Most Recent Posts

Estate Of Monster.com Founder Tax Court Victory Reversed By Second Circuit

The lengths that a billionaire might go to avoid gain recognition is an indication of what I see as one of the great drivers of wealth inequality-unrealized appreciation. Most of us have to realize in some taxable form most accretions of wealth in order to spend it to live. Statistics about what people in different income classes pay as a share of the total income taxes collected do not capture that reality.

IRS Not Making Much Use Of Bank Currency Reports

Young Earth Creationist Kent Hovind is on something of a crusade against the injustice of his structuring convictions, although his narrative leaves out that he was convicted of other crimes also and subject to an enormous civil income tax deficiency. My theory about his outrage is that he had prepared himself to be charged with evasion by establishing a Cheek defense and was blindsided by structuring. The irony is that if he had just had his wife withdraw eleven grand when that is what they needed, the routine bank report might not have caused a ripple.

Window Closing On IRS Program To Lessen Penalties, Avoid Prison For Offshore Shenanigans

” Bad actor” sounds pretty harsh and you and I both know that you are really not a “bad actor”. You are probably actually a mensch. But fifteen years ago, somebody talked you into stashing some money in the Cook Islands just in case and who’s gonna know. And it dawned on you some time ago that that was wrong and you have been agonizing about it. That could make you a “bad actor” in the eyes of the IRS. So don’t let this window close on you without getting some good advice.

Tax Refunds Due Injured Veterans – IRS Should Make It Easier

I had a long talk with a friend of mine who runs a fifteen or so person practice. We figured that you would end up spending around $1,000 in billable time trying to figure out whether the full amendment might be the better way. He ended up deciding he wouldn’t do it unless it was somebody he knew. And then he said that if a veteran came walking in off the street asking for help he would help him, but would tell the guy not to tell his buddies about the help he got.

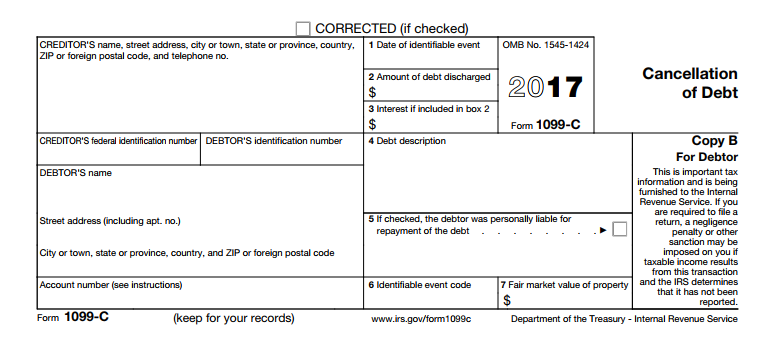

Do Not Ignore IRS Form 1099-C – It Will Not End Well

If those loan servicers know their business, it seems pretty unlikely that Joe was solvent to the extent of over $360,000 after the discharge. I don’t know. Maybe he is a really good negotiator. For the sake of argument let’s assume there is a good argument for insolvency. Joe could have filed his Form 1040 and attached Form 982. Take a look. Check box 1(b) Discharge of indebtedness to the extent insolvent or maybe 1(e) for residence interest. Then in Box 2 go for the gold and write in $364,179. That should appease the computers anyway. And even if it gets looked at, at least there is no failure to file. I’m not going to get into Part II. It only matters if you have tax attributes that you need to reduce.

If you want to be thorough you should got to Publication 4681 and fill out the worksheet on Page 6. Note at the top right-hand corner that it says “Keep for your records”. That means you don’t have to send it in with your return. So you could wait till they ask for it to fill it out. And if they never ask for it, well you saved some time.

Had Joe taken those simple steps, I would put the odds at well over 90% that his return would have sailed through the system.

Tax Court Rules Not Enough Conservation On Golf Course To Justify $10 Million Deduction

Originally published on Forbes.com. These easement cases keep coming. Section 170(h) of the Code has created a mini-tax shelter industry based on bogus conservation...

Facade Easement Deduction Not Allowed- Not Real Property Interest And Not Perpetual

Harbor Lofts had a long term lease (till 2056) on two buildings in Lynn Massachusetts that are owned by the Economic Development & Industrial Corporation of Lynn. The two buildings are the Daly Drug Building and the Vamp Building. I found something on the Vamp Building but struck out on the Daly Drug Building.

Court Of Claims Requires Reimbursement To Insurance Company Despite No Appropriation

Having health care policy set by litigation is probably less than ideal. A project of the Trump administration was to be the repeal and replacement of Obamacare. By lucky coincidence, Fear by Bob Woodward popped into my Kindle this morning. I’ll be reading it today, but I could not resist checking for blog fodder on taxes, but nothing leaped out at me. Then I realized that there might be something on Obamacare. Doesn’t seem to be a lot. Apparently blame for failure to repeal and replace went to Reince Priebus

Statute Of Limitations Can Sometimes Hurt Taxpayers

More important though is the practical point. Just don’t cut it so close. Mr. Elizalde had three years. Why not on April 1 (or better March 15) file with return receipt? If the return receipt is not back in a week or so, take some action to trace the envelope and refile if necessary, Some of the blame for this falls on the media which refers to April 15, as modified for weekend and holidays, as Tax Day. At any rate, Mr. Elizalde might have had a very good reason for cutting it so fine. I just can’t dream one up. Just remember, the last possible day is not the best possible day when it comes to tax filing.

How Tax Resistance Can Hurt Your Marriage(s) – The Kent Hovind Saga

Under the commitment of marriage, the husband takes a vow to care for and protect his wife, and to put her before anything else under God. I was not demanding extreme protection but refused to accept decisions that blatantly and foolishly welcomed risk, easy and valid attack, and the predictable demise of the life we were building together. The most disturbing aspect is that the problems I discovered were not accidental mistakes, nor were they impossible to correct. Instead, I had exposed and was demanding a complete revision of the planned, deliberate, voluntary way that Kent and his board are dedicated to operating DAL. Who was I to think I was going to persuade them all to change?

.

My marriage with Kent would have survived had I “been a good wife”, understanding that a woman’s place is in the home and her job is to support her husband without question. And a wife is certainly never to meddle in the men’s business affairs. Yes, our marriage would have survived for some time…

.

For all of the people who are just bursting with curiosity about why I left Kent Hovind, I will reduce it to one sentence. I decided I don’t want to play a lead role in the next debacle.