not be coming from the Tax Court, because of its oft mention “limited jurisdiction”. Congress has not given it the authority to create operating rules for the IRS. It’s too bad, but I have to congratulate Mr. Davis on the effort. Thinking about how to help the next person avoid the aggravation you have experienced is one of the things that helps make the world a better place.

Maker Of Greatest Shot In March Madness History Misses In Tax Court

Besides his 108 month sentence, Mr. George has a restitution amount of over $2 million to deal with. I think there is a strong possibility that the deficiency will be classified as “currently not collectible” and the ten-year clock will run it out. If that is the case, bringing this action was probably a mistake, since there will be more time for the IRS to attempt collection after his release.

Tax Court Allows Oil And Coal Magnate Over $10M In Golf Course Losses

Also connected operationally is Camp Olympia, an overnight camp for inner-city youth founded by Robertson in 1968. They also offer golf. Personally, I am grateful for not having been exposed to golf, other than the miniature sort, at an early age, counting that as an advantage of a modest upbringing , but that’s probably just me.

Wealth Tax – Constitutional Probably – Good Idea Not So Much

Whatever else a wealth tax accomplished, it would be a significant transfer from the upper-upper class to the upper-middle class. I would think that in some of the larger law and accounting firms, there are already people pitching planning techniques to beat the entirely hypothetical tax.

And if it does pass, the resulting regulations will be of mind-numbing complexity. Just for starters. What do you do about trusts? Do trusts pay the tax themselves with beneficiaries allowed to apportion their unused exemption to the trust? Or is the trust wealth somehow apportioned among the beneficiaries? However it is done, let the games begin.

And then there is valuation. Don’t get me started. And if it is a net wealth tax, what counts as a liability? Think that is easy. Read about partnership taxation.

Dressage Trainer Complains Of Tax Court Mansplaining

Judge Holmes did a holistic analysis of the horse activity and also did the factor by factor analysis that is called goofy by some. He notes that Ms. McMillan had a horse called Goldrush who was retired from competition but still had breeding potential. She had not bred him for quite some time but hoped that things would be better if she sent him to Australia. Unfortunately, he died in 2008. Judge Holmes did not note that Ms. McMillan had Goldrush’s semen frozen, so there was still an afterlife of breeding potential in 2010.

Tax Court Approves Penalty But Does Not Allow IRS To Pile On

Photocredit Pixabay - Pexels Originally published on Forbes.com. Just because somebody believes things that I find preposterous and even harmful, doesn't stop me from...

IRS Drubbed In Tax Court On Partnership Interest Deductions

As it turned out, William Lipnick never received any of those debt-financed distributions. The distributions had gone to his father Maurice Lipnick, who had transferred some of the interests to Willam during his lifetime with the balance passing after his death in 2013.

This made William’s relationship to the partnership debt different than his fathers. To William, the debt was part of his acquisition basis in the partnership. For Maurice the debt traced to however he happened to spend the money – likely making it investment interest. For William, the debt traces to his acquisition of the partnership interest making it deductible against the partnership income allocations.