Most Recent Posts

The Beast I Found In The Park

There are things that annoy me a lot. People mixing up principal and principle or e.g. and i.e. American flags touching the ground or continued being flown after they...

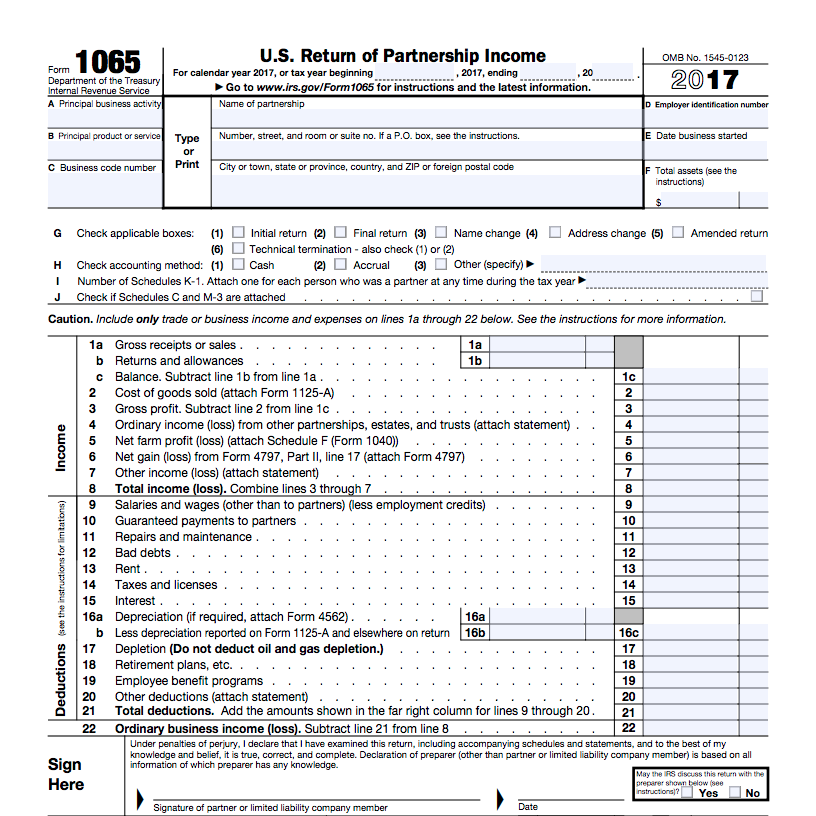

Rubber Hitting The Road On New Partnership Audit Regime

The Games People Will Pay

Most of the reasons I can think of for not electing out of CPAR involve shenanigans that are even worse than the one I imagine that I and my imaginary friend James would play on the Millenials. Assume you don’t elect out and do some really aggressive stuff in 2018. Keep the partnership alive, barely, but by the time it gets around to the adjustment year, the only partners are a couple of moribund C corporations.

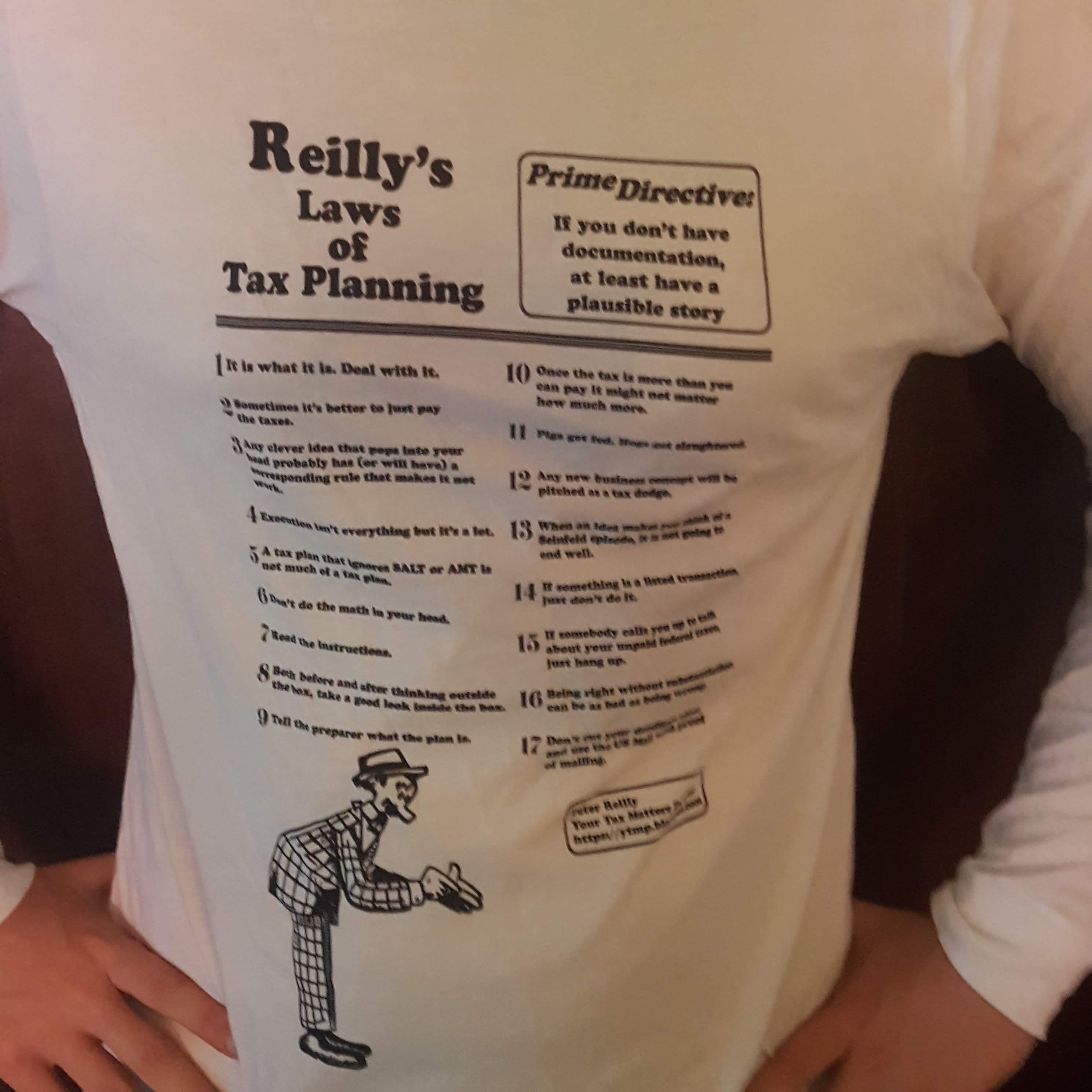

Remember Reilly’s Third Law of Tax Planning – Any clever idea that pops into your head probably has (or will have) a corresponding rule that will make it not work. So maybe shenanigans like that will be foiled. I hope so.

Who Is That Masked Man? DC Circuit Tells Tax Court To Keep It Quiet

I think what would be money well spent by the IRS is to go into the Big 4 and large regionals and hire away the people with ten years or so of experience who know they are never going to be partners because they lack soft skills and will make lousy salespeople. You give them a better work-life balance, a pension and the chance to show up all the corners that they know are being cut. It will strike terror in the hearts of corporate tax departments.

A really radical proposal would be to require public companies to disclose their tax returns as part of their SEC submissions and require the independent auditors to cover them in their opinion. That is more of an entertaining thought experiment than a realistic proposal

What Happens When You Are A Full Year Resident Of More Than One State

And if someone can afford to take on the trappings of two different domicile identities – sophisticated New Yorker and Connecticut Yankee or whatever – maybe it is fair that they pay full tax to each state. Manhattan has a lot of infrastructure to support, you want to make out you are a New Yorker, pay up.

Hobby Loss Roundup And A New Law Of Tax Planning Announced

It is rooted in one of the earliest and most significant 183 decisions, the first time 183 was discussed by an appellate court. It concerned Maurice Dreicer, a trustafarian who spent years (and hundreds of thousands of dollars) searching for the perfect steak. The Second Circuit ruled that the Tax Court had used the wrong standard in denying Dreicer’s losses.

We hold that a taxpayer engages in an activity for profit, within the meaning of Section 183 and the implementing regulations, when profit is actually and honestly his objective though the prospect of achieving it may seem dim. Because the Tax Court applied a different standard, we reverse and remand for redetermination of Dreicer’s deduction claims.

Even on that standard, Dreicer still lost, but that is neither here nor there.

IRS Should Not Be Worrying About Do Not Call Registry

The Tax Court opinion of Judge Daniel Guy in the case of Giving Hearts, Inc. illustrates a waste of IRS resources and focus that is the result of our choice to have the wrong agency regulate not-for-profit organizations. If bad acting by an exempt organization is facilitating significant federal tax avoidance, having the IRS on the case makes a lot of sense. Other abuses of not for profit status should be dealt with by the agency whose business it is to deal with that particular abuse. That’s my takeaway. Here is the story.

Law Degree Held Against Defendant In Tax Scam

Before entering his guilty plea Mr. Box listened to a federal prosecutor describe his crime. A phony W2-G purportedly issued by Seminole Casino Coconut Creek was attached to his 2011 tax return. The W2-G showed gross gambling winnings of $3,775,0000 and federal withholding of $1,057,000 (That does work out to 28%, which apparently is what it is supposed to be.)

Of course with the top federal rate being 35% in 2011 28% withholding on millions of income is going to put you behind not ahead, but that is mostly taken care of with $3,525,266 in phony gambling losses resulting in a refund of $986,618. After offsetting some tax debts Mr. Box received a check for $735,463.69.

According to this story, this sort of thing should not work anymore as the IRS accelerates matching to occur before issuing refunds beginning with 2017 returns. Still that it ever worked for refunds of this magnitude is shocking. It is also tragic as it tempted people who might otherwise been harmless to turn themselves into big-time criminals

On The Bitterness Of The Gender War

Two of my Forbes pieces - Lesbians Want A Church of Their Own and Why Gender-Critical Radical Feminists Might Want A Church And Why IRS Approved - which broke out of...

You Can’t Get Tax Advice From Your Spirit Guide

Things did not go well for Christopher Dufresne, son of famous psychic Sylvia Browne and himself a psychic, in the Tax Court decision that came out last week. Judge Kerrigan confirmed the IRS notices of deficiencies of over $500,000 and accuracy penalties that tack on another hundred thousand plus. You would have thought that he would have seen it coming, but that is not how it works according to his book.

Gender War – Dummy Guide – Where To Begin

There is no wholly masculine man, no purely feminine woman. - Margaret Fuller Top rated guide so far What I believe about sex and gender (and what I don't) by...