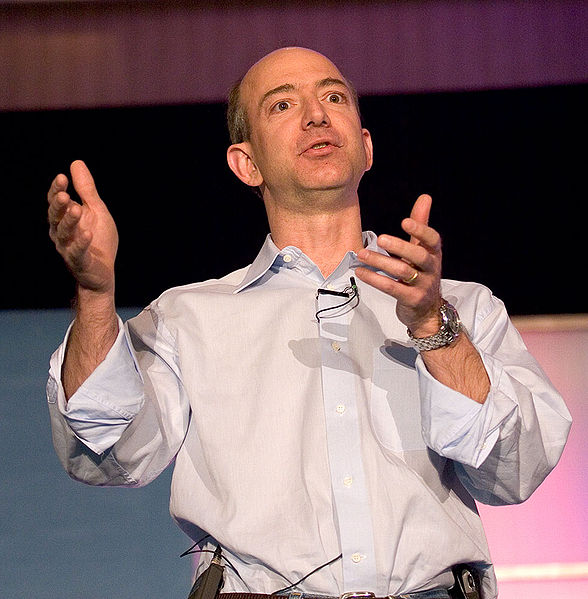

Photo credit James Duncan Davidson

Originally published on Forbes.com.

Just over a year ago Amazon founder Jeff Bezos, number one billionaire and first-ever centibillionaire, reached out to his twitter followers for advice on giving away part of his fortune. Nick Wingfield covered that in the New York Times. Now comes David S. Miller with advice for Jeff Bezos not on what causes Bezos should support, but on what the optimal vehicle for his philanthropy might be. It takes more than two hundred forty characters, but Advice for Jeff Bezos: Social Welfare Organizations as Grantmakers is available on SSRN as a download. Mr. Miller is a partner in Proskauer and is a former chair of the New York State Bar Association Tax Section.

What Other Billionaires Are Doing

Mr. Miller’s suggestion to Mr. Bezos is kind of intriguing. He thinks the optimal vehicle might not be a private foundation like Bill and Melinda Gates founded. Thrifty old Warren Buffet has been making gifts of Berkshire Hathaway stock to his friend Bill’s foundation rather than going to the substantial trouble and expense of setting up his own. Mark Zuckerberg and Priscilla Chan set up the Chan Zuckerberg Initiative LLC. Assuming the LLC is just owned by one or both of them, anything it does that has tax significance will be on their individual return (assuming they file jointly). No Form 990-PF on GuideStar for nosy people like me to blog about. And no tax benefits. Moving their assets into CZI has as much federal income tax significance as moving money from one pocket to another.

The Pluses And Minuses Of A Private Foundation

There has been a pretty public lesson on the downside of having a private foundation if you don’t want to sweat the details in the recent uproar over the Trump Foundation and its troubles with the New York Attorney General. Besides the governance problems and the required transparency of Form 990-PF, there are restrictions on what the foundation can do particularly in the area of lobbying and political activity. Private foundations have to deal with minimum distribution requirements. Also, they are subject to an excise tax on investment income. Sometimes that can be as we say “a number” – $33 million in the case of the Bill and Melinda Gates Foundation.

The upside of the private foundation is that except for the generally small excise tax and the tax on unrelated business income, everything it does is tax-exempt and, quite a big deal, there is a charitable contribution for the amount of cash or the fair market value of property donated to the foundation. The transfer of appreciated property to the private foundation is not subject to gift tax.

How Important Is That Tax Deduction?

For your regular millionaires and even some billionaires like President Trump who have a lot of realized income, the income tax deduction for a charitable contribution of appreciated property can be a big deal, but when you get to people like Jeff Bezos and Warren Buffet and Mark Zuckerberg, it is a different story. Warren Buffett receives a salary of $100,000 per year from Berkshire Hathaway. He should count himself lucky. Jeff Bezos gets a salary of $81,840 from Amazon. Their vast wealth is overwhelmingly in the form of unrealized appreciation. Unrealized means that they have never paid income tax on it and probably never will. And since it is unrealized it does not enter into their adjusted gross income which puts a limit on the income tax charitable deduction. I get into some of the points on that in this piece about Warren Buffett’s return.

The big deal is that the transfer to the foundation is not a realization event and that when the foundation sells the stock it pays a quite modest tax.

Don’t Stop At (c)3

Rather than a 501(c)(3) organization, Mr. Miller suggests that Bezos consider a 501(c)(4) -“Civic leagues or organizations not organized for profit but operated exclusively for the promotion of social welfare”. What does Mr. Bezos gain by going that route in exchange for giving up a charitable deduction that he likely can’t use anyway? Mr. Miller explains:

…assets need not be used exclusively for charitable purposes, may be used for more-relaxed social welfare purposes, and may benefit private interests so long as providing private benefits is not the primary activity.

They are not subject to the 1% or 2% annual excise tax,10 or the 5% annual distribution requirement. They may engage in unlimited lobbying, and may participate in political campaigns. They are not subject to the strict self-dealing rules; instead, they are subject to the more-relaxed “excess benefit transaction” rules. They are not subject to the expenditure responsibility rules, the excess business holdings rules, or the jeopardizing charitable purpose rules, and they need not disclose their donors.

And of course, there is that primary income tax benefit.

While a donation to a social welfare organization is not deductible, a social welfare organization would offer Bezos an income tax benefit that is often far more valuable to high net-worth individuals and C corporations: nonrecognition of the gain on donations of appreciated property. So Jeff Bezos could contribute his Amazon stock to a social welfare organization and avoid tax on the appreciation.

Another advantage is that an organization does not have to apply for 501(c)(4) status. The organization just notifies the IRS of its intent to operate under the section by filing Form 8976 electronically.

Remember The IRS Scandal

One of the things that would hold donors back from funding 501(c)(4) was uncertainty about whether such gifts would be subject to gift tax. IRS revenue agents looking into that possibility provided some grist for the seemingly endless IRS scandal as disclosed by a Judicial Watch document dump that I covered here. Congress fixed that in 2015. There is still an estate tax issue but Mr. Miller indicates there is a fix to that. It is pretty technical, so I will let you dig that out of his article if it is worrying you.

When A Social Welfare Organization Is Better Than A Charity

Mr. Miller outlines four major advantages that social welfare organizations.

First, a social welfare organization can benefit classes or a community that would not be charitable for purposes of section 501(c)(3), and can provide private benefits so long as providing private benefits is not its primary activity. Thus, an organization whose sole activity is the beautification of a single city block can qualify under section 501(c)(4) ………

Second, an organization that promotes a political ideology or is seeking to legalize an illegal activity may be exempt as a social welfare organization, even if it would not qualify under section 501(c)(3).26 A social welfare organization, in contrast to a section 501(c)(3) organization, also may engage in an unlimited amount of lobbying activity,27 and can engage in some amount of political activity …………

Third, as mentioned above, social welfare organizations are not subject to the private foundation rules.29 They may accumulate unlimited endowments, avoid the excise tax on investment income, and the prohibition on excess business holdings. Therefore, they may hold all of the stock of a for-profit subsidiary indefinitely. Had Newman’s Own, Inc., the food product company created by Paul Newman, been given to a social welfare organization rather than to Newman’s Own Foundation, a private foundation, the social welfare organization would not have experienced the existential crisis that Newman’s Own Foundation underwent, which ultimately required Congress’ eleventh hour amendment of section 4943 to save Newman’s Own Foundation from the excess business holding excise tax. ……….

Finally, grantmaking social welfare organizations are not subject to the expenditure responsibility rules and therefore have much more flexibility to make grants to foreign organizations than would a private foundation.

There is also a discussion of foreign social welfare organizations, which I will leave for you to study. Mr. Miller also discusses some of the tax policy implications of current law, raising the issue of whether transfers to 501(c)(3) or 501(c)(4) organizations should be treated as taxable transaction. If that were to happen, the Zuckerberg LLC model would probably be the best you could do.

Is This A Thing?

I spoke with Mr. Miller this week. I asked him if social welfare organizations are becoming a thing. He indicated that nobody will speak about it publicly, but he has reason to believe they are being used. He could not give me an example I could look up on GuideStar. 501(c)(4) has a bit of a bad reputation about it because of concerns about dark money and the interminable IRS scandal. I also asked him where is the best place to set one of these things up and he quickly answered Delaware.

Is This A Good Thing?

I didn’t ask Paul Streckfus what he thought about Mr. Miller’s suggestion for Jeff Bezos, but a recent comment in his EO Tax Journal makes me think that he might not be that pleased. He wrote:

I’ve said before that I think we have gone from a democracy to a plutocracy. Now I think we may be on the verge of an autocracy. What does this have to do with EO tax law?

One, dark money has permeated the EO sector, especially section 501(c)(4) organizations. I would argue that the Koch brothers and their ilk have stolen away a big chuck of our democracy as they created a plutocracy, in part through nonprofit organizations. We know the IRS can do little to restrain political abuses of (c)(4) status – not to mention similar abuses of (c)(3) status.

The nonprofit sector has always been thought of as a bulwark against loss of democracy, and some tax-exempt organizations still attempt to fulfill that goal, but overall the exempt sector may be doing more harm than good if the goal is to save democracy. Somehow all of us must develop the same urgency the Founding Fathers had in 1776 if we are to save what’s left of our democratic institutions.