Most Recent Posts

Hovindologist Down The Flat Earth Rabbit Hole

Lamar Smith is back from an assignment. I asked him to look into the odd interaction of Kent Hovind and flat earth. The way this connects with tax is kind of...

We May Have To Wait A Year For Decision In Michael Jackson Estate Tax Case

The intensity of the coverage of the Tax Court proceedings in the Jackson case may be unprecedented. There are occasions when Tax Court decisions break out of the tax ghetto into the mainstream. A notable example was Anietra Hamper, a TV anchor who tried to deduct her undergarments. But the Jackson case. Wow. Richard Rubin has written an article about the writing style of Judge Mark Holmes who is handling the case.

Ninth Circuit Decision For IRS Affects Shifting Of Income To Tax Havens

In order for the IRS to respect the allocation of income between the Cayman subsidiary and the parent, the cost-sharing arrangement to keep and improve the intangible assets needs to pass regulatory muster. One of the requirements of the regulations is that stock-based compensation be included as one of the costs. The taxpayers argued, well enough to convince the Tax Court and one of the three judges on the panel, that in an arms-length deal parties would never include stock-based compensation. The IRS did not deny that, but argued that the regulations could never replicate comparable transactions among unrelated parties because they don’t happen enough.

You generally don’t have somebody thinking they want to find somebody in a small country to buy the right to their intellectual property which they will then license back for use in the rest of the world. Further there will be a cost revenue split on future developments. You pretty much only do that sort of thing with related parties to save taxes or possibly for asset protection or some other regulatory concern. In an arms-length deal you could not consider stock-based compensation since there is a chance that the other party’s stock could really take off.

Law Professors Argue That Housing Tax Break For Ministers Is Unconstitutional

The housing allowance statute results in substantial entanglement between the government and churches, such as requiring the IRS and courts to determine which beliefs or purported beliefs should count as a religion for tax purposes, what constitutes a church or a minister, and ministerial functions, whether an ordained minister working for a secular nonprofit counts as a minister if she gives one sermon a year, and similar quandaries. The tax professors point out that ministers working not in churches but as teachers, counselors, directors of business services, alumni relations, and even as basketball coaches, now qualify for the exemption. “In sum, Section 107 requires the government to investigate and oversee both churches and ministers, delving into both doctrine and practice,” the brief states.

Marijuana Industry Faces Challenging Tax Regime

Traffickers are not taxed on their gross receipts because of 280E. They are entitled to a deduction for what they pay for their product – cost of goods sold – because we have an income tax, not a gross receipts tax. The deduction for ordinary and necessary business expenses (Code Section 162)- like gas for your vehicles, bribes to the police, bullets and rent on safe houses- is a matter of “legislative grace” and can be denied because, you know, drugs are bad like they teach you in the DARE program, that my kids had in elementary school.

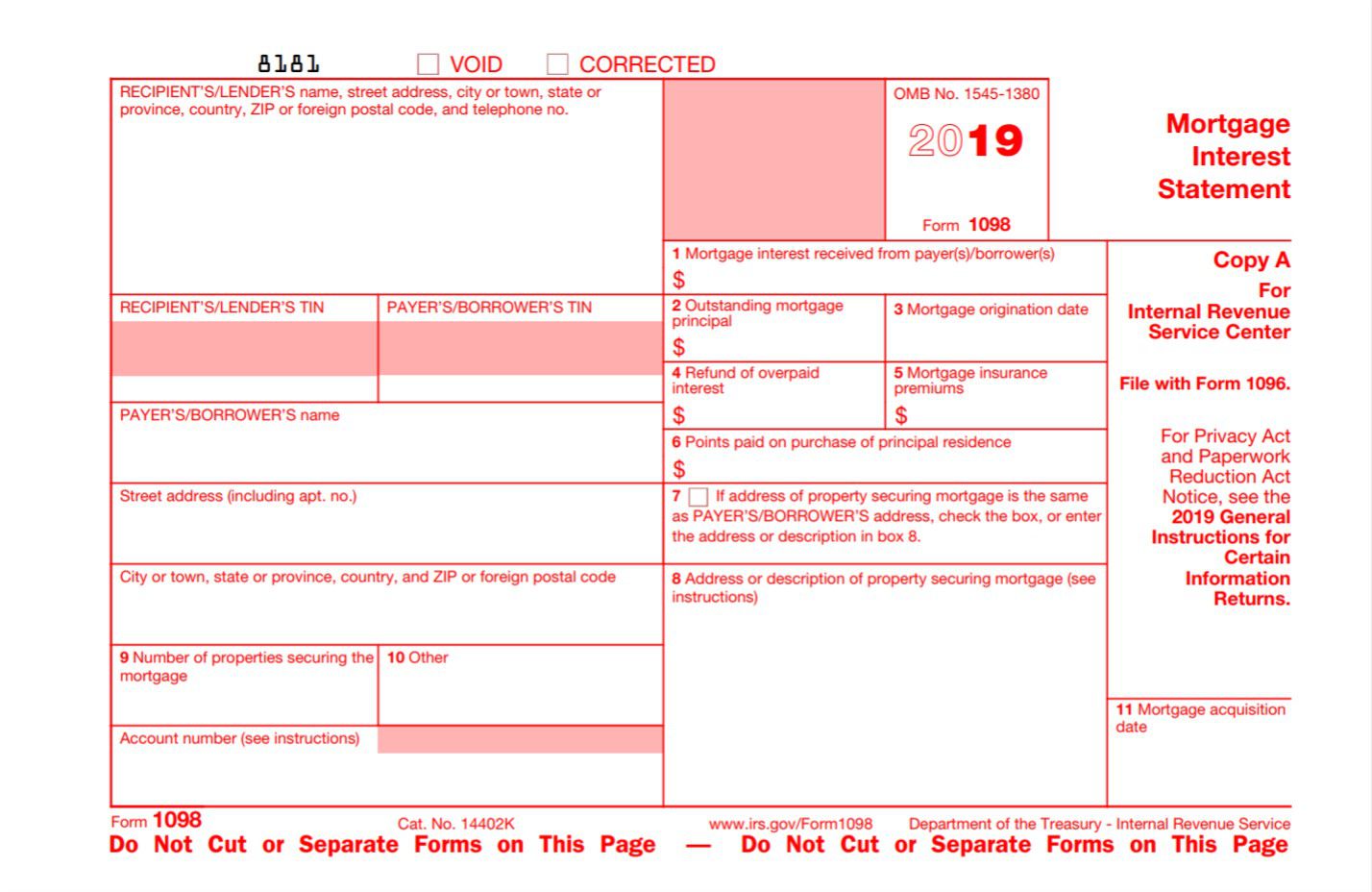

Banks Not Providing Taxpayers With Accurate Mortgage Interest Information

It seems that this problem should really be solved by the IRS. Tell the banks exactly what they are supposed to put on Form 1098 and provide some sort of expedited refund process. It crosses my mind that maybe some sort of catch-up deduction considered as an accounting method change might do the trick including giving relief for closed years.

Tax Lawyer Advises Jeff Bezos To Use Social Welfare Organization For His Philanthropy

One of the things that would hold donors back from funding 501(c)(4) was uncertainty about whether such gifts would be subject to gift tax. IRS revenue agents looking into that possibility provided some grist for the seemingly endless IRS scandal as disclosed by a Judicial Watch document dump that I covered here. Congress fixed that in 2015. There is still an estate tax issue but Mr. Miller indicates there is a fix to that. It is pretty technical, so I will let you dig that out of his article if it is worrying you.

IRS Does Not Get Hip-Hop And Hold Onto That NOL Substantiation

There is a pretty fascinating story involving Hulk Hogan, which is really beyond the scope of this piece except to note that Hulk Hogan was upset that his daughter, Brooke Hogan, had an offer from a “black billionaire guy” to back her music career, possibly to please his son. There are reports, which I won’t link to that the son was Stack$ and you can find if you look a Brooke Hogan video produced by SoBe.

Overall none of this is very edifying, but I note that Hulk Hogan, to the contrary notwithstanding, Mr. Barker does not appear on the Forbes list of billionaires. The revelation of Hulk Hogan’s remarks came about in some litigation that you can read about in Conspiracy: Peter Thiel, Hulk Hogan, Gawker, and the Anatomy of Intrigue by Ryan Holiday.

Fight Against Chicago Streaming Tax Part Of Larger Struggle To Limit Government

One argument was that the tax violated the Internet Tax Freedom Act because the tax was not imposed on “automatic amusement machines”, which would seem to favor pinball wizards over hardcore gamers. The city does, however, have an annual tax on the machines, which seems a lot more practical than taking a percentage. Also, the City taxes live performances at a lower rate. The court was OK with that because live performances are different than experiencing things on the internet. Who knew?

On that issue of being taxed by the city even when you are not in the city, that is addressed by the Mobile Sourcing Act. And there was a Commerce Clause argument which went nowhere.. All in the plaintiffs seem to have put on a first-class effort, which to me is a little out of proportion to three bucks or so on the Netflix bill.

Trump Foundation Truth And Poetry

Now I’m not a Trump supporter by any means. I attended a rally in Worcester Mass in 2015, which I reported on here. He suggested in his speech that John Kerry screwed up in Iran so badly because he hadn’t read Art of the Deal. I followed up the rally by reading Art of The Deal myself. My conclusion, based on his own words, was that I did not want this man to be in charge of anything I was involved with including my country. Nonetheless, I am inclined to “give the guy a little”, as Tony Schrantz pleads. The most that can be reasonably extracted from the NY AG complaint is some lessons about how not to run a private foundation. The closing lines of the Bruce Hopkins poem sums it up pretty well.

The lesson here is obvious – exempt orgs and foundation law can be tricky.

Yet, running a private foundation is really rather straightforward, quite easy.

The Trump Foundation overlooked the greatest solution in this situation:

Hire a bunch of foundation lawyers, pay them well; that’s the safest alchemy.