Note – This article discusses the version of TCJA that came out of the House. What ultimately passed was less skewed toward the wealthy at least in regard to how 199A works.

Originally published on Forbes.com.

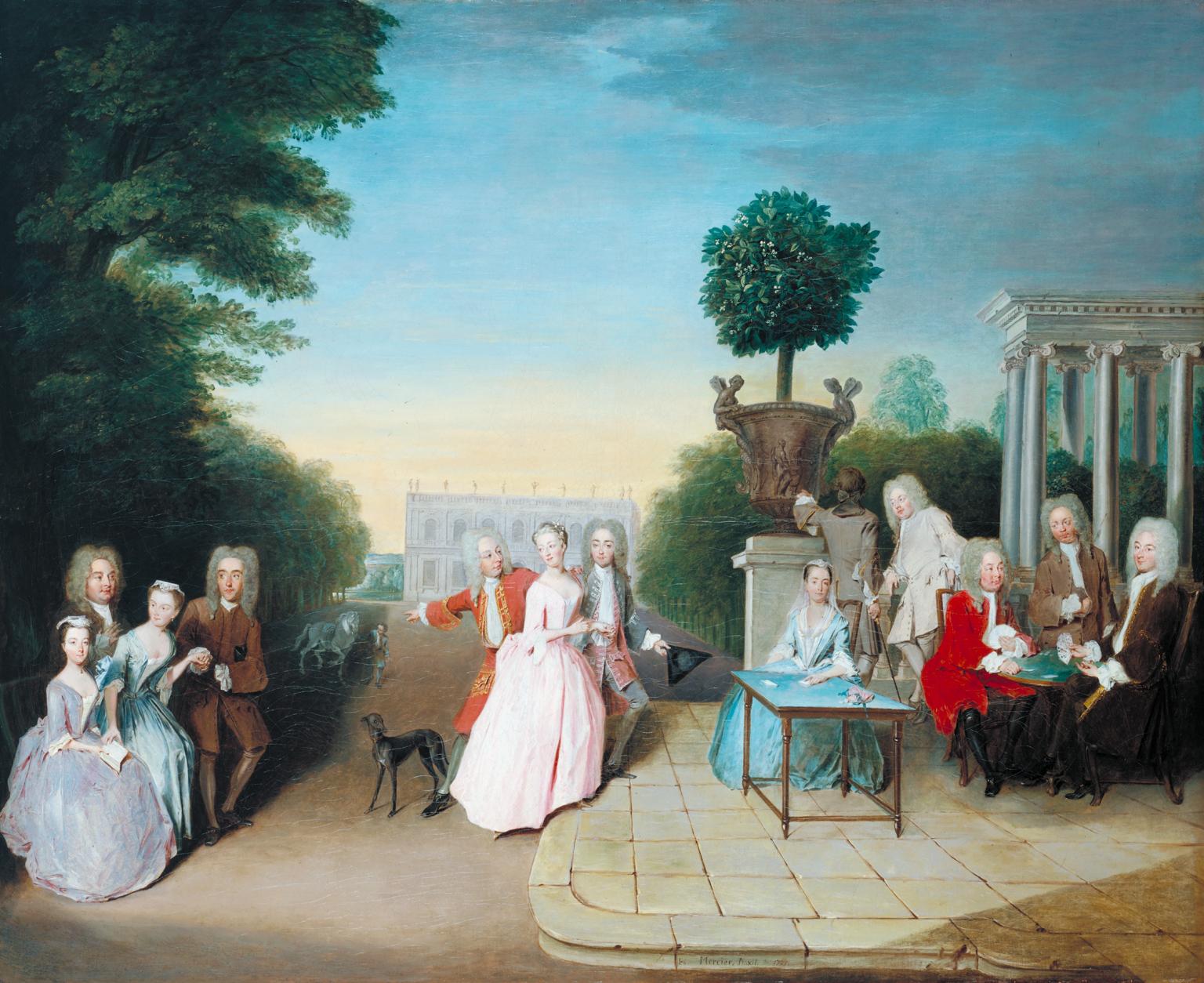

The Tax Cuts And Jobs Act seems to be directed to what I would call the New Gentry, although my covivant favors the term Entitled Children. I think that what has happened is that the land of the free and the home of the brave has developed something that we will never admit to having – a gentry. My theory has three main bases – a close reading of the Tax Cuts and Jobs Act, a lifetime of kind of random unsystematic historical study, and largely anecdotal observations from over thirty years of pretty high-end tax practice. I’ll start by explaining what I mean by gentry.

Learning About The Gentry

One of my more vivid memories from high school is an incident in my AP English class Junior Year.

We had been reading The Moonstone by Wilkie Collins or maybe it was Dracula by Bram Stoker. The question that puzzled many of us that we had for Mr. Canavan was how was it that none of these people seemed to have jobs. We all had (or as with me had had) fathers who had jobs, as did our uncles and all our father’s friends and our little league coaches and scoutmasters. That’s what men mostly did. They had jobs.

Mr. Canavan smiled and started explaining to us the life of the English gentry, perhaps being relieved that he could give us this lesson without having us read George Eliot. The good life was to be the eldest son who inherited a landed estate and was supported by the work of loyal tenant farmers. If you were out grubbing to make money, your end goal was to buy yourself a landed estate so your eldest son could be gentry. For younger brothers there would be an army commission or a benefice to keep them from hanging around the manor house seducing the housemaids. Masterpiece Theater did not begin airing until 1971, which was why we couldn’t figure this out on our own.

But We Don’t Have A Gentry

Actually I think, we may and it looks to me that the Tax Cuts And Jobs Act is meant for them, It’s really amusing because a more accurate title might be The Tax Cuts For People Who Don’t Need Jobs Act. I use the word “need” advisedly. Many of the New Gentry have, what you and I might call jobs. And they might work very hard at them and be well paid. What they actually have though are careers. Careers and jobs look very similar from the outside, but they are different. A career is something you do to contribute to society and have a sense of affirmative purpose. It might be a sacred calling or perhaps a frivolous pursuit. A job is something that you do to feed your family.

A good job is clean work with no heavy lifting that pays well. Those jobs look a lot like careers.

There is a tendency in looking at the distributional effect of a tax cut to lump all people with the same taxable income together. That is not the way this tax cut is skewed. To show you that I have made up three people.

The three guys are Tom, Dick and Harry. They are married with a couple of kids and in their early fifties. And they each have taxable income of about $2 million.. It is mostly ordinary income. They each have an income tax liability of about $730,000 under current law.

What The Tax Cuts Act Does For Tom Dick And Harry

Tom is a part of the new gentry. He is the grandson of the founder of the largest grocery chain in his part of the country. His $2 million in taxable income is mostly flow-through income from a number of operating S corporations and real estate partnerships. Dick is an aspiring member of the new gentry. His father founded the second-largest grocery chain in his part of the country. Dick’s income is all from the grocery chain – a pretty modest salary (Because the old man does not want the non-family managers to be getting big ideas) and a really big S corporation flow-through. Harry has a background much like mine only he is much smarter and harder working. He is a top-notch plastic surgeon. The Tax Cuts And Jobs Act cuts the income tax of all three of them – Tom, Dick and Harry. Only Harry not so much.

I figure Harry’s saving at about $10,000 from the new rate tables and of course, if he is practicing in New York or California, the loss of the state income tax deduction will wipe that saving out and then some, but let’s have him in Texas with not such a big house for the sake of simplicity. Dick does a lot better. I figure he saves about $100,000. Tom is the big winner. His tax cut is around $230,000. The reason for the difference is Section 1004 of the act – Maximum Rate on Business Income of Individuals. That section provides that the highest rate to be paid on “qualified business income” is 25%.

You may have read that income of physicians and other service providers will not qualify for the special rate. That is not strictly true. If Harry owns the building where his practice operates or has other expensive assets used in the business, some of his income might qualify, but our Harry does not have anything like that. Dick is not in a service business, but he works more than 500 hours a year in the business, so only 30% of his income from the business qualifies. Tom, on the other hand, does a little bit of this and a little bit of that but rarely earns more than $30,000 a year and none of it is anywhere near the grocery chain. So all of his income is qualified business income.

That’s the deal. For people with taxable income over $260,000 (That is for married couples. Different threshold for others) the maximum rate is 25% on qualified business income. Qualified business income is 100% of income from a trade or business where you don’t materially participate and 30% of the income from a trade or business where you do materially participate unless it is one of the disfavored service businesses like medicine and accounting. Then it is 0%. The percentages can be tweaked if you have a lot of capital assets in the business. My back of the envelope shortcut is that a million dollars in assets will transform $80,000 of income into qualified business income.

To restate. Well-off people who work will pay more tax than well-off people who don’t work.

And Then There Is The Estate Tax

The bill also phases out the estate tax over the next several years. And of course the estate tax was one of the biggest brakes on the growth of the New Gentry. And the step-up in basis that allows possibly a lifetime of appreciation to escape taxation remains in place. The urge to cash in and diversify, tax free, may well destroy more small businesses than the estate tax ever did. Remember that this preferential rate for businesses is only enjoyed to the maximum by the relatives who don’t work in the business.

It is not just the Estate Tax that is repealed but also the Generation Skipping Tax. And I believe that the Generation Skipping Tax was actually the biggest threat to the growth of the New Gentry. That will be the subject of another post.

Other Coverage

Jim Puzzanghera and James Rufus Koren of the LA Times wrote a story that illustrates the limited reach of the special rate.

The National Federation of Independent Businesses is not supporting the bill in its current state, because the 25% rate is no help to most of their membership that does not have taxable income over the threshold and also because of the exclusion of service providers. I spoke with Jack Mozloom. He told me that they are working with the committee to improve the bill. He said it is fine that Caterpillar is getting a nice tax cut, but the NFIB members who buy equipment from Caterpillar could use one too.