Along with other folks who concern themselves with estate planning, I have been discussing the idea of there being some urgency in making gifts that use up the current gift tax exemption. Our transfer tax system – gift and estate taxes – is unified. There is a lifetime and beyond credit against gift and estate taxes. Once the credit is used up taxable gifts require actual payment of gift tax and estate tax kicks in. As of today the credit covers $5,120,000. As the law stands now, effective January 1, 2013, that goes to $1,000,000 . I think the case for urgency is fairly self-evident. Given how difficult and involved estate planning can be, people, for whom this is relevant, should be gearing for action now, if they have not already done something. I do like to be balanced in my posts, so I will first make the case for inertia, just so you know that it is there.

The Case For Inertia

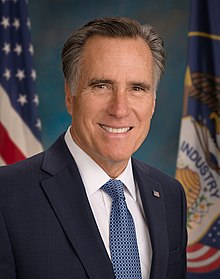

Romney wants to repeal the estate tax. The Obama proposal I have seen kicking around the most is to go to $3,500,000. Whether that is down from $5,120,000 or up from $1,000,000 depends on how you look at it. I did not bother to ask Jill Stein what she thought, but I would not be too concerned about that. She is not very likely to win. The most outstanding fact that advocates for inertia have going for them is that for as long as the current system has been in effect, nearly 40 years, the unified credit equivalent has never gone down. If you want another argument for inertia here it is. I know from an off the record discussion that a very well connected estate attorney has been told, off the record, by an important legislator, that continuation of the $5,120,000 unified credit is a done deal regardless of who gets elected. I am not making that up. Rumors like that do float around in the estate planning community. It is more solid than one I wrote about last year. Last year’s rumor about the shift to $1,000,000 being accelerated was a goad to action.

The Case For Action Is Compelling

When you break down possible outcomes on the political scene, they all argue for at least looking at your assets and sitting down with a planner to see if there is something worth doing.

Romney Sweep

Suppose Romney wins in a stunning sweep and the estate tax is repealed. Well we had a year in which the estate was repealed. During that year the gift tax was still in effect. Romney’s latest plan would preserve the gift tax at 35%. Suppose the estate tax is repealed but the lifetime gift tax credit is allowed to drop to $1,000,0000. Well who wants to make big lifetime gifts if there is no estate tax ? Fine. If the estate tax is repealed, how long will it stay repealed? A Romney sweep in November might deliver us to the promised land, but it also might lead to a backlash. People running for Congress in 2014 will have a long list of billionaires who died during the two year period with estates that escaped taxation.

Obama $3,500,000 Plan

The Obama $3,500,000 plan also includes restrictions on valuation discounts. Right now techniques like the family limited partnership can leverage $5,120,000 to support the transfer of seven or eight million dollars in assets. The $3,500,000 might only support the transfer of, well, $3,500,000.

The Fiscal Cliff And Gridlock

Remember the drop to $1,000,00 is hard-coded in the law now. That is the default. But could Congress let such a horrible awful thing happen ? Here is something to think about. According to this story the latest bunch in Congress is “extremely wealthy”. Burn that extremely wealthy into your mind before you click on the link. Here you go. The average median wealth of a freshman senator is $3.96 million, which is pretty wealthy I guess. Freshman congressmen on the other hand have median wealth of $570,418. They make $174,000 per year. I really understand why many people in the 47% would look at a net worth over five hundred grand as extreme wealth. To me it is a house and an underfunded retirement account and no estate planning problems to speak of. How hard will it be for them to throw the $5,120,000 unified credit exemption equivalent under the bus in the midst of a major fiscal crisis ? And they don’t have to throw it under the bus. It is already lying in the street. In order to save it they must stop the bus and invite it back on

The Most Compelling Situation

I have written a bit on the practicalities and competing concerns in doing a mega gift. The most compelling situation to me is that of a legacy asset. My friend Matt Erskine has a boutique practice in Worcester]. Legacy assets are one of the things that he focuses on and I will close with his comment:

Legacy assets are ideal for the “megagift” for several reasons:

- art, real estate, family business interest and other Legacy Assets are secular investments, that is held for more than 10 years, and so the gifting of an asset does not substantially reduce the lifestyle or disposable financial wealth of the client,

- The financial value of Legacy Assets is not correlated to the investment market,

- The personal and social value of legacy assets is both real and significant,

- Since there is both a financial and a social value to the ownership of legacy assets, they work well with charitable split interest trusts that can significantly leverage the Unified Credit, and

- There are techniques that can be used with legacy assets that cannot be used for investment assets.

The problem is that few professional advisers understand the issues and opportunities surrounding the gifting of legacy assets, and even fewer owners of legacy assets are even aware that such planning is possible.

Forbes.com Oct 14th, 2012