Originally published on Forbes.com on September 2nd, 2012

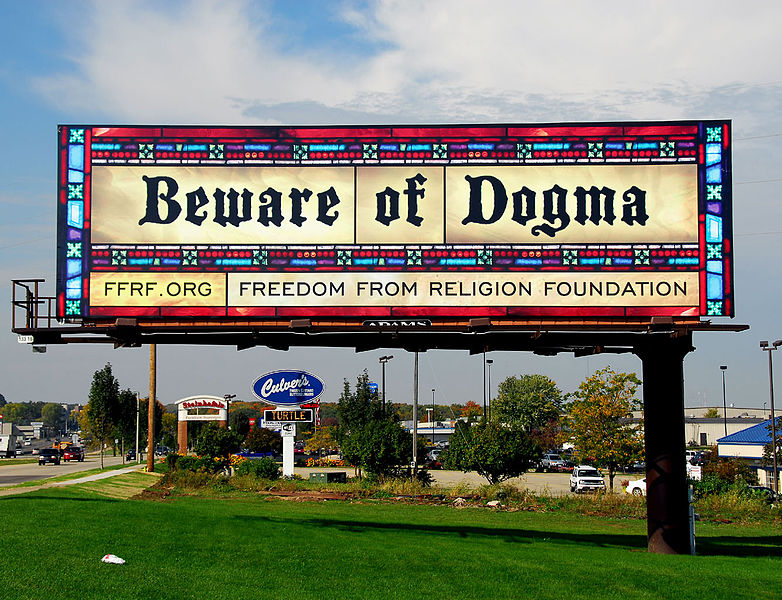

Southern Baptists Against Clergy Tax Abuse (SBACTA) is not a real organization. I just made it up. There is no question, though, that if it did exist who its spokesman would be. The Reverend William Thornton who blogs on Southern Baptist Convention issues under the title SBC Plodder is the man. I have been following his blog for sometime now. He has gotten me hooked on the conflict in the SBC between Calvinists and anti-Calvinists. I just love fights that I don’t have a dog in. I started following him because of his writing on the parsonage exclusion, which should be back in the news, but somehow the rest of the media is missing it. The parsonage exclusion allows ministers to receive some of their compensation in the form of a housing allowance that is exempt from income tax. There is a lot of doubt about the constitutionality of the provision, but until last week’s ruling in favor of the Freedom From Religion Foundation, nobody has ever been able to get standing to challenge the provision in federal court. (It is hard to get standing to challenge somebody else’s tax break.)

I’m not going to get into the constitutional question in this piece other than to observe that much as I admire constitutional purists, I am not one myself. I also think that constitutional purists are actually rather rare. Activists and advocates tend to use the Constitution like a drunk uses a lamppost – more for support than illumination.

It appears to me that SBC is the denomination with the most at stake in this fight. According to the Census Bureau, SBC is the second largest denomination in the US by number of members with 16 million compared to Catholicism’s 68 million, but far and away the largest in terms of number of churches (45,000) and ordained clergy serving parishes (105,000). That makes for many small churches, but there are also some very large ones. Of the 1,419 megachurches identified by the Hartford Institute for Religion Research over 200 are Southern Baptist. (A megachurch is a Protestant church with consistent Sunday attendance of over 2,000. There are many large Catholic parishes but they lack the institutional characteristics of megachurches.) The small churches and the large churches are the two sides of the coin when you look at the problem of the parsonage exclusion. Reverend Thornton with many years “in the trenches” has trenchant observations on both. Basically his concern is that abuses of the parsonage allowance by religious racketeers will cause public alienation for a relatively modest benefit that can be critical to the viability of small churches. I’ve selected some of his best passages on the issue and am sharing them.

From SBC Plodder by Reverend William Thornton

My last post on the Minister’s Housing Allowance, our Sacred Tax Loophole, was probably unwelcome with some of our Southern Baptist colleagues (Nope. You cannot use your housing allowance for a second home) because it shared the bad news that the more affluent clergy among us cannot expect Joe Sixpack to subsidize their second home at the beach or in the mountains.

Let’s not get too upset about it because that first home that does qualify can be the Biltmore House and a high-income clergy person can pour as many hundreds of thousands of dollars into that as he can in order to maximize his or her tax break.

Makes sense in the same way that a lot of federal tax policy makes sense.

And, no, Rick Warren didn’t originate the housing allowance but he was the catalyst for the federal law passed a decade ago that made it a bit smoother for us.

Does anyone misunderstand that when clergy claim such exemptions to income by right and tax law that sooner or later folks will pay attention and say that something just isn’t right here? Why should the government subsidize a mansion for clergy and not some hourly worker’s hovel?

Why indeed?

The FFRF certainly has some material to work with, what with clergy mansions like the one above, not to mention the clergy who are “qualified” for the housing allowance as ministers of loose basketballs, ministers of maintenance, ministers of fun overseas mission trips and other odd church staff positions.

I’m guessing that the FFRF lawyers know how to hit softballs out of the park.

The average SBC minister in my state has a compensation package (generally salary plus housing allowance, or rental value of a pastorium) of around $71,000 and the housing allowance probably translates into a savings of a thousand dollars annually or so. A thousand dollars is real money to most SBC clergy.

If asked, and I have been asked about this, I cannot say that we clergy deserve this tax break any more or less than any other group with some pull in D.C.

My megacompensated SBC clergy brethren might have to reassess their use of the Sacred Clergy Housing Allowance for their homes in Sedona or on Virgin Gorda.

Last year I wrote about the housing allowance in You can have my Housing Allowance when you pry my cold, dead hands off of it…or when lawmakers get fed up with the abuse of the minister’s housing allowance by rich ministries, religious racketeers, and greedy pastors who have a second home and put much of their income in a housing allowance for that home, every dollar of it completely free from any income tax at all.

The piece linked above is on the scandal of trumpeter Phil Driscoll who was using about $200,000 of his clergy housing allowance for a second home. Not his first – a second (in some court filings the phrase the plural “second homes” is used).

I might have called it a scandal by a greedy ex-con ordained musician but it was perfectly legal. Join the ministry and shelter hundreds of thousands of dollars in income from any income tax, perfectly legal, and enjoy sun and fun while doing it.

Ridiculous.

The idea that Joe Sixpack is paying taxes and Phil Driscoll is being given tax breaks for money he uses to pay for vacation homes is both abhorrent and absurd to this retired SBC pastor who continues to receive part of his retirement in the form of a housing allowance.

Seems that a federal appeals court has ruled that when the tax code refers to the housing allowance as “that rental allowance paid to him as part of his compensation, to the extent used by him to rent or provide a home” it means A home, not a bunch of homes.

I offer a Baptist hurrah for the singular being interpreted as one and not many.

The problem for us non-trumpet playing hackers and plodders in ministry is that folks are always suing the government to eliminate the housing allowance. Cases like Driscoll’s may eventually arouse sufficient indignation at religious racketeers and greedy preachers to cause lawmakers to severely restrict or eliminate even our modest housing allowances.

I don’t care how many homes Phil Driscoll has. I do care if his use of the housing allowance brings down the ire of sensible people on ordinary, one domicile, clergy like myself and almost all of my colleagues.

Someone make the case that Joe Sixpack has to pay taxes on his income and doesn’t get any exclusion for his singlewide complete with a deck and a mangy dog sleeping under it, while Kenneth and Gloria Copeland live in an 18,280 square-foot lakefront parsonage on 25 acres valued at $6.2 million and exclude hundreds of thousands of dollars from income taxes under the housing allowance.

The SBC Executive Committee’s attorney, Augie Boto, is quoted in the WSJ article to say that “the housing allowance is critically important for making ends meet—it is not a luxury.” True enough for almost all of us hackers and plodders in the SBC’s 46,000 churches who might be able to put $20k or so of our income in the housing allowance and save a few thousand annually on income taxes. It’s not us that cause the disgust with this particular tax law.

Augie Boto, Frank Page, the SBC Executive Committee and our favorite SBC lobbyist, Richard Land, ought to be proactive on this matter and find a way to support legislation that will preserve the Housing Allowance in a reasonable fashion while excluding the ridiculous abuses, legal though they may be, by people like Phil Driscoll and Kenneth Copeland.

Else we all will lose. Besides that, it just ain’t right.

———————–

You can follow me on twitter @peterreillycpa.